Pound Sterling up Against Euro, More Gains Forecast

The British Pound has edged higher against the Euro at the start of the new week with the two currencies now exchanging at 1.1769 on the spot markets.

The recovery from the February low of 1.1556 appears to be nervously edging higher to 1.18 - where it failed in early and late Januarly.

Concerning the outlook, we believe there is reason to expect the uptrend to extend a little further towards this key level.

Our analysis shows the exchange rate has formed what appears to be a bull flag pattern which would typically advocate for the near-term trend higher to extend.

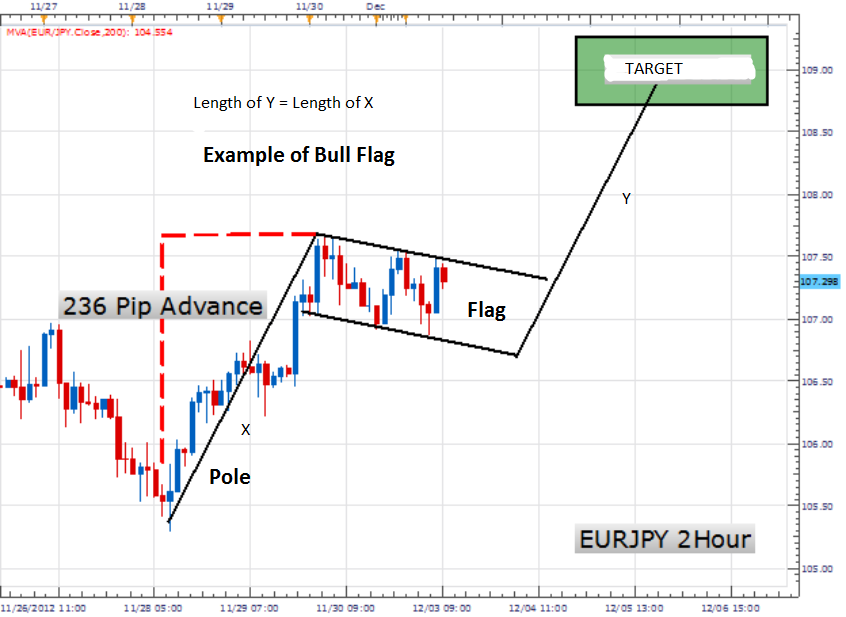

Here is an example of how such a pattern would typically be expected to play out:

These patterns generally reach an end target which is equal to the length of the pole extrapolated higher (X = Y), therefore noting such a pattern on GBP/EUR would suggest some decent upside for those hoping for a better exchange rate.

However, the flag on GBP/EUR may not reach that high – not without difficulty anyway - as the 1.18 resistance area lies in the way.

Recall the exchange rate capitulated at this level twice in January confirming traders don't like the Pound this expensive.

There is another formidable barrier just beyond here in the shape of the 200-day moving average - the moving average is the green line in chart and is where traders often lay market orders in anticipation of a reversal in trend.

The assumption that other traders will be doing the same ascribes something of a self-fulfilling prophecy to what is a theoretical line drawn on a chart.

We have therefore set an initial target at just below the 200-day moving average at 1.1850 in anticipation of resistance to the uptrend being found here.

The MACD is also now poking above its zero-line indicating the trend is probably bullish.

We’d however only be looking for confirmation of more upside from a break above the January 26 close of 1.1790.

Data, Events this week for the Pound

Inflation data for January is out at 9.30 on Tuesday, February 12, with analysts estimating a rise of 1.9% from the previous 1.6%.

The Bank of England will only raise interest rates should inflation be seen to be rising faster than they expected, and if markets see the prospect of higher interest rates on the horizon they will start bidding the Pound higher.

However, a rise in inflation is forecast due to the impact of the weaker Pound which has increased the cost of imports.

However, inflation is rising across the world at present as oil prices recover from record lows.

Therefore the Bank of England will look through any rise in inflation should they be due to these factors.

That is why markets will be watching instead is the core inflation rate - that element of the inflation picture that is due to economic growth, and wage rises in particular.

Therefore, what markets will instead be looking at is the core headline figure which is forecast to rise by 1.8% year-on-year in January, up from 1.6% in December.

Should the core level rise faster than expected then markets might take a bet that the Bank will be looking to raise interest rates sooner than they indicated in their February Inflation Report.

We heard last week that outgoing MPC member Kristin Forbes believes that an interest rate is actually warranted owing to the resillience of the UK economy.

If inflation beats expectations then perhaps other members of the MPC will share Forbes' view.

With wage data being so important then, expect market focus to turn to jobs and earnings data due out on Wednesday.

Average earnings will be in focus with 2.8% growth in wages being forecast. If this beats expectation then Sterling could be bid higher.

Watch for the unemployment rate to stay unchanged at 4.8%.

The Bank of England believes the economy's full employment threshold lies at 4.5%, the sooner this level is reached the sooner rates will likely rise.

Data, Events for the Euro

Monday see’s the release of growth forecasts from the European Commission, which are expected to show steady continued growth in the region, reinforcing the currently quite positive investor outlook for the Eurozone.

The ZEW Sentiment Index, which is a survey of financial professionals, and is normally a good leading indicator for the outlook for the economy is scheduled for release at 10.00 on Wednesday.

The previous 17.92 result is forecast to show a rise to 23.2 in February.

Thursday sees the release of the minutes from the last European Central Bank (ECB) policy meeting, which investors will especially be scrutinizing for any signs of policy tightening, possibly in the form of discussions of tapering current accommodation.

The Bigger Picture...

Don't be surprised if the Euro completely ignores the data and ECB-related events as it would appear that a notable degree of political risk is being absorbed by the single currency ahead of French elections.

Financial markets are focused on the French presidential election, but there is another, nearer-term catalyst for euro weakness: the stalled talks between Greece and its international creditors.

"If the impasse isn't resolved by the time Eurozone finance ministers meet on Feb. 20, politics will make it hard to resolve afterwards. And if the IMF pulls out, both Germany and the Netherlands have said they won't participate further," says Mathieu Reaud at UBS.

We have flagged the prospect of Grexit (Greece leaving the Eurozone) as a distinct possibility for 2017.

While this would be good for Greece we believe, and good for the strength of the remaining Eurozone, we would anticipate short-term uncertainty to weigh on the Euro.

Of interest is just how keen Germany are to push Greece to the exit door ahead of key elections later in the year.

German finance minister Wolfgang Schäuble last week said Greece must leave the Eurozone if it wants some of its debt cut by Germany and fellow European creditors.

He told German broadcaster ARD that debt forgiveness would be in violation of European rules:

“We can’t undertake a debt haircut for a member of the European single currency, it’s ruled out by the Lisbon Treaty. For that, Greece would have to exit the currency area. The pressure on Greece to undertake reforms must be maintained so that it becomes competitive, otherwise they can’t remain.”

“The odds of another Greek crisis are rising. The long-lasting stand-off between the IMF, Germany and Greece has heated up, and no easy solutions are in store. The current approach will inevitably lead to another escalation, maybe also Grexit,” says Jan von Gerich, Global Fixed Income Strategist at Nordea Markets in a note to clients.

All this uncertainty makes for a weaker Euro going forward we believe.