Euro Exchange Rate Forecasts Raised by Morgan Stanley

- Written by: Gary Howes

Those watching the foreign exchange markets will be a little surprised by news that a major institutional analyst has raised its forecasts on the euro.

Morgan Stanley have told clients that they are raising their projections on the euro from their previous estimates.

That said - revising forecasts higher does not amount to suggesting the euro exchange rate complex will rise from its current levels.

Morgan Stanley still see a lower euro from here, but its floor is now expected to be higher than previously thought.

The news comes as the euro continues to defy expectations that the ongoing Greek debt saga will be a negative to its valuation.

Despite the news out of Greece becoming ever more negative the euro continues to trade close to where it was months ago:

- The euro to pound exchange rate is at 0.7198 following a strong week of gains.

- The euro to dollar exchange rate is at 1.1009 proving that 1.10 is a significant point of support.

- The euro to Australian dollar rate is at 1.4849 - just below the best levels of 2015.

- The euro to Swiss Franc is at 1.0494 - towards the upper end of its 2015 range.

Note: These are spot market quotes, your bank will affix a discretionary spread when conducting transfers. However, an independent FX provider will seek to undercut your bank’s offer and in the process offer up to 5% more FX. Learn more.

We have said time and again that those watching the euro should be keeping an eye on German debt markets as the economic profile of Germany and decision making at the European Central Bank remain central to the outlook.

Morgan Stanley: A Lower Euro, But Not as Low as We Previously Thought

“We have revised our EUR projections higher, but see this revision as only a mark-to-market exercise that does not use a new framework,” say Morgan Stanley.

Since the bank keeps their previous framework, the question is, why have they adjusted their EUR forecasts moderately higher?

“The answer focuses on how long EUR’s corrective advance lasted during the spring,” says a FX note entitled Staying USD Bullish.

When the euro dollar exchange rate fell down to 1.05 earlier in 2015 there was an assumption that the rebound would not be maintained for the extend of time that it has - indeed - seeing euro dollar stuck above the 1.10 marker confirms it is happy to resist advances against the dollar.

Against the pound sterling we continue to see the EUR refuse to cede ground below 0.71 for any length of time.

The Bund is to Blame

We have mentioned that German debt markets are central to the euro’s valuation in our intro.

Morgan Stanley have based their upgraded euro profile largely on developments concerning the bund saying:

“We find a number of factors that caused the rebound to last for a while. First, in April the overvaluation of Bunds ran into stiff resistance, as 10y Bund yields failed to fall below 5bp.

“The subsequent bond sell-off saw cross-currency yield differentials easing in favour of EUR. Moreover, rising Bund yields undermined equity markets, pushing volatility differentials between EMU’s risky assets and comparable US markets towards unprecedented highs.”

In short, as bund yields improved so did the value of the euro and there is little to suggest the deep decline in yields will re-emerge.

Hedging has also been important to euro valuations - as investors expose themselves to European markets, in anticipation of an outperformance due to the ECB quantitative easing programme, so they have hedged their exposure via short euro positions.

“Since many investors had been long EUR-denominated risk on a currency-hedged basis, the decline of EMU equity market valuations left portfolio managers with unwanted EUR short positions. This was created by their portfolio and FX-hedge positions no longer matching up,” note Morgan Stanley.

This has seen the necessary euro buying as hedges are shut down.

Another pro-euro factor has been financial cross-border flows easing off sharply which has worked in favour of EUR.

Greece: The Real Impact Still Lies Ahead

We have mentioned time and again that Greece is not having the impact it should.

That does not however mean that Greece won’t impact the euro at all!

Goldman Sachs are forecasting parity in the euro to dollar conversion based on Greece prompting a strong response from the ECB. Note that even if Greece is not ejected from the Eurozone an ECB response could well happen.

Morgan Stanley say, “cross-border flows are unlikely to stay subdued for long. Should Greece head towards the euro exit and EMU politicians fail to repair the reputational damage, international investors are likely to retreat from peripheral assets, putting EUR under selling pressure.”

Morgan Stanley argue the sharp decline of EUR holdings by international reserve managers has provided a stark warning signal, “Global real money accounts bought into EUR, believing in the irrevocability of EMU membership.”

Should this assumption not survive, and EMU converts into a club of fixed exchange rates with the possibility to exit, Morgan Stanley expect two things to happen:

1) Global investors will not only retreat from peripheral assets. We would also see a fragmentation of EUR capital markets, with private sector borrowing costs in the periphery becoming more expensive relative to the core. Domestic lenders would increasingly lend domestically and no longer EMU-wide.

Subsequently, EMU would grow less strongly than under conditions of a more optimal set-up for its capital market.

EMU would continue running lower returns compared to other currency areas,suggesting international investors would cut their exposures.

2) Domestic funds would increase their foreign asset holdings. We think this would happen because core EMU banks and insurance companies would face the challenge of running FX risks in peripheral countries that cannot be hedged.

In sum - the resiliance of the euro thus far has prompted analysts at Morgan Stanley to raise their forecast profile.

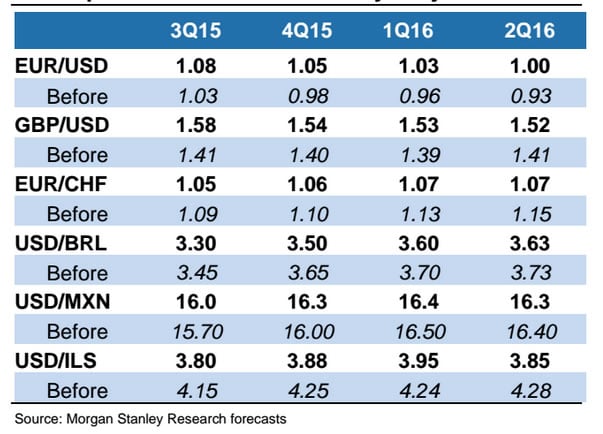

BUT - the outlook is laden with risk, particularly surrounding Greece. Here are the revised forecasts: