GBP/EUR Looks to Break Major Resistance Line in a Busy Week

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling faces a busy calendar in the coming week that can ignite some welcome volatility against the Euro.

The Pound-to-Euro exchange rate's recovery has entered a consolidative phase, but like a coiling spring, it is readying for its next directional move, and we think that could be higher.

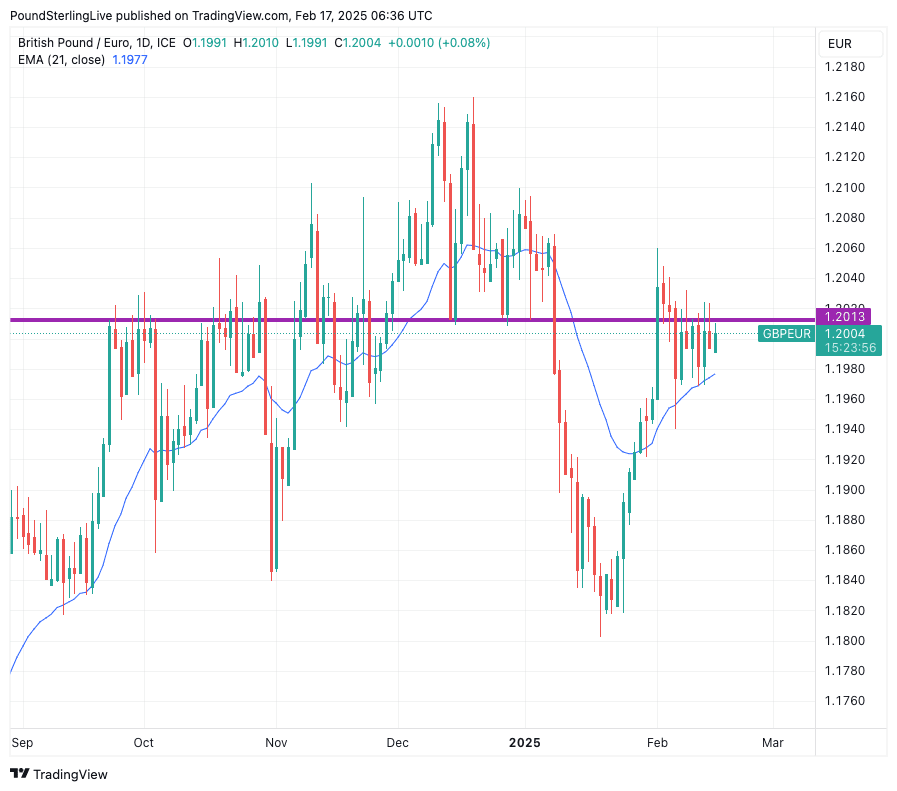

GBP/EUR is wedged between the rising 21-day and 9-day Exponential Moving Averages, both located at 1.1976, and the horizontal resistance ceiling at 1.2013:

Above: GBPEUR at daily intervals showing the pivot at 1.2013 and the supportive 21-day exponential moving average.

As seen above, the 1.2013 resistance line stretches back to late September, where it capped a strong advance and ultimately led to a pullback.

It again resisted the recovery in mid-October and, despite the odd false break, was unable to be broken and held despite numerous attempts through to the end of November.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, the ceiling did give way in December, and Pound-Euro subsequently printed new multi-year highs at 1.2150, at which point the 1.2013 line began to act as a floor as a new, higher range was carved out.

The exchange rate is, therefore, at an important technical pivot level and because it is above the 21-day Exponential Moving Average, a break higher is the preferred prediction.

This suggests the potential for levels at 1.2050 and higher this week.

"The combination of sticky carry advantage and tariff resilience implies an improved near-term outlook for the pound versus the euro. The longer-term directional path is also constructive thanks to supply-side reforms (including a closer relationship with the EU), but also demand-supportive fiscal stimulus from April," says a weekly FX market note from Barclays.

However, failure to break the ceiling on the release of soft UK data (or strong Eurozone data) could allow for some temporary weakness and a pullback to 1.1950 would be likely.

Whether or not a breakout happens this week will depend on the outcomes of a busy data calendar in the UK and Eurozone.

ð¯ GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. ð© Request your copy.

The UK calendar will be busy this week and offers some GBP-specific GBPEUR volatility.

The UK's data pulse is in the process of recovering, having cratered after the country came under new management following last year's July election.

With expectations so low, the prospect of upside surprises has grown, particularly on the inflation front, which can boost the Pound.

Here’s a breakdown of key UK economic events scheduled for next week, along with market expectations:

Tuesday, February 18

📌 Average Weekly Earnings (Dec, YoY)

Inc. Bonuses: 5.9% (expected) vs. 5.6% (previous)

Ex. Bonuses: 5.9% (expected) vs. 5.6% (previous)

🔹 Market Impact: A higher-than-expected figure could reinforce inflationary wage pressures, which would imply the Bank of England has little scope to accelerate the rate cutting cycle. This would be supportive of GBPEUR.

📌 ILO Unemployment Rate (Dec)

Expected: 4.5%

Previous: 4.4%

🔹 Market Impact: If unemployment rises, it could signal the labour market is softening, potentially weakening GBP.

📌 Employment Change (Dec, 3m/3m)

Expected: 50K

Previous: 35K

🔹 Market Impact: A strong reading indicates resilient hiring trends, supporting growth and possibly keeping wage growth elevated.

📌 BoE Governor Andrew Bailey Speaks

🔹 Market Impact: If Bailey delivers hawkish remarks, GBP may strengthen as markets price in fewer rate cuts in 2025. A dovish tone could weigh on GBP.

Wednesday, February 19

📌 Consumer Price Index (CPI) (Jan, YoY & MoM)

MoM Expectation: -0.3% vs. -0.2% (previous)

YoY Expectation: 2.8% vs. 2.8% (previous)

Core CPI (YoY): 3.7% vs. 3.2% (previous)

🔹 Market Impact: A slowdown in inflation would increase the probability of BoE rate cuts later in 2025, weighing on GBP. However, economists see building upside risks for inflation this year, and a stronger print could make the case for the Bank of England to grow increasingly cautious about further rate cuts. This would boost GBPEUR.

📌 CBI Industrial Trends Orders (Feb)

Expected: -30

Previous: -34

🔹 Market Impact: A higher-than-expected figure suggests improving UK manufacturing sentiment, but the sector remains weak overall.

Friday, February 21

📌 GfK Consumer Confidence (Feb)

Expected: -24

Previous: -22

🔹 Market Impact: A lower confidence reading reflects weaker consumer sentiment, possibly dampening future spending and economic growth.

📌 Retail Sales (Jan, MoM & YoY)

Inc. Automotive Fuel (MoM): 0.5% (expected) vs. -0.3% (previous)

Ex. Automotive Fuel (MoM): 0.9% (expected) vs. -0.6% (previous)

🔹 Market Impact: A rebound in retail sales could support GDP growth and indicate stronger consumer spending, boosting GBP.

📌 Public Sector Net Borrowing (Jan)

Expected: -£20.3bn

Previous: £17.8bn

🔹 Market Impact: Lower borrowing could ease fiscal pressures, but higher-than-expected borrowing might increase concerns over government debt levels.

📌 UK Services PMI (Feb, Preliminary)

Expected: 51.0

Previous: 50.8

🔹 Market Impact: A reading above 50 signals expansion, which may support UK economic optimism and boos the Pound.

📌 UK Manufacturing PMI (Feb, Preliminary)

Expected: 48.5

Previous: 48.3

🔹 Market Impact: Still in contraction (<50), but a slight improvement could signal bottoming out of the UK manufacturing sector.

Week Ahead: EUR

Here’s a breakdown of key Eurozone economic events scheduled for next week, along with market expectations:

Tuesday, February 18

📌 Germany ZEW Economic Sentiment (Feb)

Expected: 20.0

Previous: 10.3

🔹 Market Impact: A higher reading signals improving investor sentiment in Germany, which could support EUR strength.

📌 Germany ZEW Current Conditions (Feb)

Expected: -89.4

Previous: -90.4

🔹 Market Impact: A slight improvement but still deep in negative territory, indicating ongoing economic weakness in Germany.

📌 Eurozone ZEW Economic Sentiment (Feb)

Expected: Not Provided

Previous: 18.0

🔹 Market Impact: If the reading improves, it could reflect growing optimism in the broader Eurozone economy, supporting EUR.

📌 Eurozone GDP Q4 (Second Estimate, YoY & QoQ)

Expected: 0.0% QoQ, 0.1% YoY

Previous: 0.0% QoQ, 0.1% YoY

🔹 Market Impact: A weak GDP print could reinforce expectations of ECB rate cuts, potentially weighing on EUR.

Thursday, February 20

📌 Eurozone Consumer Confidence (Feb, Preliminary)

Expected: -14.0

Previous: -14.2

🔹 Market Impact: A slightly improving but still negative confidence level suggests households remain cautious, which could limit EUR upside.

Friday, February 21

📌 France Manufacturing PMI (Feb, Preliminary)

Expected: 45.3

Previous: 45.0

🔹 Market Impact: Still in contraction (<50), indicating continued struggles in French manufacturing.

📌 France Services PMI (Feb, Preliminary)

Expected: 49.0

Previous: 48.2

🔹 Market Impact: An improving services sector could provide some support for the French economy and EUR.

📌 Germany Manufacturing PMI (Feb, Preliminary)

Expected: 45.5

Previous: 45.0

🔹 Market Impact: A manufacturing PMI below 50 signals continued contraction in Germany’s industrial sector, which could weigh on EUR sentiment.

📌 Germany Services PMI (Feb, Preliminary)

Expected: 52.5

Previous: 52.5

🔹 Market Impact: The services sector remains in expansion (>50), helping offset weakness in manufacturing.

📌 Eurozone Manufacturing PMI (Feb, Preliminary)

Expected: 47.0

Previous: 46.6

🔹 Market Impact: While still in contraction, a slight improvement could ease concerns of further economic slowdown in the Eurozone.

📌 Eurozone Services PMI (Feb, Preliminary)

Expected: 51.5

Previous: 51.3

🔹 Market Impact: Services remain above 50, signalling economic expansion, which could help stabilise EUR.