Euro-to-Dollar Week Ahead Forecast: At Risk of 1.03

- Written by: Gary Howes

Image © Adobe Images

The Euro-to-Dollar exchange rate (EURUSD) faces downside risks in the form of tariff announcements, a European Cenral Bank (ECB) decision and the U.S. job report.

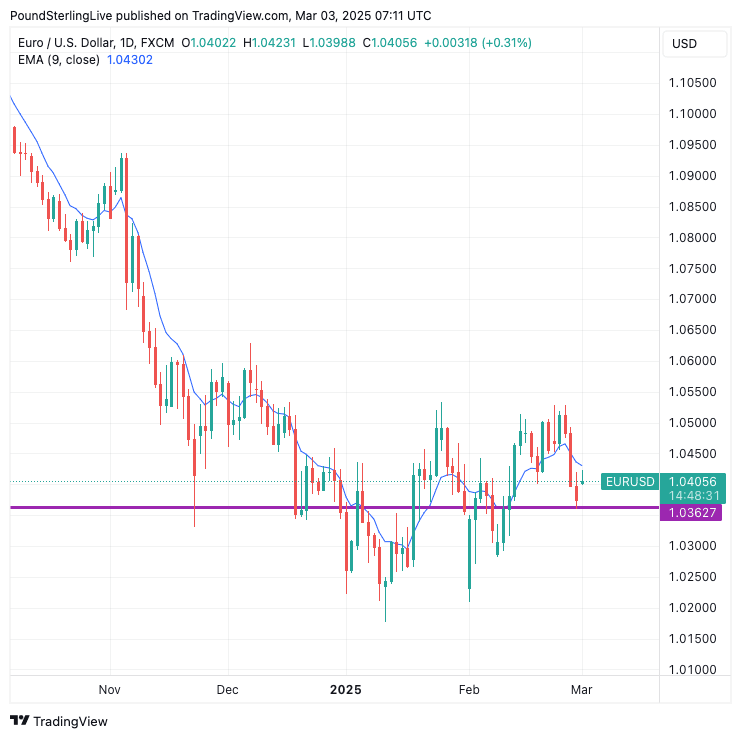

EURUSD last week failed to break the ceiling at 1.05 and the subsequent pullback takes it below the nine-day exponential moving average (EMA) at 1.0429.

Our Week Ahead forecast model judges that a fall below the nine-day EMA is a signal that further weakness is likely as the short-term trend has turned lower. Based on this, the initial target is last week's low at 1.0392, ahead of 1.03:

Above: EURUSD at daily intervals.

"It's set to be a pivotal week for markets, as trade tariffs on imports from China, Mexico, and Canada are due to kick in," says James Knightley, an economist at ING Bank.

"The US jobs report for February and a decision from the European Central Bank will also keep investors on high alert," he adds.

Euro-Dollar will likely remain heavy into the U.S. tariff announcements on Mexico and Canada, scheduled for Tuesday, which pose significant two-way risks for the Euro-Dollar.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"While the rhetoric about a new global trading order has been clear, the enactment of tariffs on March 4th would be a clear and scary sign for markets that we are officially done with the neocon/neoliberal world order and moving to Transactional Neomercantilism," says Brent Donnelly, founder of Spectra Markets.

The severity of the tariffs will send a clear signal as to what the European Union can expect when President Donald Trump finally turns his guns on Europe.

We know from Commerce Secretary Howard Lutnick's Sunday media round that tariffs on Canada and Mexico are proceeding. However, there is ample scope for a delay and the final measures to be less severe than first touted:

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"There are going to be tariffs on Tuesday on Mexico and Canada, exactly what they are, we're going to leave that for the president and his team to negotiate," he said.

The comments confirm that the advertised blanket 25% import tariff is likely to be avoided, which would prompt some relief for the CAD and MXN, as well as tariff-sensitive currencies such as the EUR.

For the USD, any watering down or delay would trigger weakness and allow the Euro-Dollar to return towards the resistance ceiling at 1.05.

"The main risk to our view of a higher USD this week is if President Trump reverses or delays increases to tariffs that are scheduled for Tuesday 4 March (US time). In this case, the USD would fall by at least 1%," Kristina Clifton, Senior Currency Strategist at Commonwealth Bank.

Trump last week reiterated the U.S. would proceed with tariffs on the EU. Official White House Photo by Molly Riley.

For now, however, we would not expect a break above the 1.05 ceiling as Euro strength would soon fade.

Trump has said he intends to tariff EU imports as the EU has treated the U.S. "very bad" in trade, ensuring enough uncertainty to ensure bouts of Euro strength prove limited. Only when the final tariffs on the EU are agreed would we expect the kind of clarity that would allow the Euro to enter a more decisive recovery.

There's a busy data calendar to look forward to in the U.S., which should offer some volatility; however, it's Friday's non-farm payroll job report that is the highlight of the week.

The market expects a 185K reading for February, up from a previous print of 143K.

A strong jobs report would reinforce economic resilience, pushing back rate cut expectations at the Federal Reserve and boosting USD. A disappointing print could weaken the dollar.

"Consumer confidence is already weakening on concerns about consumer spending power and government austerity measures, and more headlines about tariffs won’t help the situation," says James Knightley, an economist at ING Bank.

The U.S. Dollar's trend of weakness for much of 2025 reflects a turn in the data from outright U.S. exceptionalism to something more benign. This has allowed the market to price in further rate cuts at the Fed, which has helped Euro-Dollar off the lows.

A continuation of the trend should limit any weakness in the week ahead, even if there are some euro-negative tariff headlines.

Thursday's ECB decision shouldn't be forgotten, as another interest rate cut is expected alongside fresh guidance.

What will be of interest is how the ECB reacts to signs of renewed disinflation in Germany, France and Spain, as it suggests there is more scope to cut interest rates beyond March.

If the ECB hints that it is growing more comfortable with inflation and that the economy needs further support via lower interest rates, then the EUR can come under pressure.

However, analysts agree that there is not enough in the incoming Eurozone data to warrant a major change in course at the ECB, which should limit any post-decision market reactions.