Robo-Traders May Not be the Only Reason The Euro is Recovering

The Euro rebounded suddenly on Friday morning taking markets by surprise.

EUR/USD spiked up to 1.0645, gapping above key resistance at 1.0500, a level which had been expected to cap the recovery.

GBP/EUR also fell to lows of 1.1616, breaching key support at 1.1700.

Ipec Ozkardeskaya, market analysts at LCG, explained the spike higher as a ‘flash crash’ sparked by the sudden mas triggering of automated algorithmic trading programme fills, as well as thin holiday volumes.

“Surpassing the 1.0500 level triggered substantial algo orders and sent the EURUSD up to 1.0653 from 1.0484 in a single move.

“Thin holiday volumes aggravated the quake.

“The EURUSD consolidated between 1.0520/1.0550 following the spike.

“Given the nature of the price action, a further downside correction towards 1.0500/1.0475 could be expected,”

Hedge Funds Cut Bearish Positions on Euro

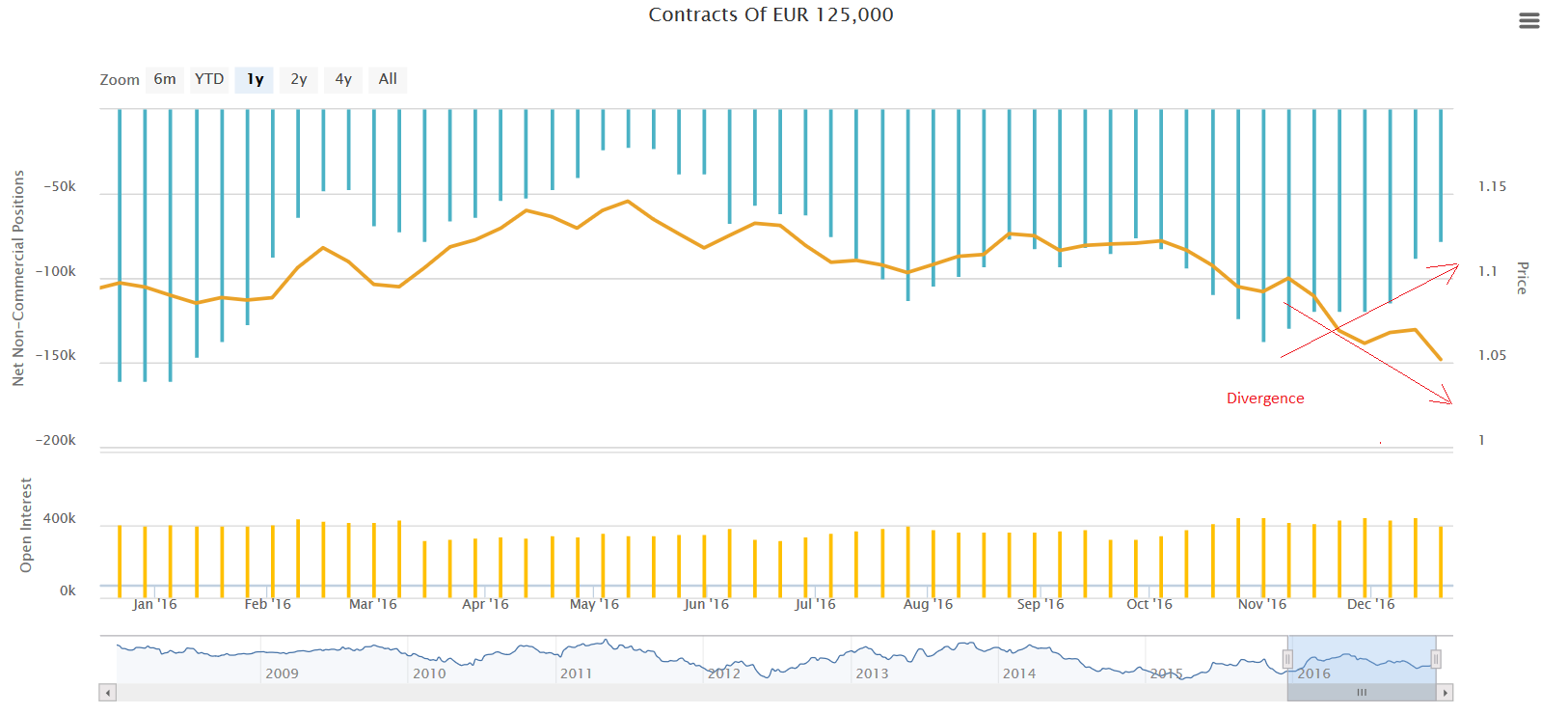

There has also been a growing disconnect between the activity of professional traders - hedge funds and asset managers - who have been lightening up their Euro short positions in the futures market and the actual currency which has continued declining.

A ‘short’ position is one which profits from a down move in the underlying asset.

The Euro’s steady decline since November has been accompanied by a falling number of speculators taking trades against the Euro.

This suggests someone is wrong – either the exchange rate is not adequately reflecting the improving sentiment about the Euro, or the large speculators are wrong.

The chart below shows the divergence between speculators positions – which show them becoming progressively less bearish - and the EUR/USD pair, which is falling regardless.

It suggests the spike higher on Friday may have been a readjustment to reflect the less negative positioning .

Poor US Trade Data

Some of the reason for the recovery can also be attributed to particularly poor Trade data for the US which may have burst the post-Trump bubble.

Nevertheless, under-par trade data alone cannot explain the extent of the move on Friday.

Whilst the other factor may have been ‘algo trades’ as Ozkardeskaya suggests, there also seems to be an argument to suggest that the recovery may be due to a perception of lessening political risk in the Eurozone.

Are Political Risks Easing?

The Euro has lost a lot of ground since the theme of political risk began to undermine it earlier in the year when analysts started to look ahead to 2017.

The year is packed full of key elections in France (April 23 or if necessary May 7), The Netherlands (March 15), Germany (October 22) and possibly Italy (TBA).

The risk of the election of an anti-EU government or President and the potential breaking up of the EU has pressured the Euro down.

A more recent reassessment of those risks, however, has suggested that the real chance of such an occurrence may be a lot lower than previously thought.

“In France, the far-right candidate Le Pen is expected by commentators to make it to, but not win, the second round. An unexpected victory for Le Pen would call into question the EU project. Germany’s Chancellor Merkel, meanwhile, is expected to win a fourth term, although the right-wing AfD party is a key wildcard,” said Lloyds Bank’s Han Ju-Ho.

The failure of the far-right candidate in the Austrian Presidential Election, Norbert Hoffer, on December 4, may have caused a reassessment and downgrading of the risks of the populist, far-right, coming to power in other parts of the EU

But it also now seems highly unlikely Le Pen will win in France, facing as she probably will, the already quite far right catholic Francois Fillon in a final round, who is likely to share appeal on many right-wing policies and steal voters from Le Pen.

In the Netherlands, the freedom party will have to form a collation to gain power, which will probably curb its anti-EU policies.

The real risk of an extremist starting a break-up of the EU looks rather low at the moment, therefore.

The one risk we can see which other analysts are not focusing on, however, is that of an increase in Jihadist terrorist attacks, which could polarise opinion in places such as Germany and lead to a call for tighter border controls.

On the flip-side, however, there is also a possibility that more attacks might also at the same time galvanise those who argue a more integrated approach is required to combat terrorism in the EU.

Gradual Economic Recovery Supportive

That the Eurozone is gradually recovering is another factor supporting a rebound in the single currency.

Eurozone Unemployment is falling, Headline if not Core Inflation is rising, Growth is rising moderately and the European Central Bank (ECB) has reduced its QE programme in size, albeit whilst extending it in length after extending it to the end of the 2017.

“Recent economic data show that economic growth has remained moderate.

“Q3 GDP growth was 0.3%q/q, the same as the prior quarter, and survey indications suggest that it will be stronger in Q4.

“The euro area unemployment rate remains high, but it fell to a seven-year

low of 9.8% in October, with employment growth supporting domestic demand.

“Overall, we look for the euro area economy to expand by 1.6% in both 2016 and 2017,” says Lloyds Bank’s Han Ju-Ho.

Core Inflation Key for Euro

As for the ECB’s reduction of monthly QE from 80 to 60bn, that could be seen as an extended ‘taper’, which is likely to be positive for the Euro as 2017 progresses, and talk a further reduction in QE emerges.

The main risk from the economic data front is the Core Inflation fails to rise.

Core CPI remains stagnant but is expected to rise, perhaps as the base effects from rising commodities start to feed through.

But the risk is that it will not and this will prompt more QE from the ECB.

“President Draghi sounded dovish and left open the possibility that asset purchases could be ramped up in the future if downside risks to economic growth materialise or underlying inflation fails to pick up. B

“But if ‘core’ inflation does rise as projected, the ECB may start to wind down asset purchases from 2018,” concludes Han Ju-Ho’s analysis.

Save

Save

Save

Save