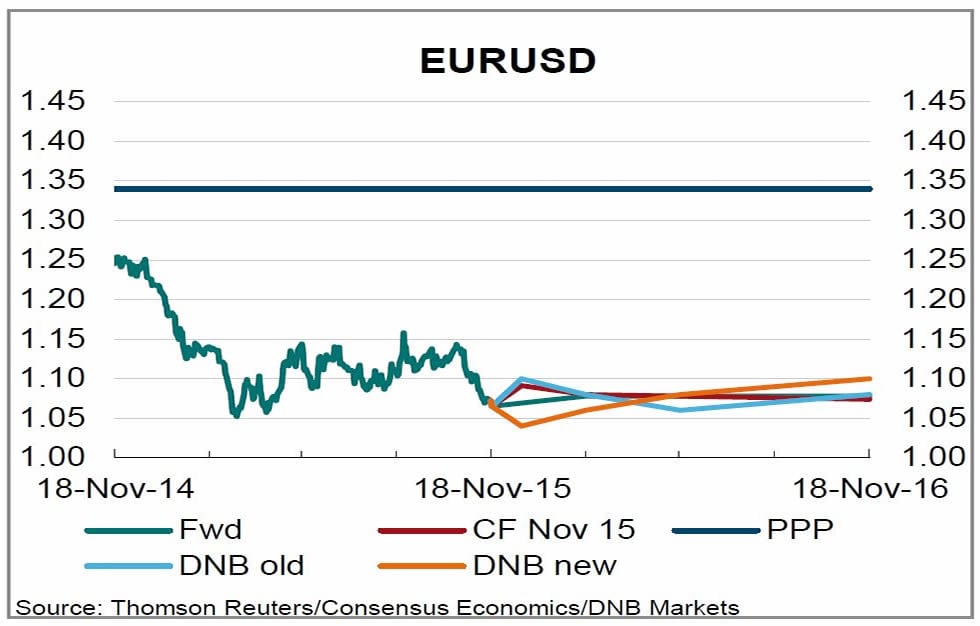

DNB: EUR/USD Exchange Rate Forecast to Fall to 1.04 Then Recover in 2016

Another leading researcher has forecast a better 2016 for the euro with a turn-in-trend occuring towards the end of the first quarter 2016.

The news comes as the EURUSD exchange rate trades below the 1.07 barrier mid-week but importantly it appears a base has been formed at 1.06 which was rejected on Monday.

There are concerns that the 'sell' trade against the euro is now incredibly crowded – when the market is so heavily invested in a trade what can happen is that any reversals can be quite brutal.

Despite such concerns traders have opted to follow the trend and ignored what could have been a potential trigger to a short-squeeze higher - strong PMI data from the Eurozone.

The Flash Eurozone PMI Composite Output Index came in at 54.4 (53.9 in October) which is a 54-month high confirming Eurozone growth is headed in the right direction.

Nevertheless, it would appear the data is simply ‘too little too late’ and the European Central Bank will not shirk from a December rate cut.

If anything, more traders are likely to jump onto the crowded train. Nevertheless, the euro to dollar exchange rate can’t seem to break notably lower.

“The pair continues to find support around 1.06 and appears to lack the momentum needed to see it push for a move back to the next support level around 1.0450-1.05, which would see the pair trading around this year’s lows,” says Craig Erlam at Oanda.

DNB: 1.04 Could be the Floor

Fresh forecasts on the euro have just been released by the economics team at DNB Bank, Norway’s largest financial services group.

DNB suggest declines could extend to 1.04 but they have altered their forecasts to take in a firmer profile for the shared currency starting in the first few months of 2016.

The EUR to USD conversion is forecast to move further downwards in the near-term, driven by the familiar theme of central bank policy divergence (ECB rate cuts v US Fed rate rises = EUR lower).

“While the ECB has become more dovish and signals further stimulus, Fed has been surprisingly hawkish and kept the door open for a December hike,” says DNB’s Camila Viland.

DNB now believe the ECB will both increase its monthly asset purchases from 60 to 80 billion euros and cut rates by 10 bps in December.

Two weeks later they expect Fed to hike the policy rate by 25 bps.

“We expect another two hikes in 2016. The monetary divergence seems to a large degree to be taken account for in the current market pricing. Still, we believe that the central banks decisions have potential to drive EURUSD further down short term, towards 1.04,” says Viland.

However, DNB believe the tenor of Eurozone economic data flow will start improving from here while the Eurozone’s current account surplus is forecast to provide additional support to the euro.

“Thus long term we believe market participants may become less pessimistic on behalf of the euro and EURUSD to gradually move upwards again,” says Viland.

The progression of DNB’s thought process on the euro to dollar exchange rate looks as follows:

For reference the theme of a recovering euro from about March 2016 is a theme we are increasingly picking up on with Lloyds Bank and UniCredit being to prominent examples of proponents of this scenario.

Meanwhile HSBC echo this dynamic with their forecast for a softer USD profile in 2016.