Euro Back in Black, Italian Bonds Calm after ECB Says Won't Tolerate "Financial Fragmentation"

- Written by: James Skinner

-

Image © European Central Bank

- EUR/USD spot at time of writing: 1.0887

- Bank transfer rates (indicative): 1.0513-1.0589

- FX specialist rates (indicative): 1.0731-1.0796 >> More information

The Euro swung back into the black in choppy month-end trading Thursday and 'periphery' bond markets were rising following the April European Central Bank (ECB) press conference, potentially suggesting lesser concern among investors about financial stability in Southern Europe.

European Central Bank President Christine Lagarde told markets the bank remains committed to doing everything it can to support citizens through the coronavirus crisis and that it will not "tolerate any risk of financial fragmentation."

"This is ECB-speak for saying that the central bank is indeed here “to close the spreads” and that it intends to do just that," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics. "Ms. Lagarde emphasised that the ECB remains flexible in the face of the crisis and that it will not hesitate to deploy such flexibility to further enhance its tools, if needed. This goes without saying almost, but the point is, sometimes central bankers have to say the obvious, over and over again, to send a message."

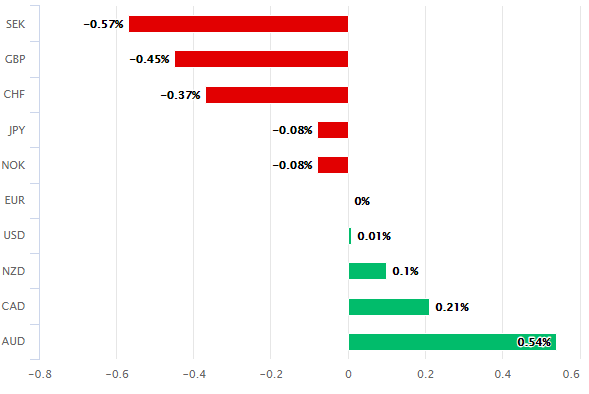

Above: Euro performance against major rivals Thursday. Source: Pound Sterling Live.

Thursday's message came in the wake of the April meeting of the Governing Council and at the tailend of a month that saw 'periphery' bond yields lifted sharply amid investor concerns about debt sustainability in the Eurozone.

Lagarde also reiterated an earlier call for "joint and coordinated policy actions between monetary and fiscal authorities," in an apparent reference to EU finance ministers and national leaders who're yet to agree a meaningful European fiscal response to the coronavirus crisis. Finance ministers have been tasked with agreeing the details of a recovery fund before May 06, after having put together a €540 bn package that fell short of market expectations.

"In the Eurozone‘s worst recession ever, the ECB will almost certainly have to scale up its asset purchases this year. The bank had no need to do so today already. Its economic number-crunching left brain half probably suggested the ECB it can afford to wait, while its political intuitive-thinking right brain half likely encouraged the ECB it should indeed wait and not take finance ministers fully off the hook at this stage," says Florian Hense, an economist at Berenberg.

Above: Euro-to-Dollar rate shown at 15-minute intervals alongside Italian 2-year bond yield (blue line).

The Euro was also down against all major rivals except the Australian Dollar heading into the press conference, with some of the heaviest losses coming against other European currencies like Sterling and the Swedish Krona, although it swung back into the black against some including the Dollar after.

Italian bond yields also fell while the spread or difference between Italian and German government debt costs fell three quarters of a percent to 1.41%, indicating less concern among investors about Southern Europe.

“The ECB has done little to stabilise equity markets, but has perhaps done the job in the credit markets, for now," says Hinesh Patel, a portfolio manager at Quilter Investors. "The outlook for Europe remains murky, but Lagarde does at least seem to continuing Draghi’s policy of ‘whatever it takes’."

The ECB said Thursday it's "fully prepared" to increase the size of its pandemic-emergency-purchase-programme of quantitative easing, which commits it to buy €750bn of European government and corporate bonds, by as much as necessary and for as long as needed. That's equal to around 6.3% of an €11.9 trillion Euro area GDP for 2019.

"We continue to think that the ECB will increase the size of the PEPP by EUR 500bn. This now looks likely by the June Governing Council meeting or before," says Nick Kounis, a economist at ABN Amro. "Government bond supply is surging and we think that the current level of purchases is insufficient to mop this supply up. Without a step up, financial conditions could tighten further."

Above: Euro-to-Dollar rate shown at daily intervals alongside 2-year Italian government bond yield (blue line).

The ECB also said Thursday the interest rate on its targeted-longer-term-refinancing-operations (TLTRO III) will be further reduced so that it sits 50 basis points below the main refinancing rate of 0%, which would leave it matching the negative deposit rate of -0.50%, from June 2020 until May 2021.

But those which have met predetermined lending targets will be able to refinance borrowings at another rate that is 50 basis points below the already-negative deposit rate, which is a reward that will increase the compensation effectively paid by the ECB to those lenders for the relative success in providing increased credit to the real economy.

New TLTRO loans are also in the pipeline with the aim of "preserving the smooth functioning of money markets by providing an effective liquidity backstop" and will incur an interest rate of -0.25%, which means the ECB will effectively pay lenders to refinance borrowings in the hope that it increases the flow of credit from the banking system to companies and households.

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility remain unchanged at 0.00%, 0.25% and -0.50% respectively. The ECB's original quantitative easing programme will continue at the same pace of €20bn per month alongside purchases under the extra €120bn per month "envelope" announced in March.

Thursday's decision comes after Eurostat said the Eurozone economy contracted by -3.8% on a quarter-on-quarter basis in the initial three months of the year, the steepest contraction seen by the bloc's 19 economies at least since the launch of the Euro in 1999. However, economists widely expect an even worse outcome for the current quarter.

Many were looking for assurance that the ECB will stand behind the Italian bond market to prevent further problematic increases in yields, which often move in the opposite direction to Euro-to-Dollar rates in times of crisis, given a continued absence of a European solution to the cost of the coronavirus containment effort that's stoked debt sustainability concerns across the 'periphery'.