The Euro Still in 'Pole Position' against the British Pound and US Dollar

- Euro to Dollar exchange rate today: 1.1504

- Euro to Pound Sterling exchange rate today: 0.8852

- Pound to Euro exchange rate today: 1.1295

The Euro is set to rise to 1.20 against the US Dollar and to 1.0 against Pound Sterling this year say analysts at HSBC. This is one of the more agressive pro-Euro stances in the analyst community.

Citing short, medium and long-term drivers they conclude that the Euro could hit these targets by year-end, or even before.

Analysts outline six reasons why the Euro has further to rise.

1. Short-term FX Positioning

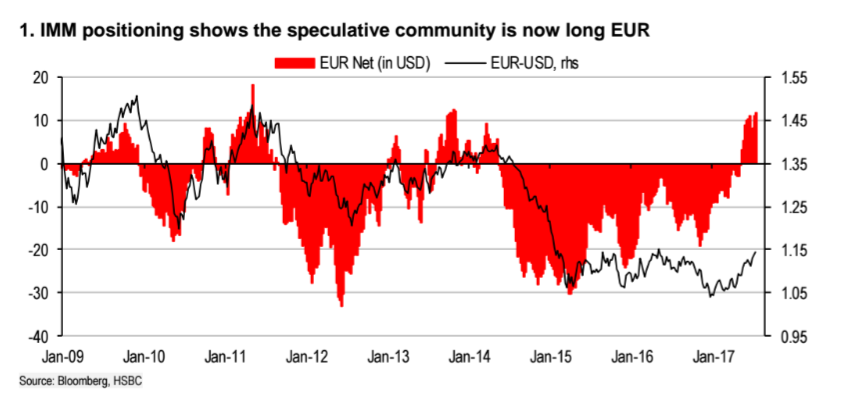

Short-term positioning refers to IMM (International Monetary Market) information available from futures exchanges such as the Chicago Board of Trade on trading positions held by large speculators, hedge funds and the like, in the currency futures markets.

Positioning is important - if the market is positioned at extremes on a trade it becomes harder for that trade to gather further entrants required to keep the trade moving. An example to consider is Sterling where positioning against the currency had reached extreme levels earlier this year creating a scenario where the decline actually started to fail.

So balanced positioning would be suggestive that a move has the potential to really move further.

HSBC focus on contracts held on EUR/USD futures by large speculators as well as their own home-made FX positioning indicator.

“The IMM data shows a clear shift in the last six months amongst the speculative community from short EUR to long EUR positions. This segment of investors now appears to be long EUR at the largest scale since late 2013 – well before the ECB started QE,” said HSBC.

The way most analysts interpret FX positioning is as a contrarian indicator, which means that they look for extremes and use those as an indicator that the opposite will happen - as the ‘elastic’ of the extreme ‘snaps back’.

The fact that the number of Euro long (buy) contracts held by speculators is at its largest since 2013 suggests the currency could be overbought and at risk of a move lower, however, HSBC do not agree.

Although the Euro is popular amongst institutional investors it is no-where near the peaks of buying interest it reached in 2012 and 2015.

HSBC also question the long-held assumption that extreme positioning usually leads to a move the other way, saying that their research shows extreme positioning often actually leads to greater “volatility” in either direction.

Thus, for them the buying extreme in the futures market could well be an indicator for even more buying to come – not necessarily the opposite.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

2. FX Options Positioning

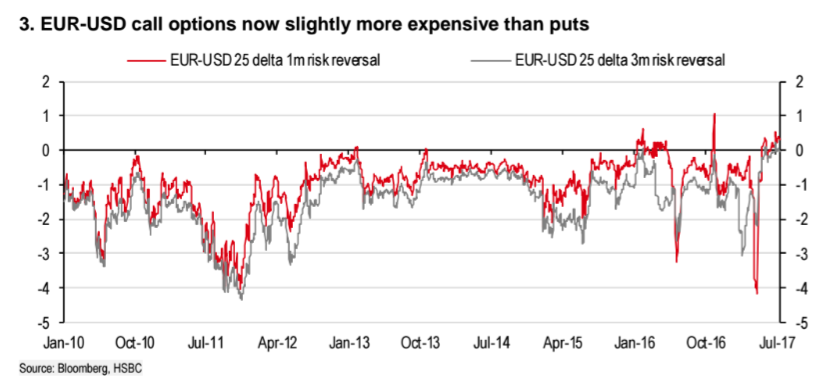

Buying interest in the FX Options markets is another way of gauging market sentiment.

Options can provide a limited risk, leveraged trading tool for speculating on currencies, most often employed by professional traders or traders seeking to hedge an open FX commercial position.

The thing with options is that you pay a set amount – a premium – and that’s it. If you are right about the direction of the market you make a leveraged win, if you are wrong, all you lose is the premium.

Options which make money when the market rises are called ‘Calls’ and those when the market falls are called ‘Puts’.

So, what is the FX options market telling us about EUR/USD?

After analysing the cost of Put and Call premiums for EUR/USD options HSBC’s Dominic Bunning notes how up until recently the cost of Call’s was consistently and significantly cheaper than those of Puts, because the market thought there was more chance of the exchange rate falling than rising, due to the Euro’s inherently bearish trend.

This changed recently in 2016 and now the costs have flipped with those of Calls now more expensive than Puts as confidence in the Euro has returned.

3. Portfolio Investors

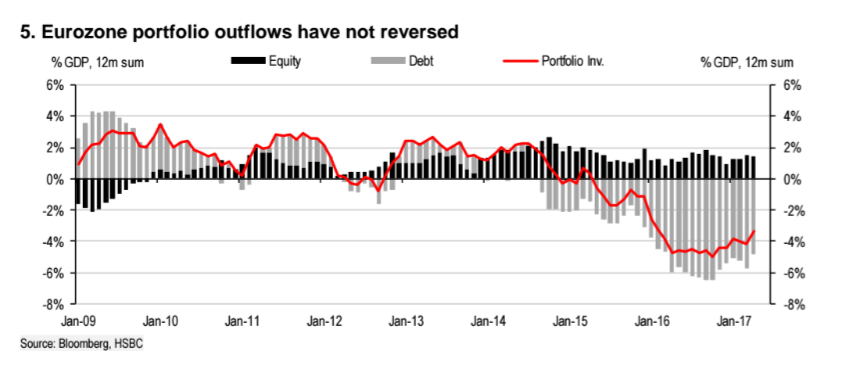

Amongst the indicators HSBC’s Bunning’s looks at are those which provide a medium-term outlook including the demand for Eurozone financial assets: bonds, stocks and shares from international portfolio managers.

Eurozone portfolio flow data continues to show a low level of demand for Eurozone bonds ever since the balance of demand between foreign investors buying Eurozone bonds and Eurozone investors buying foreign bonds went negative in 2015.

Eurozone stocks and shares continue to enjoy a small positive balance.

The balance for bonds looks like it is rising from a bottom.

Bunning interprets this as showing that there is great potential for the market to rebalance as investors start buying Eurozone debt again.

Increased demand, when it materializes, will have the side effect of also pushing up the Euro.

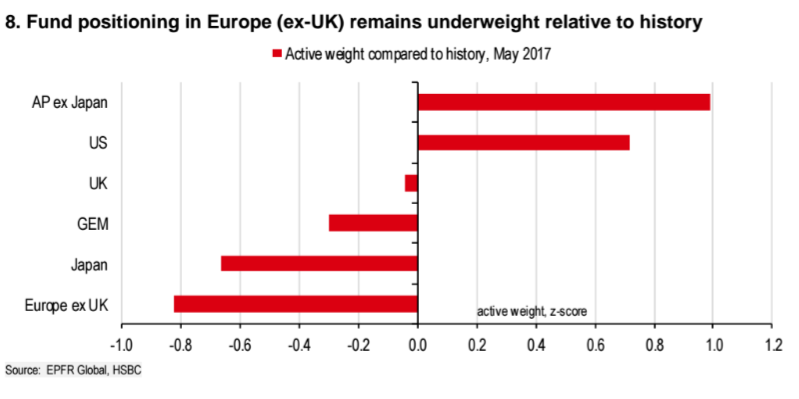

4. Equities Historically Underweight

Although there is a net positive balance of equity portfolio buying in the Eurozone, it is at historically low levels which suggest space for upside potential.

Increased buying of Eurozone equities from outside the region would increase euro-currency demand.

5. Euro Demand from Reserve Managers

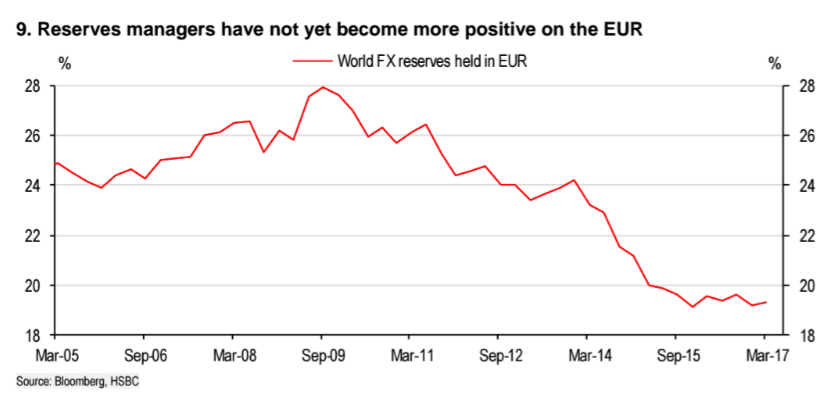

A slower moving medium-term indicator for the Euro is reflected by demand from central bank reserve managers for the currency.

“We track reserves managers’ declared currency holdings as a gauge for positioning amongst this segment of the market. These long-term investors tend to move very slowly in their asset allocation. Chart 9 shows how in the last seven years the weighting of EUR amongst reserves holdings globally has decreased, steadily but significantly,” said Bunning.

The decline in Euro holdings since 2011 was probably due to the sovereign debt crisis which leaked in 2015 when the final Greek bailout deal was agreed.

The chart of euro-holdings looks overstretched to the downside, however, and the current possible basing pattern may be the start of the steady recovery.

HSBC argue that the substantial fall in the risk that the EU will breakup following the Macron win in France will probably now lead to a resurrection in Euro holdings amongst reserve managers, and thus further strength for the currency.

6. Sell-Side Analysts Not All Behind the Euro Yet

Sell-side analysts work for investment banks and brokers.

It is their job to sell prime brokerage services to funds, banks and hedge funds, essentially they are the bank's broker.

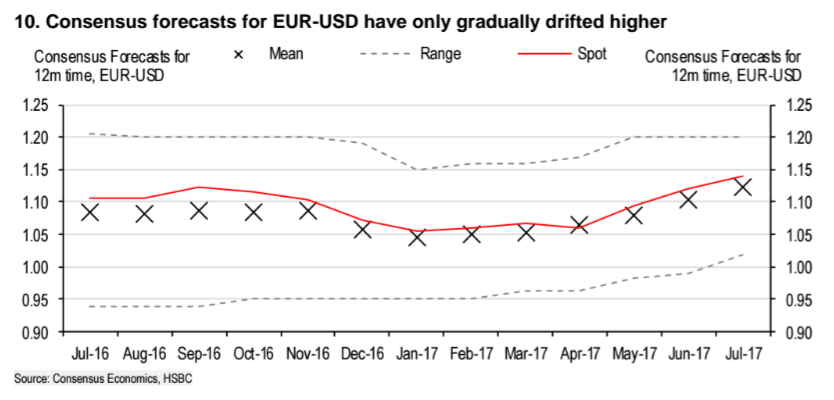

According to HSBC’s Bunning they are characteristically slow ("glacial") at shifting their stance.

The consensus view of Sell-side analysts has shifted only slightly higher in recent months, “and continues to look for a modest EUR deprecation, as it has for the majority of the last year,” says Bunning.

The range of forecasts has also narrowed from 26 big figures to 18 in a year and this points to a lack of conviction, say HSBC.

This reflects a resistance to a change in view:

“Those who were targeting below parity in EUR-USD will find it hard to turn outright bullish on the single currency, given all the structural, cyclical and political risks that were being referenced previously,” said the bank.

Whilst this is not a bullish sign for the Euro, it is also reassuring to those who might think the Euro’s rally is overstretched.

It is not according to institutional analysts, so, again there may be further for it to go.