Euro Tears Higher as Economic Activity in Eurozone Starts to Run Hot

The Euro was seen dominating the Pound and US Dollar on Tuesday, July 18 thanks to a combination of the woes suffered by its two counterparts and some strong Eurozone data.

The Dollar is seen struggling as US President Trump looks to be losing control of his legistlative agenda while the Pound retreated following the publication of inflation data that showed price pressures had eased between May and June.

The Euro meanwhile benefited from data showing that business sentiment in the Eurozone and it's largest economy, Germany, was running hot.

The EUR/USD is seen trading sharply higher at 1.1538

The strengthening Euro was also felt by the Pound:

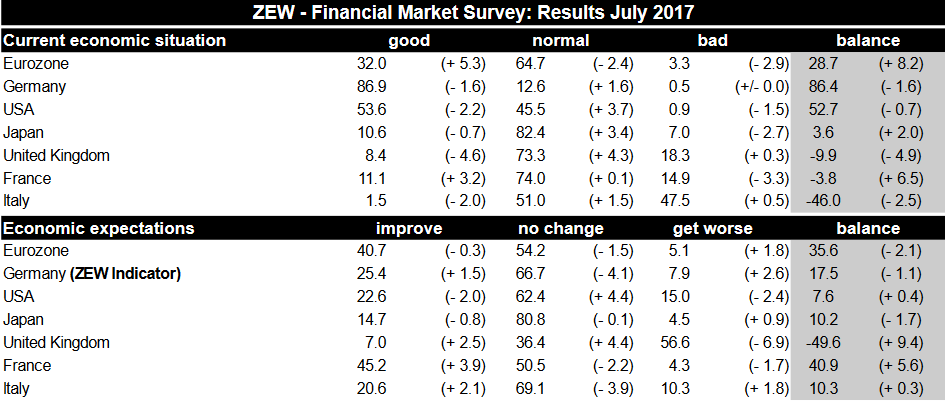

The latest release of the latest ZEW economic sentiment gauge showed the balance of ZEW economic expectations for the whole Eurozone region in June fell by 2.1 basis points, to 35.6 in June, from 37.7 previously when a lesser fall to 37.5 had been forecast by analysts.

This is the forward-looking (6 months ahead) part of the survey, and appears to have a good track record in predicting future growth.

The ZEW economic sentiment guage is a survey-based economic data series, generated from interviews with 350 financial professionals, who are asked to answer whether they think conditions have improved with a simplified three option answer: better, worse of unchanged; the results are then presented as a balance of the answers.

The Current Situation, meanwhile, rose 8.2 basis points to a final print of 28.7 for the Eurozone region.

The data for Germany, showed a fall in the Current Situation gauge from the previous reading – although to a still near multi-year highs at 86.4.

The medium-term forward-looking ‘expectations’ gauge showed a fall of 1.1 to 17.5 in Germany.

“Our overall assessment of the economic development in Germany remains unchanged compared to the previous month. The outlook for the German economic growth in the coming six months continues to be positive. This is now also reflected in the survey results for the eurozone,” comments ZEW President Professor Achim Wambach, PhD.

Economic development as measured by ZEW was also seen as trending higher significantly in the Eurozone, despite the short-term blip lower in June, according to Dr. Wambach.

“The indicator for the economic situation in the eurozone has been steadily increasing, now reaching its highest level since January 2008. With that said, the economic outlook for the eurozone has experienced a clear overall improvement,” said the Doctor.

The steady growth reflected in the ZEW survey results echos what economists have been saying about the recovery in the Eurozone.

The imprvoed outlook for the region is the reason the European Central Bank has been discussing cutting the crutch of monetary stimulus, and the ZEW data is another tile in the mosaic leaning towards that decision.

A cut in stimulus is likely to strengthen the Euro as it will increase yields and reduce the ECB's money printing, which has been diluting the Euro's unit value.

Save

Save