EUR/GBP to go Higher in the Long-Term says Societe Generale's Juckes, Cites UK's 'Frightening' Lack of Savings

Regardless of the boost it has received from the announcement of a snap election, the longer-term outlook for Pound Sterling is not so good, says Société Générale’s Kit Juckes.

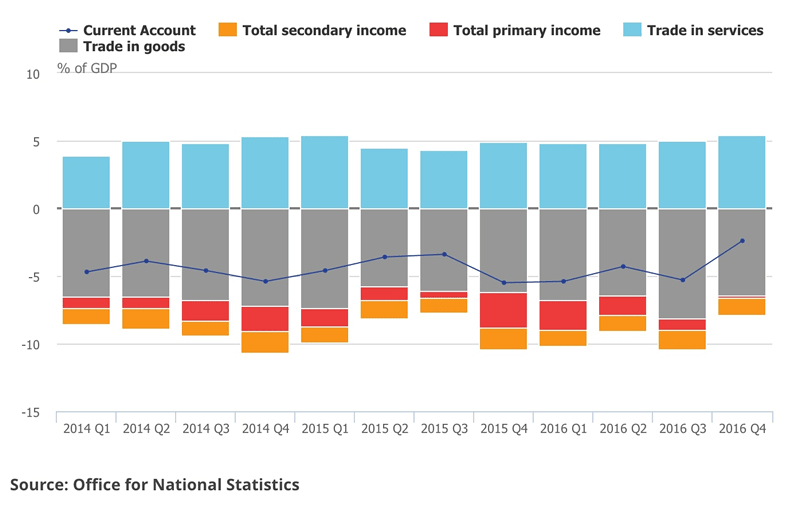

The problem hinges on the UK’s high Current Account deficit, which means it imports more than it exports, which should ordinarily lead to a weaker Pound.

But the problem is far worse than people really believe.

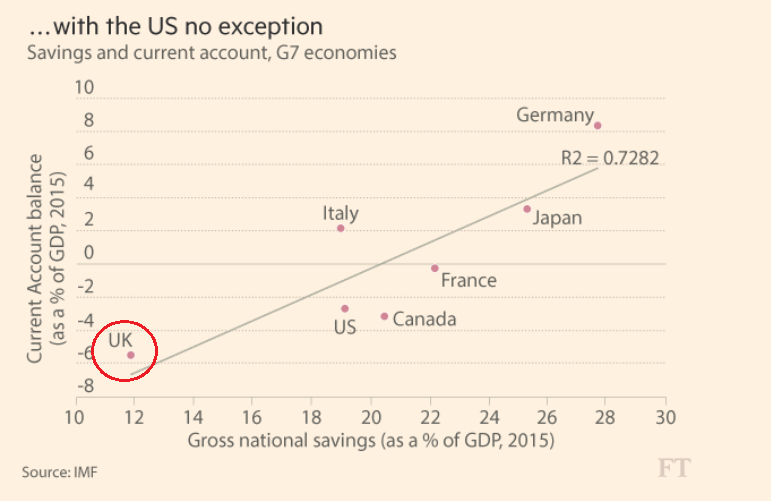

Juckes draws on a chart in the Financial Times which shows a high correlation between the Current Accounts of major countries and their savings ratios.

The chart is from an article written by Financial Times columnist Martin Wolf in which he argues that Current Account is more a symptom of the country’s ability to save than its openness to trade – as argued by Trump’s Minster of Trade, Wilbur Ross, in his defence of protectionism.

Juckes bases his weaker long-term outlook for Sterling on the position of the UK on the graph – right in the bottom left hand corner.

“But what sticks out like a sore thumb in Mr Wolf's chart is the UK's position. The deficit is improving so the chart overstates it, but the lack of savings in the UK economy is, frankly, frightening at first glance. The UK economy is holding up well as Brexit approaches, but it's living on credit," says Juckes in a note dated April 19.

However, Juckes' note comes before the ONS announced it had actually revised higher the country's current account deficit for the years leading up to 2012.

If anything there is a chance the figures could be understated.

The figures showed British companies had paid out more interest to foreign holders of corporate bonds than initially estimated, resulting in a larger current account deficit. The ONS said the current account deficit for 2012 now stood at 4.4% of gross domestic product, compared with 3.7% in its previous estimate.

The ONS revised up the deficit for every year dating back to 1998 by an average of 0.6 percentage points. The biggest revisions occurred from 2005 onwards.

Last month the ONS said Britain's current account deficit tumbled to 2.4% of GDP in the final three months of 2016, less than half its reading of 5.3% in the third quarter

However, the ONS on Wednesday also revised up its earlier estimates of how much Britons saved.

The household savings ratio for 2012 rose to 9.8% from 8.3% previously, with a similar upward revision for 2011.

But, the ratio for Q4 2016, which has not yet been revised, stood at its lowest since 1963 at 3.3%.

The implications for the British Pound are stark.

"This is potentially disastrous, and will continue to act as an anchor for the currency over the long term," says Juckes.

Juckes says he believes it is still a wise bet to be long on the Euro to Pound exchange rate as a core trade in 2017.

The call by Juckes comes at the same time a number of other institutional researchers are seen turning more positive on Sterling.

Following the UK Prime Minister's call for a snap election in June, the British Pound staged a remarkable rally.

For George Saravelos at Deutsche Bank the move represents a game-changing moment for a currency they have long been bearish on. Indeed, Deutsche Bank had warned EUR/GBP might even fall to 1:1.

But the longer-term stability that a majority Conservative government promises and the longer-term transitional Brexit period a stable government can offer is seen as a positive.

The German bank has put its clients on notice that it will be revising higher its forecasts for the British Pound in coming days.