British Pound: Here's Why a EUR/USD on Steroids Could Keep Pound-to-Euro Pinned Down

- Written by: James Skinner

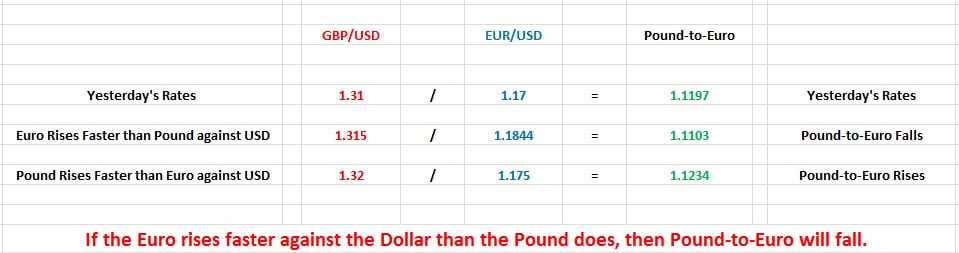

The Pound must keep up with the Euro’s gains relative to the Dollar if the Pound-to-Euro rate is to keep its head above water.

The Pound-to-Euro exchange rate could be pinned down close to its current lows during the coming days as a surging Euro-to-Dollar rate conspires with the intricate mechanics of the foreign exchange market to keep Sterling under pressure.

This is because the Pound-to-Euro is a foreign exchange “cross rate”. In order to calculate this rate, in its simplest form, interbank dealers take the GBP/USD rate and divide it by the EUR/USD rate to get a conversion price.

The effect of this is that the Pound must keep up with the Euro’s gains relative to the Dollar if the Pound-to-Euro rate is to keep its head above water. See the below graph for an example of how this works.

Wednesday saw the Euro continue its nascent surge against the US Dollar, rising 0.42% against the greenback to trade at a month-long high of 1.1840. The common currency has risen more than 200 points against its North American rival since the London open Monday.

Above: EUR/USD rate shown at hourly intervals. Captures Monday and Tuesday trading.

Meanwhile, the Pound-to-Dollar rate was relatively unchanged a short time before noon Wednesday, quoted just 0.03% higher, at 1.3159. Similar was true of the British currency’s performance during the Tuesday session, as shown by the below graph.

Above: Pound-to-Dollar rate shown at hourly intervals. Dates back to Friday.

There are multiple reasons behind the currency market’s machinations during the week-to-date but, first and foremost, the Euro has received a boost at a time when the Pound has come under renewed pressure from events in Westminster.

Prime Minister Theresa May’s plight is well known by those in both the UK and Europe. Sitting on a wafer thin majority, the PM must deliver Britain’s exit from the EU while avoiding a rebellion from either the Brexit or Remain wings of her party and, to a lesser extent, parliament.

This came to a head at the weekend with a The Times report suggesting around 40 Conservative Party MPs were prepared to sign a letter of no confidence in the Prime Minister, which threatens a party-wide vote on her leadership.

Meanwhile, German GDP growth reached a six-year high in the third quarter, according to data released Tuesday, with the economy expanding at a faster than expected pace of 0.8%.

On an annualised basis, German economic growth is now tracking 2.8%, its highest level since the first three months of 2011 and the onset of the Eurozone debt crisis.

The stand-out economic performance comes at a time when traders are growing nervous about continuing to hold the US Dollar, which enjoyed a strong run throughout October, but is now falling from favour.

Growing doubts over the Trump administration’s ability to get its signature tax-reform bill through Washington and on to the statute book are the driving force behind recent Dollar weakness.

The net effect of all of this has been a modestly higher Pound-to-Dollar rate, a substantially higher Euro-to-Dollar rate and a Pound-to-Euro rate that is weaker by an equally substantial measure.

Above: Pound-to-Euro rate at hourly intervals. Captures Monday and Tuesday on righthand side.

Pound Sterling Live reported Tuesday how some strategists, supported by a yawning gap between UK and European bond yields, see further downside as being limited for the Pound-to-Euro rate over the short term.

This view is still a valid one but continued gains for the Euro-to-Dollar pair could also mean that any gains for the Pound-to-Euro pair will also be limited, in the short term at least.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.