GBP/EUR Exchange Rate Slips Below Trend-Line, 1.16 Forecast Near-Term

The GBP to EUR exchange rate has fallen below a key technical level at the start of the new month and we believe it is poised for further declines in the near-term.

The shift in near-term sentiment comes after the exchange rate enjoyed a period of strength in February just as our forecasts laid out at the start of the month suggested.

Sterling climbed in value as per the forecasts made by our technical analyst Joaquin Monfort who wrote at the start of February that his studies indicated that February would be an ‘up-month’ for Sterling-Euro.

His call was correct and we have just released the latest prediction for March, can he get it right again?

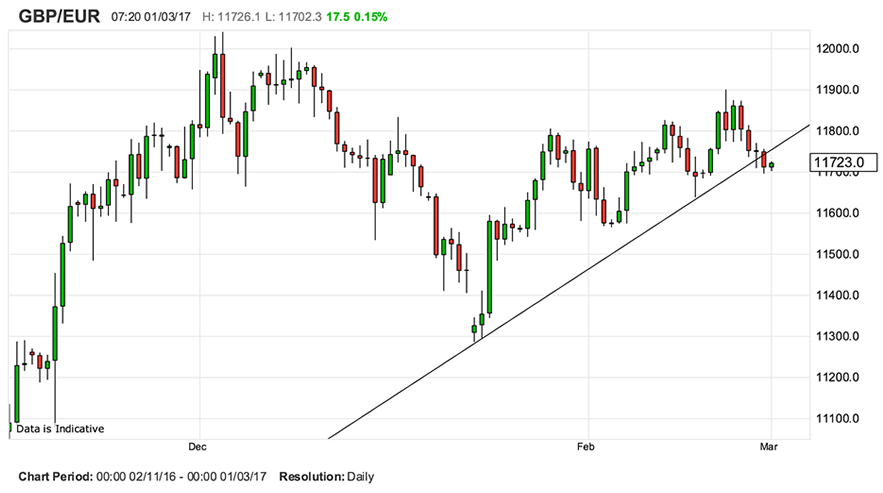

However, momentum appears to have been erased over recent days and we note that the exchange rate has now fallen below its trend line that has held the recovery since mid-January:

We believe the break below the trend line is the technical confirmation required to call time on the uptrend.

The break is likely to lead to a decline below the trendline which is equivalent to the move prior to the break.

This suggests a move down to roughly 1.1600 may be on the cards.

Confirmation of such a move, however, might be required, with a break below yesterday's lows at 1.1700 supplying that.

With the GBP/EUR exchange rate currently quoted at 1.1656 we note that banks are charging rates in the vicinity of the 1.1373-1-14 band for international payments while independent providers are quoting a more competitive rate towards the 1.1550-1.1580 area.

Manufacturing Data Slows (but the wheels keep turning)

Mixed March data releases for both the UK and Eurozone offset each other and led to little net change in the exchange rate on the morning of March 1.

UK Markit/CIPS Manufacturing PMI, released on March 1, has shown a slight slowdown in UK Manufacturing activity after coming out at 54.6 from 55.9 previously when a lesser fall to 55.6 was expected.

Markets were expecting a reading of 55.6, down from the previous month’s 55.7.

Despite the fall economists remained confident about the sector.

“Despite the fall in February’s UK Markit/CIPS manufacturing PMI, the survey still suggests that the sector carried a decent amount of momentum into 2017,” says Capital Economics’ Scott Bowman, who also said he expected the sector to show higher growth in 2017 compared to 2016.

Nevertheless, a decline in New Orders, which are a forward-looking indicator, does raise concerns about the sustainability of the positive outlook.

European Manufacturing PMI’s, meanwhile, released a half an hour before UK data, also showed a slowdown in the sector, but not as acute as in the UK.

Eurozone Manufacturing PMI came out at 55.4 in February from 55.5 previously when no change was expected.

This temporarily led to a fall in GBP/EUR.

Lending data from the UK was also mixed with Mortgage Approvals surprising to the upside at 69k in January when 68k had been forecast, but UK corporate lending slowing to 2.7% in January from 3.2% in December, led to a fall in the Bank of England’s preferred measure of bank lending M4 (excluding intermediate OFCs) money supply.