British Pound Eyes Temporary Move Above 1.20 Against the Euro

- Pound to Euro exchange rate: 1.1960, week's high: 1.2028, low: 1.1746

- Euro to Pound Sterling exchange rate: 0.8378, week's high: 0.8513, week's low: 0.8313

The British Pound hit a fresh three-month high against the Euro at 1.2028 in the hours following the decision by Prime Minister Theresa May to call a snap general election for June 8.

The Pound has since retraced back into the 1.19's which is to be expected following such a big jump. The question now regards how far can the Pound can extend its rally.

Traders like the idea of May gaining a larger majority which would see her being able to shake the dependence on hard-liner members of her own party that are seeking a hard-Brexit in upcoming negotiations with the EU.

“The markets were quick to price in greater economic and policy stability under what they expect will be a significant majority given the weakness of the opposition," says Peter Ashton, Managing Director of Eiger FX. "There is still huge uncertainty surrounding the implementation of Brexit but a strong majority party will help to provide a degree of stability while we negotiate the choppy waters ahead."

"Today’s news has been a good enough reason for another squeeze in short GBP positions – in our opinion the most credible explanation for GBP’s post-announcement rally," says Viraj Patel, an analyst with ING Bank N.V in London.

Patel says the GBP to EUR exchange rate could run higher to 1.20 but he is not confident that the Pound will be able to make levels above here stick.

Indeed, ING maintain their view that the Pound will ultimately end the year at much lower levels. For Patel and his team the outcome of Brexit negotiations will be what matters for Sterling over the longer-term.

"EUR/GBP is on its way to reach, test and break below 0.83 as the uncertainty of the French Presidential elections weigh on the Euro says Georgette Boele, an analyst with ABN AMRO in Amsterdam.

EUR/GBP at 0.83 equates to 1.2048 in Pound to Euro exchange rate terms and this represents good value for those intent on buying Pounds.

Note that the French elections are imminent which leaves a short amount of time in which to capitalise on Euro weakness as we would assume a decent recovery on a Macron victory.

It might not be all plain sailing for the Pound and we wouldn't be surprised if increased uncertainty posed by the UK elections start to weigh on the outlook. A number of analysts warn that the move higher in Sterling might be overdone and should the polls narrow it might be left looking exposed at such hights.

“Investors will sit on their hands while the door-knocking gets underway, and we’d expect to see Dollar-backers profit. The price of gold and silver could also pick up, while the Pound and Euro remain plagued by political uncertainty,” says Paul Sirani, Chief Market Analyst at Xtrade.

International Money Transfers:

Get Quoted

Likely Amount Your Bank will Give:

EUR 0

This amount is based on the industry's average spread cost for the amount you entered as per research by Accourt

Likely Amount RationalFX will Give:

EUR 0

This amount is based on typical spreads charged by RationalFX

Request Quote from

RationalFX

A Landslide Looks Likely, Softer-Brexit Possible

There is certainly the feeling that the landscape has shifted in favour of Sterling over the past 24 hours.

The announcement by May that the country would go to the voting booth was unexpected in that she has repeatedly said she was not looking to make such a move despite her party's commanding lead in the polls.

It would appear May believes a commanding victory in June would strengthen the UK's hand in Brexit negotiations and therefore had little choice but to opt for a vote.

A number of institutional analysts believe that May might actually be using the election to gain advantage over her own right-wing party members as much as the opposition parties.

"Dealing day-to-day with a small majority has given Conservative backbenchers significant power to force the government to back down on a variety of issues.

Election campaigns can be deeply unpredictable but opinion polls suggest a Tory majority that would make that problem disappear," says the BBC's Laura Kuenssberg.

The calling of a general election was always a possibility after May triggered Article 50, although she had denied she would call one.

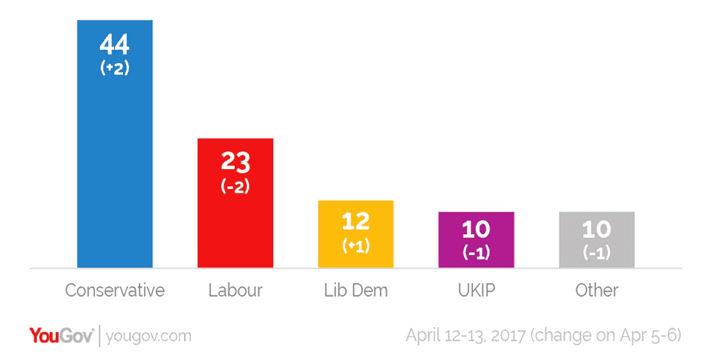

The latest YouGov poll on UK voting intensions gives the Conservatives the widest margin over Labour for 34 years, with the Conservatives polling 44% of the vote, in contrast to 23% for Labour.

"Who can blame Theresa May for calling an election that appears to be hers to lose?" reflects Kathleen Brooks at City Index. "As we have seen with the Turkish lira, political stability is key theme that can drive currencies higher today, and Pound traders obviously see PM May as a stabilising force."

The analyst notes markets might also have changed its view on Brexit, after the massive Pound sell off on the back of the referendum last year, today the market seems to be welcoming Theresa May’s decision to try and solidify her leadership at the helm of the UK’s Brexit mission.

"If the market is taking the view that it is better the devil you know, and with the odds massively in Theresa May’s favour that she will win this election, we could see the Pound catch a bid as we lead up to June 8th, and our 1.30 forecast for GBP/USD doesn’t seem that outlandish," says Brooks.

Brooks also suggests the Pound may also be rising on the back of expectations that Labour will be obliterated by this election, which could drag the party away from the Far Left.

At this juncture, one of the only risks to May’s leadership is if the Labour Party join forces with the Lib Dems as some anti-Brexit alliance, however, with less than 2-months’ to go before the election it is hard to see how any opposition to May can organise themselves to stand as a true challenge to the PM.

"Thus, this could be a fairly easy ride for Theresa May, and maybe for the Pound too," says Brooks.