5-Day Forecast: GBP/EUR Exchange Rate

The GBP/EUR exchange rate is seen trading notably higher at the start of the new week being quoted at 1.1484, 0.55% higher than seen at the start of the day.

This week sees two important events that will shape the outlook for the currency pair: the UK general election and the rate meeting of the European Central Bank (ECB), both on Thursday, June 8.

Most analysts appear to be expecting a rise in Pound Sterling after the election, as Prime Minister May is forecast to increase her majority, however, a combination of news of a further terrorist attack in London and Jeremy Corbyn’s recovery in the polls has the potential to upset this expectation.

The ECB meeting is expected to be neutral for the Euro unless there is a signal from the governing council that QE needs to be unwound which would be positive for the currency.

However, the ECB is unlikely to signal an end to stimulus as it will want to keep the Euro weak to help support the recovery.

What are the Technicals Telling us?

GBP/EUR’s price chart, meanwhile, is showing a very bearish break below a key trendline (turquoise line), followed by a throwback to the line, and then the subsequent resumption lower on Friday - a classic combination of features which make up a trendline break motif.

The rebreak below the initial 1.1424 break lows is key and sets the pair up for a continuation down.

There is open ground until you get to the S1 monthly pivot at 1.1280 where the pair is likely to stall and consolidate.

Monthly Pivots are lines used by traders to gauge the trend and are often places where the exchange rate bounces or even reverses.

We would seek a break below 1.1400 for confirmation of a continuation down to S1 at 1.1280.

Data, Events to Watch for the Pound

The key event for Sterling is the election on Thursday. As we have already stated pundits have positioned themselves behind a win for the Conservatives but Labour has recovered to within 3-5% of the Tories and there is now a threat of there being a hung parliament.

“A failure to secure a more comfortable margin of seats (17 as of now) would weaken May’s position going into Brexit talks,” said NBF Economics Strategy.

A small majority would lead to the Pound weakening – only a majority of over 30 would help Theresa May in negotiations and support Sterling according to ING Bank N.V.

“We think were Theresa May's government to increase its working majority into the 30-50 seat area in Thursday's vote, GBP could enjoy a very modest bounce,” says ING’s Chris Turner.

“The main risk to GBP is an even smaller Conservative majority or a hung parliament. This would send EUR/GBP to 0.89 and GBP/USD to 1.26,” continued Turner.

EUR/GBP at 0.89 equtes as a Pound to Euro exchange rate of 1.2356.

Other major data releases, including PMI’s are likely to be completely overshadowed by Thursday’s election and this is confirmed by the Pound rallying despite the release of service PMI data which came in below expectations.

Data, Events for the Euro

The main event for the Euro is the ECB rate meeting.

The ECB will probably want to keep the Euro down so they are unlikely to gush about the recent recovery, and frustratingly low inflation makes it highly unlikely they will talk about a timeline for dismantling QE.

ECB chair Mario Draghi probably has not altered his stance from only a week ago when he said that the region still needed stimulus, so if anything the Euro is likely to remain either neutral or to fall.

“While we do look for the ECB to change is balance of risk around growth from downside to neutral, we think that the forward guidance is likely to remain unchanged based on recent comments from Draghi and other Governing Council members. This should leave a dovish tone, as markets realise that the ECB needs to see a lot more progress on inflation before the easing bias goes,” say Canadian investment bank TD Securities in a note to clients.

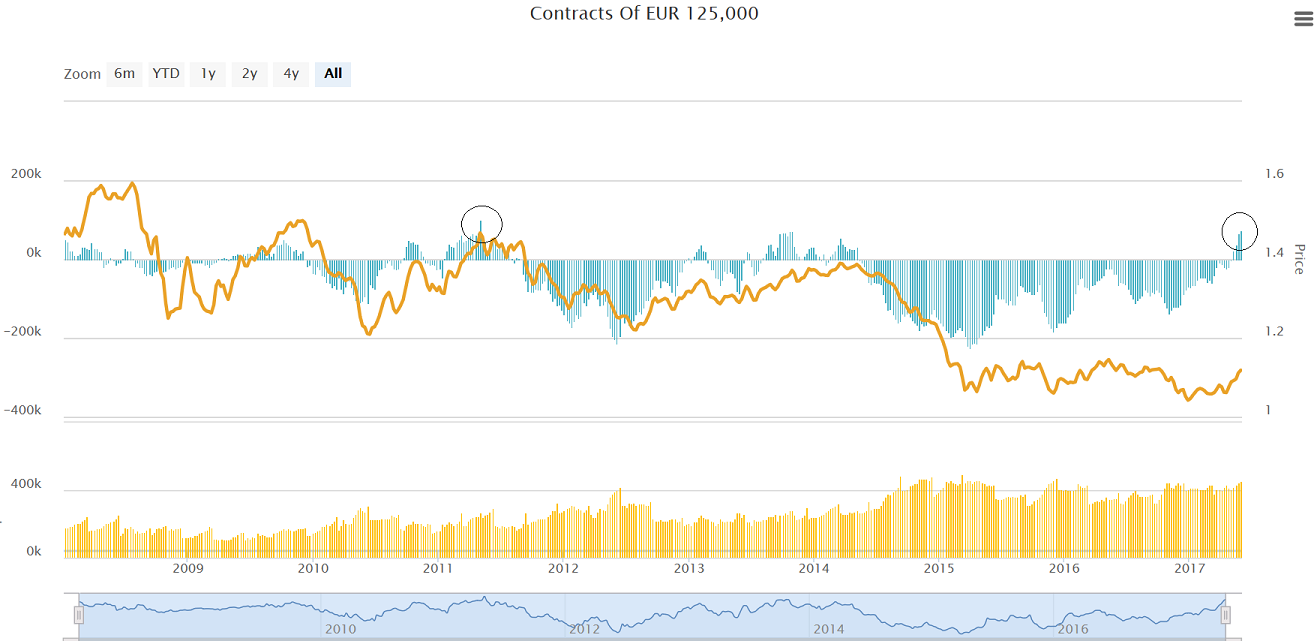

The other main thing to note about the Euro is the massive rise in investors giving up their bearish positions in the future’s market.

The divergence between the relatively low Euro and the record high positive positioning in the futures market - which is a reflection of the smart money’s optimism for the currency - suggests the Euro may seek to ‘catch up’ and, therefore, has further to rise.

“The EUR net long has climbed to a fresh multi-year high, exceeding (in contract terms) the 2013 high to reach levels last seen in 2011. Short covering remains the dominant driver (six consecutive weeks) in delivering an improvement in the net, with gross longs hovering just below the record seen in April,” said Scotiabank’s Osborne.