Pound Sterling Triggers Fresh 3-and-a-Half-Month Lows vs. Euro as Merkel Wins Migration Reprieve at EU Summit

- Striking of migration deal at EU summit sees Euro stronger across the board

- 'Position squaring' ahead of month-end a reason behind Sterling's recent falls

- BoE's Haldane keeps alive prospect of August interest rate rise at BoE, could limit GBP downside

Image © Rawpixel.com, Adobe Images

The Euro is the best-performing currency ahead of the weekend as a deal is struck by European leaders over migration policy at the EU summit, delivering a reprieve to German Chancellor Angela Merkel whose coalition government came close to breaking over the matter.

The bad news for those looking to buy Euros with their Pound Sterling ahead of the weekend is therefore that the strong sell-off in GBP/EUR that started on Thursday is extending through the Friday session.

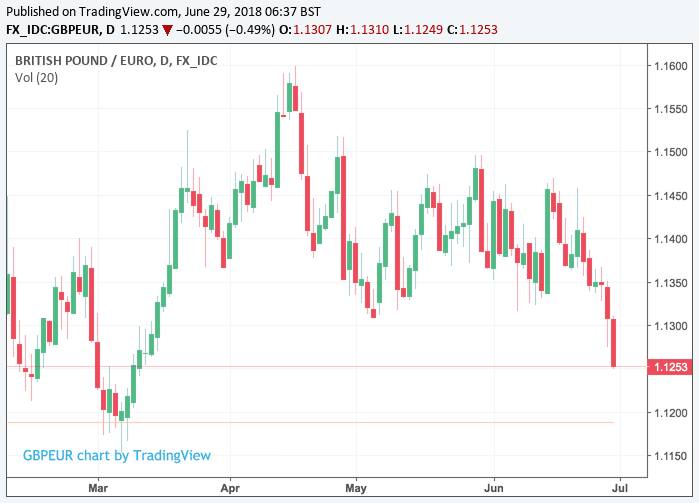

Sterling has cut through the key 1.13 support level - which has long-proven to be a solid level of support for the exchange rate from where we would have expected a rebound. That the Pound has fallen through the floor might just indicate this market might be ready to make a big directional shift lower towards 2018 lows at 1.1152.

At the time of writing the Pound-to-Euro exchange rate is quoted at 1.1256, the day's low is at 1.1248, this is also a three-and-a-half-month low.

Hideyuki Sano who sits on the Thomson Reuters Asia currency desk says that a deal on migration struck by the EU following marathon talks overnight is behind the fresh jump in the Euro. "The Euro jumped more than a half cent on Friday after European Union leaders reached an agreement on migration, a thorny issue that has threatened EU unity and the fate of German Chancellor Angela Merkel," says Sano.

"Not many saw this coming, which is illustrated by the jump in EUR/USD today, but the deal agreed amongst EU members on immigration is important. While it remains to be seen how water-tight and realistic this deal is, the development at least removes the near-term risks of political instability that could have resulted in the collapse of the government in Germany," says Derek Halpenny, European Head of Markets Research at MUFG.

We warned earlier in the week that the Euro would be in trouble should no deal be struck as it was increasingly clear the fate of Europe's longest-serving leader Angela Merkel was tied to such a deal, and it is clear that the currency markets were indeed embedding some risk premium into the Euro on these fears.

Merkel needed to reach an agreement concerning the arrivals of asylum seekers at the German border to ensure the continued support of her CSU partners in the German coalition government.

Above: Angela Markel and EU Council President Donald Tusk. © European Union

According to the conclusions of the June 28 session, EU countries could now set up new migrant centres on a "voluntary" basis. These centres would process migrants to determine which are genuine refugees and which are "irregular migrants, who will be returned", the text of their agreement says.

However, it was unclear which countries would volunteer to host the centres, importantly eastern bloc EU nations such as Hungary and Poland won't be forced to take in migrants. The joint communique also speaks of restricting the movement of asylum seekers between EU states - the key win for Merkel.

"The agreement takes a lot of the pressure off not just the EU as a whole but specifically off German Chancellor Merkel, who was under intense pressure from her interior minister to do something to stem migration. The agreement probably means no further worries about her coalition falling apart. It’s therefore positive for the Euro," says Marshall Gittler, an analyst with ACLS Global.

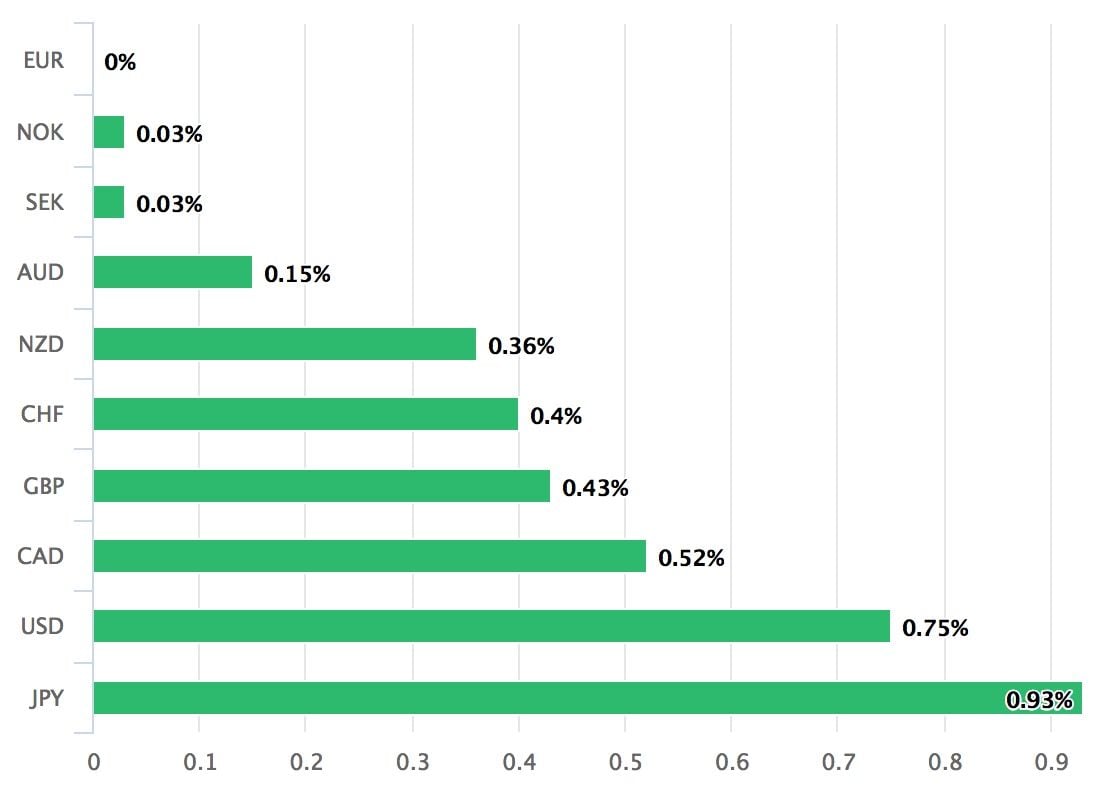

The EUR/USD exchange rate was an eye-watering 0.77% higher at 1.1651 on the news, and the Euro is easily the best-performing major currency today:

But there are other factors at play when it comes to GBP/EUR we are told.

Robert Howard on the Thomson Reuters currency desk says month-end buying of the Euro is being mooted in currency circles as being a factor in the Euro's rise to its highest level against the Pound in the second quarter.

"The combination of end of month positioning squaring, a lack of positive news on Brexit coming from the EU summit and global investor caution were a good enough reasons for EUR/GBP to challenge the 0.8850 area," says Piet Lammens, a foreign exchange analyst with KBC Markets in Brussels. EUR/GBP resistance at 0.8850 translates into the 1.13 support level in GBP/EUR.

If correct and there are indeed technical considerations behind the move then we could expect many of the losses suffered by Sterling against the single-currency to be reversed once flows have completed.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Sentiment towards Sterling remains extremely poor at present, and with the EU summit unlikely to offer any substantive comment for markets regarding Brexit, we don't see any potential relief in the near-term.

"GBP is looking extremely vulnerable right now. Base case is that GBPUSD hold's 1.30. But if EURGBP posts a topside breakout from its narrow range, it doesn't look pretty for GBP. Surprisingly UK data has been ok, but won't take much bad Brexit news to take the Pound down," says Viraj Patel, an analyst with ING Bank.

Patel has struck a relatively optimistic stance on Sterling over recent months, and therefore his views are not taken lightly.

The reason Patel is worried is because at the time of writing the EUR/GBP's ascent now leads it to threaten 0.8843, which in GBP/EUR exchange rate terms translates into a threatening of the floor at 1.13.

We have noted for some time now that the GBP/EUR exchange rate pair is subject to a very restrictive range and would expect it to stay within the range, but a break out of this range could potentially invite a strong directional move, and for Sterling-Euro it appears that it will be to the downside.

"Currently, risks to the GBP/EUR appear to be roughly offsetting, but that may not remain the case. The fact that these drivers could converge at any point in time, to either support EUR or GBP, means we must remain constantly vigilant, especially as the tendency following a break of an entrenched range is for a marked price move," says Gajan Mahadevan, a Quantitative Strategist at Lloyds Bank.

The break appears to have come earlier than we anticipated, and it appears to have taken place in favour of the Euro.

Haldane Offers GBP Some Fundamental Support

Andy Haldane © European Central Bank, reproduced under CC licensing

Sterling did manage to recover some ground in late trade Thursday, ahead of the EU summit news, thanks to the Bank of England's Chief Economist Andy Haldane who said in a speech that he believes the UK is currently enjoying a "tight" labour market with mounting pay pressures; an observation that lead him to vote for an interest rate rise at the Bank of England's June meeting of the Monetary Policy Committee (MPC).

Delivering the Academy of Social Sciences Annual Lecture in London, Haldane said raising interest rates now will help avoid raising interest rates sharply in the future in the event of a surge in inflation, adding he would have voted for an interest rate in May had the economy not slowed down in the first few months of 2018.

"Data on the consumer since the May MPC meeting has, virtually without exception, bounced back strongly," says Haldane adding that a Bank Rate rise of 25bp would still leave monetary conditions extraordinarily accommodative.

The comments from Haldane confirm to markets that the Bank of England now appears on course for an interest rate rise at their August meeting, this assumption should keep Sterling supported to some extent.

Observing the Pound's improvement following the comments, Neil Jones, a strategist with Mizuho Bank Ltd says it is "likely the market is cutting the Haskel shorts on Haldane comments."

The "Haskel shorts" referred to by Jones is the increase in bets for a fall in Sterling placed by foreign exchange markets after the newest member to the Bank of England MPC Jonathan Haskel told parliamentarians that he believes there is more 'slack' in the economy than the Bank of England currently assumes.

The debate over 'slack' - or spare capacity - is an important one as the Bank tends to raise interest rates when 'slack' disappears. Haskel's views on the matter were interpreted by markets as being suggestive that he would only reluctantly vote for interest rate rises.

Haskel takes over from Ian McCafferty in September.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.