Euro-to-Dollar Rate Outlook Clouds as Analysts Look for Economic Recovery, while Flagging Recession Risks

- Written by: James Skinner

-

Image © Thorsten Schier, Adobe Images

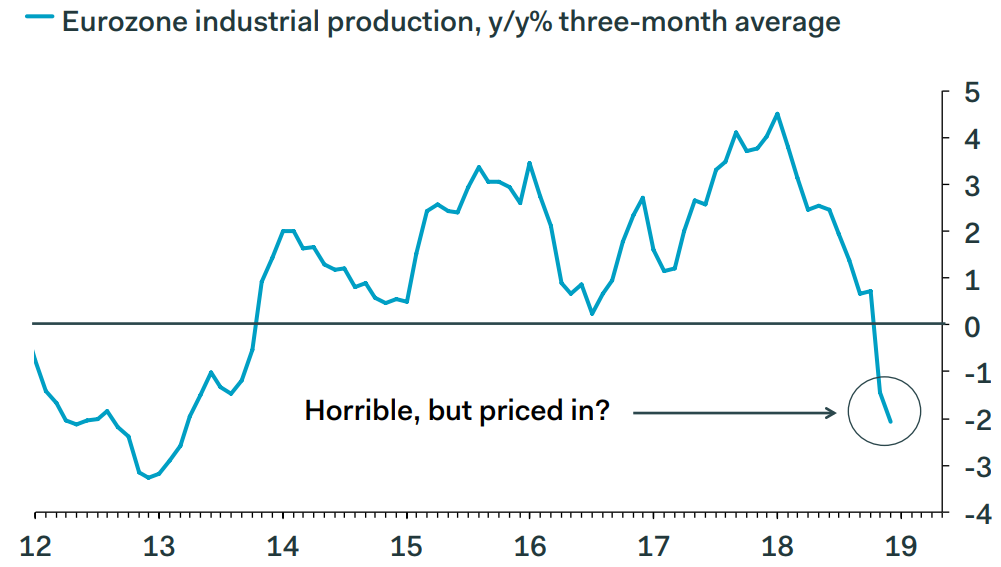

- EUR industrial performance in Q4 worse than expected, data shows.

- Eurostat now seen revising Q4 growth down to just 0.1% Thursday.

- Economists look for Q1 pick-up, while quietly flagging recession risk.

The Euro-to-Dollar rate fell Wednesday after official data revealed a steeper-than-anticipated slump in Eurozone industrial production took place in December, leading analysts to warn that estimates of GDP growth for some countries could be downgraded on Thursday.

Industrial production fell by -0.9% during December, deepening the decline recorded for the previous month, when consensus among economists had been for only a -0.4% fall. Eurostat also revised its estimate of November's contaction up to -1.7%, from -1.4% initially.

This means Eurozone industrial output contracted by a mammoth -4.2% when December 2018 is compared with the same period one year ago, which has prompted some economists to suggest Eurostat's estimate of final quarter GDP growth will be revised down on Thursday.

The decline was not just concentrated in traditional manufacturing economies like Germany, but was broadly spread out across Eurozone countries, with industrial output in the Republic of Ireland falling by a staggering -13.4%.

"These data are a bit worse than we expected. Industrial production plunged by 1.4% quarter-on-quarter in Q4, 0.2pp below our initial estimates. This, in turn, supports our view that tomorrow’s second Q4 quarter-on-quarter GDP estimate will be revised down slightly, by 0.1 percentage points to 0.1%," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics.

Above: Quarterly growth in industrial output, year-over-year. Source: Pantheon Macroeconomics.

The world and it's wife appeared to conspire against the Eurozone economy in the second half of 2018 as new EU rules on measuring the emissions output of new cars brought production in the automotive sector to a standstill and a deteriorating global economic backdrop hurt the broader industrial sector.

China's economy is faltering and expected to slow further in 2019 as President Donald Trump's tariffs on exports to the U.S. stymy activity in the manufacturing sector and crimp spending among households.

This is significant given Europe's manufacturing sector accounts for a substantial portion of output in countries like Germany and is highly sensitive to changes in Chinese activity given interconnections between both sectors.

"That said, these data don’t tell investors anything that they didn’t already know. Manufacturing in the EZ has been stung by slower growth in global trade a whole hosts of one-off factors, the latter which appear to be fading at the start of the 2019. All eyes are on the Q1 hard data now for signs of stabilisation or, perhaps, even a modest upturn," adds Vistesen.

Markets care about the industrial data because of what it means for GDP growth, which is an important driver of the inflation pressures that dictate European Central Bank (ECB) interest rate policy.

Interest rate decisions are normally only made in response to changes in the inflation outlook but impact currencies because of the push and pull influence they have over international capital flows and their allure for traders.

Above: Euro-to-Dollar rate shown at hourly intervals.

The Euro-to-Dollar rate was quoted -0.26% lower at 1.1296 Wednesday and has now declined -1.42% so far in 2019, after falling by around 5% last year.

"EUR/USD has traded through BUT NOT CLOSED below 1.1265. These are the December lows. Provided that the market holds here we favour a recovery to the 1.1535 200 day moving-average and the 1.1623 mid October high," says Karen Jones, head of technical analysis at Commerzbank.

The Euro was quoted lower against all G10 currencies on Wednesday, although analysts are far from unanimous in their forecasts of where it will go next.

"EUR/AUD shorts are working and we like being long NOK and CAD, against EUR, USD or GBP," says Kit Juckes, chief FX strategist at Societe Generale.

Above: Euro-to-Dollar rate shown at daily intervals, capturing 2018 collapse.

Eurostat's second estimate of GDP growth in the final quarter will be released on Thursday alongside Destatis' initial measurement of German growth during the final months of 2018.

"December’s 0.9% fall in industrial production confirms that there was a broad-based slowdown in the euro-zone at the end of last year, which was not due to problems in just one or two sectors or countries. The downturn will serve to keep worries about a possible euro-zone recession alive," says Andrew Kenningham, chief Europe economist at Capital Economics.

GDP growth fell from 0.4% to 0.2% in the third quarter and both Pantheon and Capital Economics say Eurostat will downgrade its estimate for final quarter on Thursday, which will mean growth fell by half again at year-end.

The two economists are also on a similar page as far as what will happen next is concerned. They're both now watching incoming data for the first month of the New Year in the hope of ascertaining whether the slowdown has continued in 2019 or if the economy stabilisied.

"We suspect that the industrial sector will perform a little better at the start of this year, in line with the manufacturing PMI. And other parts of the economy should do better than industry. However, the risk of an outright recession has clearly risen," says Kenningham.

The ECB has acknowledged that risks to the economic outlook are now tilted to the downside and hinted strongly that it may be 2020 before the bank is able to lift its interest rate from current record low levels, when only a few short months ago markets were anticipating a hike after the summer of 2019.

This is important for the Euro currency because its appeal to investors is hinged on the ECB eventually being able to "normalise" its interest rates structure.

Above: Euro-to-Dollar rate shown at weekly intervals, capturing ups and downs of post-crisis years.

The ECB's interest rate is still at 0% and its deposit rate is at -0.4%, meaning it costs banks to deposit money at the ECB rather than paying them.

An improvement in the interest rate outlook will require a pick up in economic growth and for core inflation to show consistent signs of making a sustainable return toward its target of "close to but below 2%".

But with May's elections for the European Union parliament expected to enfranchise a large and potentially policy-blocking contingent of anti-Euro, anti-austerity and anti-integrationist lawmakers, it's not yet clear that even a pick up in inflation would be enough to meaningfully lift the Euro for now.

There is also a lingering threat of a so-called trade war between the EU and U.S. given an American investigation of whether EU car exports are a "national security threat" is expected by February 17.

National security was cited for actions aimed at shutting some global steel producers out of the U.S. market last year and this report's conclusions could given President Donald Trump a green light to clobber European Union-made cars with 25% tariffs.

"The EU wants to strike tariff-cutting deals on industrial goods (“we abolish our car tariffs, you abolish your SUV tariffs.”). However, the US is also seeking enhanced access to the EU agricultural market. On this issue, the political room for the EU to yield to US demands is very limited," says Holger Schmeiding, chief economist at Berenberg.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement