EUR/USD Exchange Rate Forecast 2016: ING See Parity Breaking

Analysts at Dutch bank ING are forecasting the decling of the euro exchange rate complex to continue with a fall below parity in EUR/USD predicted.

"Even though a continuation of the technical rebound cannot be ruled out, its extent should be limited," say Easy Forex.

ING have told clients they do not believe the recent devaluations in the Yuan will prove to be a game-changer for the euro exchange rate complex.

Analysts have confirmed to clients that they continue to forecast the euro to dollar conversion sinking below parity in 2016.

The news comes after the euro was able to advance 0.6% against the dollar on a month-on-month basis.

Despite near-term noise the euro-dollar is 17.2% down on a year-on-year comparison confirming just where the trend in this pair lies.

0.98 is maintained as a floor for the currency pair by ING's forecasters.

In a note released on 17 August ING have said the US Fed will ignore the recent volatility concerning the Chinese central bank and the levels at which it fixes the CNY.

“In our base-case scenario, CNY price action will stabilise and there will be a lack of negative spill-over into global equity markets. This will in turn allow the Fed to hike in September,” says Chris Turner, Head of Foreign Exchange Strategy at ING.

We had argued last week that the outlook for the pound and dollar (against the euro) was potentially undermined by successive days of foreign exchange market intervention at the PBoC.

According to ING the euro and emerging market currencies (EM) could experience short-term stabilisation, “yet the EM FX segment should experience a second leg of weakness once the Fed hikes and (b) the Fed’s tightening will take the support away from EUR,” says Turner.

In fact, Turner argues the more the market doubts the Fed’s move on 17 Sep, the greater the EUR/USD downside following the actual lift-off.

Fed Tightening Will be Gradual

The potential risk of exported deflation from China to the rest of the world via weaker CNY is one of the main reasons why ING’s economists now expect an even more gradual pace of the Fed’s tightening cycle.

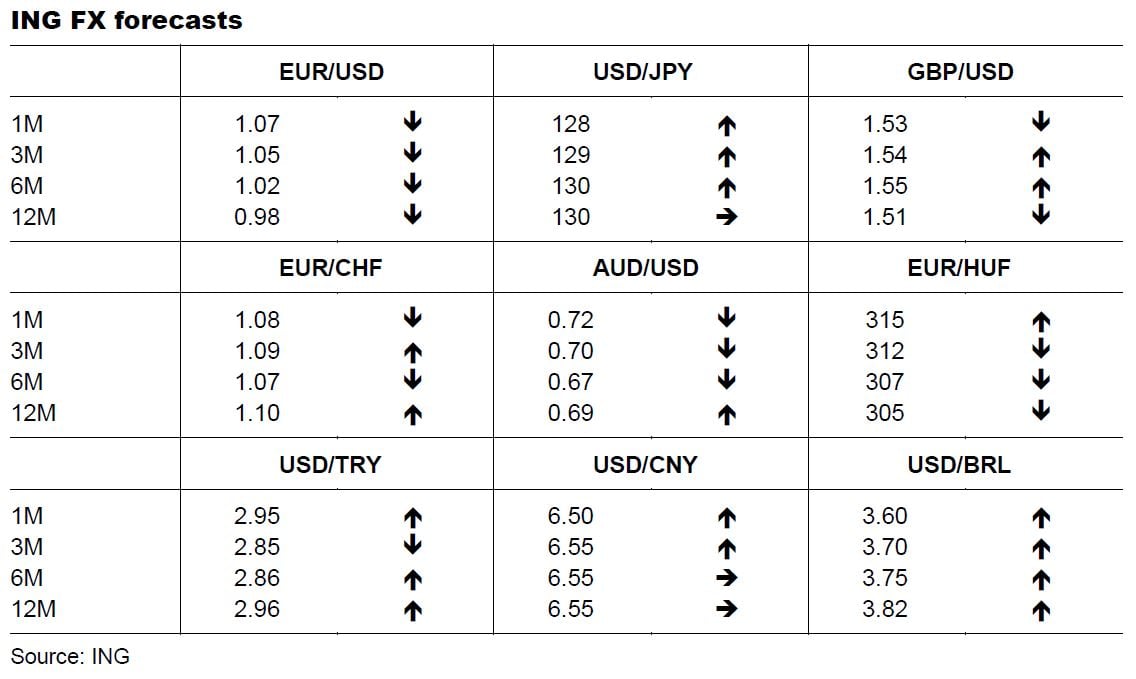

“This, coupled with the Fed’s greater sensitivity to USD strength, points towards a more gradual path of EUR/USD decline. We now expect EUR/USD to bottom at 0.98 in 2Q16,” say ING.

In three months the euro dollar exchange rate is forecast to fall to 1.05.

The pair will likely fall to 1.02 in 6 months and will possibly bottom out at 0.98 in 12 months.

Short-Term Levels Justified

Looking at the nearer term picture a recent reversal in USD fortunes has seen the shared currency compete agressively for the region just above the 1.10 threshold.

According to ING, "the current level of EUR/USD (at 1.1060) is now closer to what our models suggest as “justified” short-term levels (just below 1.1000 after taking the recent decline in short-end US rates into consideration) compared to the “unjustified” 1.1200 last week. Once the UST 2-year yield breaks above the recent high of 0.75%, expect a more pronounced EUR/USD downside."

Levels to Watch

Easy Forex have told clients that they retain a negative bias on the euro in the immediate term horizon saying short positions below 1.1095 are preferred with targets lying 1.1015 & 1.098 in extension.

However, should the euro strengthen and push above 1.1095 then market watchers should look for further upside with 1.1125 & 1.1165 as targets.

"Even though a continuation of the technical rebound cannot be ruled out, its extent should be limited," say Easy Forex.