Euro Rally Here to Stay as Italian Stresses Ease

The Euro's impressive rally thus far in 2017 is likely to become more entrenched according to analysts at Morgan Stanley; an ominous message for those hoping for a stronger Pound to Euro exchange rate over coming months.

Expectations for a stronger Euro follows a set of increasingly positive data releases from the Eurozone, rounded off by European Central Bank President Mario Draghi changing rhetoric on the outlook for ECB interest rates and quantitative easing.

"The EUR rally has set in," says Morgan Stanley FX Strategist Hans Redeker. "The ECB's Draghi turning from ‘ultra-dovish’ to ‘moderately hawkish.’"

In June we saw Draghi tell the ECB Forum on Central Banking held in Sintra, Portugal, that the threat of deflation has gone and that deflationary forces have been replaced by reflationary forces.

Redeker says these comments are meaningful and, "with the hindsight of the market reaction, well-timed.”

But, the story is more complex and has multiple layers.

For the Euro exchange rate outlook, it is developments in Italy and how this country impacts ECB policy that has Morgan Stanley confident that further advances are possible.

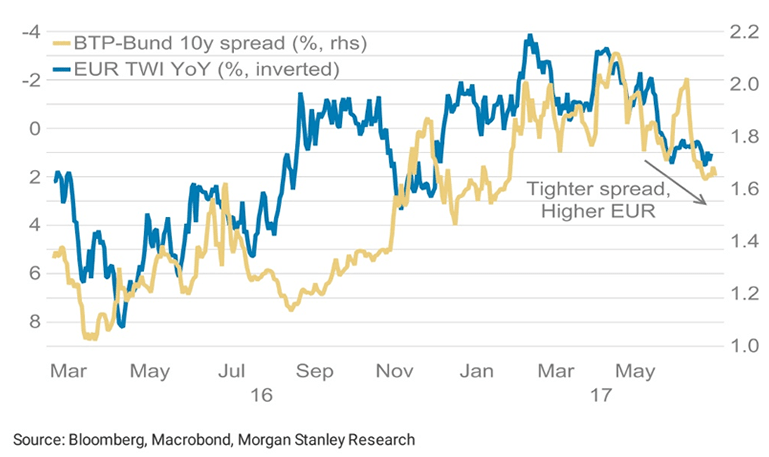

“When we think about the 'canary in the coal mine' to gauge the reaction to Draghi's apparent change in tone, it is not EUR we are focused on. Rather, it is the BTP spread,” says Redeker.

This spread is the gap between German and Italian sovereign bond yields - i.e the difference between the Eurozone’s most stable financial asset vs the most fragile systemically-important financial asset.

As can be seen in the above graph, there is a clear valuation between this variable and the value of the Euro.

Italy therefore matters more than many currency observers would have us believe.

A tighter spread implies increased stability as the premium for owning Italian debt fades; a signal that the ECB’s job of promoting financial stability is delivering.

“BTP spread stability suggests that EUR has more upside potential even though leveraged accounts seem to be positioned long EUR already,” says Redeker.

Investors Can Get a Lot More Bullish on the Euro

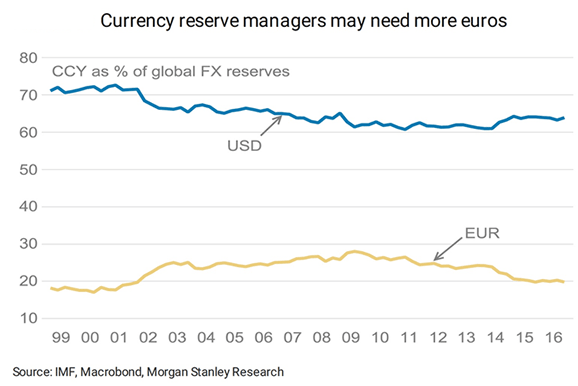

According to Morgan Stanley, what counts for the long-term EUR trend is the evolution of the weighting of Euros in real money portfolios.

In short, global investors need to pick up more Eurozone assets than they currently own, a process that would drive demand for the Euro as a side-effect.

Research conducted by the US investment bank suggests that during earlier periods of Euro weakness and low EUR-denominated sovereign yields, investors reduced their EUR weighting significantly.

For instance, currency reserve managers used to invest 28% of their assets into euros in 2008, but they have reduced this weighting to 20%.

“In sum, global real money investors seem to be significantly underweight EUR relative to historical levels, and may now reconsider the EUR outlook after the ECB turns towards tapering,” says Redeker.

This could drive a sea-change in demand for the Euro which could take it notably higher.

How High Can the Euro go?

According to Morgan Stanley, the outlook would be less EUR-friendly if BTPs disagreed with the ECB’s tapering intention.

Monetary policy in the Eurozone had to be driven by its weakest link, making EUR trade according to Italian fundamentals.

“Pushing monetary policy for Italian circumstances into overly tight territory could have widened Italian credit spreads, leading to an unwanted tightening of Italian monetary conditions,” says Redeker.

This is why the BTP spread remains an important variable to watch when judging the EUR outlook.

For now, it is noted that the BTP spread is stable and for good reason: the Italian economic outlook has improved, as evidenced by the country’s PMI readings.

“Globally improving trade, combined with the booming performance of Italy’s main European trading partners, seems to have generated sufficient support for the Italian economy to allow the ECB to taper without risking Italian credit spreads tightening,” says Redeker.

Morgan Stanley are forecasting the Euro to Dollar exchange rate (EUR/USD) to trade at 1.18 by the end of the year.

The Euro to Pound exchange rate is forecast at 0.92 by year-end, equating for a Pound to Euro exchange rate at 1.0870.