Pound-to-Euro Exchange Rate hits May Best as Markets Sharpen Focus on Bond Yields

- Global ten year bond yields matter again for currencies

- GBP/EUR ultimately seen sticking to well-established consolidation zone

- Euro starting to take note of developments in Italian politics

© Rawpixel.com, Adobe Images

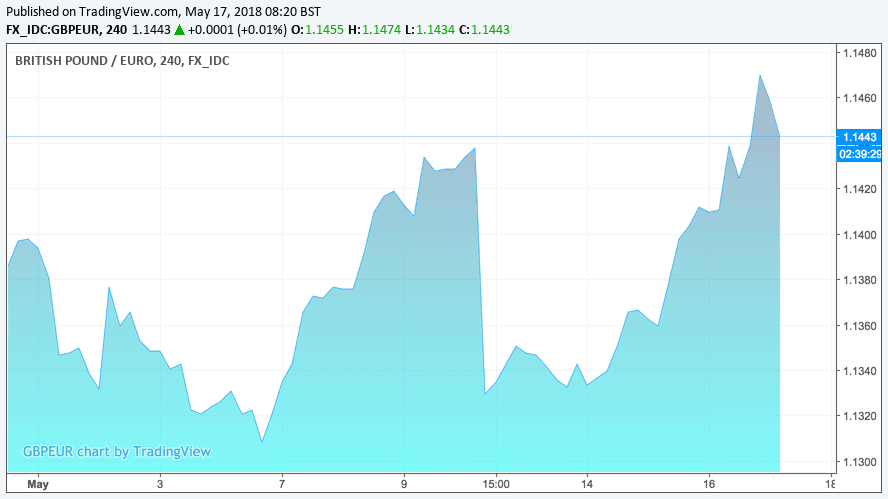

Pound Sterling has today registered this month's high against the Euro at 1.1472, having advanced for four days in succession as foreign exchange traders continue to take their cue from developments in the gargantuan global bond markets.

The current market dynamic appears to be favouring the currencies of countries that command a higher yield on their sovereign debt; the strengthening Dollar appears to be the big theme for foreign exchange markets once more with a jump higher in the yield on US Government bonds being the key culprit behind the advance.

At the time of writing the US ten-year yield is at 3.06%, UK ten-year yields are yielding at 1.5%, and the German bund 10-year yield at 0.62.

If we attach the relevant currencies to the yields, we get a similar order of performance: the Dollar is dominant, the Pound is outperforming while the Euro is a laggard and the Yen and Franc continue to struggle.

"For markets, the US 10y rate is all the rage. There are media reports of calls for a move to 4%, though the market consensus sits below 3.2% for year-end," says Mark McCormick, North American Head of FX Strategy with TD Securities.

The Dollar's advance has proved particularly detrimental to the EUR/USD exchange rate; losses by the Euro here are seen to be impact a host of other Euro-based exchange rates, EUR/GBP included.

Pound Sterling is therefore seen to be advancing on the Euro in this environment, with four consecutive days of advances taking the exchange rate to the current month's high at 1.1472 and in the process erasing the losses suffered one week ago when the Bank of England opted to keep interest rates unchanged at its May policy meeting while also downgrading inflation and growth forecasts for 2018.

Concerning the outlook, as long as the current regime remains in place, much will depend on what happens to UK, US and German yields. At present, the UK ten-year yield appears to be in an uptrend, something that could well support the Pound.

Image (C) Bloomberg

We note though that significant advances to fresh 2018 highs for the GBP/EUR exchange rate are unlikely at this point owing to factors such as UK economic underperformance, and lingering questions as to the process of Brexit negotiations.

Broadly speaking, this exchange rate looks to be in a consolidate phase and therefore lacks any major directional pull into unchartered territory. This is not great news for those hoping for a better Sterling-Euro exchange rate, but it does also provide some certainty that the prospects of a substantial shift lower is remote.

"A breach of nearby 1.1300/10 support might well extend the past few weeks retracement somewhat nearer 1.1200 but preliminary evidence suggests any such sell-off will struggle much below 1.1250," says Trevor Charsley with foreign exchange payment specialists AFEX.

This week we published findings from Charsley and analysts at Danske Bank that confirm the exchange rate to be in a broad uptrend, but that it is a slow-burning move that requires bucket-loads of patience.

Should Sterling find support and stage a recovery, Charsley says a break of resistance at 1.1450 should allow for another test - and potentially a breach of - prior 1.1600 highs.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Euro Weakness Amidst Italy's Big Political Experiment

Typically the phrase 'political woes' in the context of foreign exchange markets is applied to the UK regarding the ongoing struggle for the type of Brexit various factions within both major parties desire.

However, Eurozone politics are back to the fore now that two very different Italian parties are trying to form a coalition government.

The Financial Times ran a story discussing an early draft of Italy’s populist parties’ platform for the upcoming government, which included a mechanism for leaving the EU and a request that the ECB write off EUR 250 billion of Italian sovereign debt.

"The Euro may continue to broadly underperform here – even against sterling," says John J Hardy, Head of FX Strategy at Saxo Bank. "As some have pointed out – the irony here is that without Italy, the euro should be much stronger."

Hardy says the "EUR/GBP looks heavy if the 0.8750-25 area gives way."

Markets greeted the news that Italys League and Five Star Movement were closing in on a deal with a nonchalant shrug, but the release of proposed details to the coalition government's agenda appear to have prompted some moves.

One of the draft ideas is to demand the cancellation of €250bn (£220bn; $295bn) of Italian bonds bought by Italy's central bank under the European Central Bank's massive bond-buying stimulus programme.

Italy has the second-highest public debt in the Eurozone after Greece and the two parties are planning to increase budget expenditure by tens of billions of euros, with plans for a minimum universal income and a flat tax of 15% for low and middle earners.

The two party leaders also launched an attack on EU officials, accusing them of interfering in the talks process while reminding markets of their anti-EU roots by balking at a host of European Union and Eurozone rules.

Analyst Shaun Osborne at Scotiabank says Italian politics are now seen to be weighing on Euro sentiment, as German Bund/BTP spreads have widened significantly in the past few days, but he is not yet convinced the Euro will suffer too much damage.

"The yield gap at 141bps is only just returning to levels seen two months ago, hardly a crisis at this point," says Osborne. "The EUR itself has been less sensitive to developments in peripheral sovereign yields/spreads more recently, which makes the EUR’s latest swoon perhaps look a little more like more positioning cleansing than a more significant shift in bearish sentiment."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.