Pound-to-Euro Week Ahead Forecast: The Rise Can Extend

- Written by: Gary Howes

Image © Adobe Images

The Pound-to-Euro exchange rate (GBPEUR) can extend its short-term trend higher, but we are entering a key resistance zone here.

Pound Sterling starts the new week with a bid against the Euro and we would expect a gentle climb to continue in the coming days, although risks surround Bank of England speeches and Thursday's UK GDP report as well as emerging technical resistance.

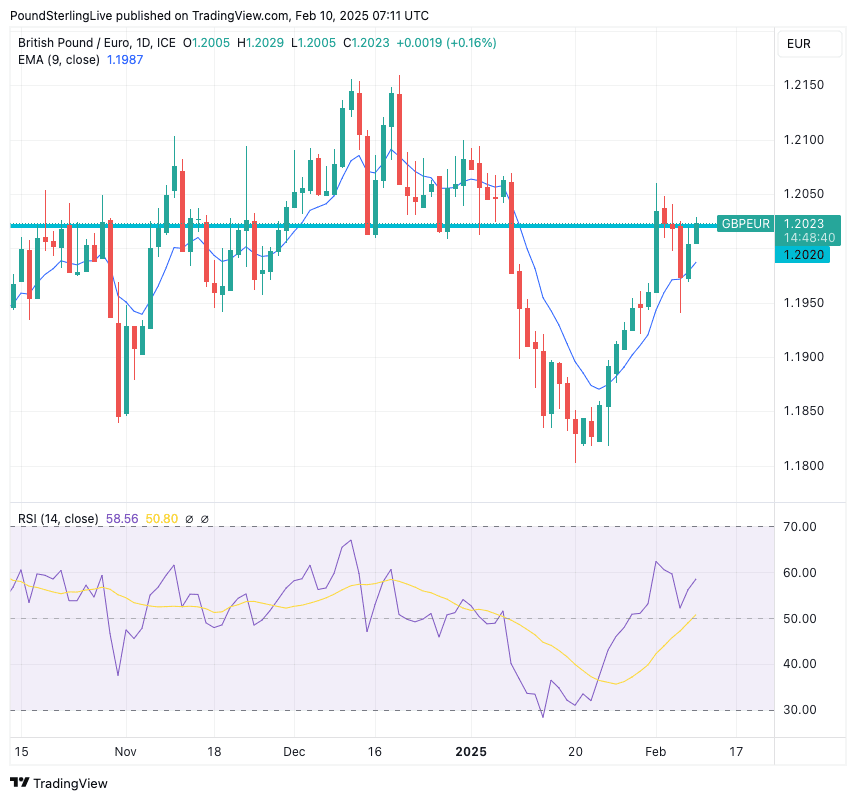

The technical indicators are aligned for a short-term continuation of the recent climb, with the Relative Strength Index (RSI) above 50 and pointing higher. The exchange rate is back above all its key moving averages, which advocates for the upside.

Gains are expected to carry the exchange rate above the 1.2020 line, which has formed a pivot since September. Moving above the pivot takes GBPEUR into the November-December range that extends as high as 1.2150:

Above: GBPEUR at daily intervals.

Can GBPEUR attain those 2024 highs at 1.2150 again? This is possible in the coming weeks, but GPBEUR is an exchange rate that is prone to enter stretches of sideways action, and the recovery of the past two weeks looks generous, meaning we are likely to see the recent rate of climb fade.

Another way of looking at the chart is to see 1.2020 as the beginning of a massive technical resistance zone in which selling interest inevitably rises. Speculators will start laying sell orders around here as they anticipate reversals, while those looking to transfer money will start buying euros, knowing this could be as good as it gets.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Our preferred stance for the coming five days is for the exchange rate to probe 1.2050 with increased two-way action as resistance comes into play.

Pound Sterling's recovery against the Euro suggests the early-2025 concerns about the UK's debt dynamics were overblown. However, growth concerns still persist, and we wonder if GBPEUR would be well above 1.2150 were it not for these concerns.

With this in mind, the UK releases some important GDP numbers on Thursday, and the market thinks the economy shrank 0.1% in the fourth quarter of the year, following on from the third quarter's 0% growth.

The UK economy has flatlined, yet inflation is rising, creating 'stagflationary' conditions, which are rarely supportive of a currency.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Risks to Pound Sterling would be Thursday's GDP outturn undershooting the already dire -0.1% expected.

Following last week's Bank of England decision, we have a speech from Governor Andrew Bailey to look forward to on Tuesday, and fellow Monetary Policy Committee member Megan Green speaks on Wednesday.

But it's MPC member Catherine Mann, who shocked observers by voting for a 50 basis point cut last week, who will attract the most attention. She speaks on Tuesday and will explain why she has dramatically changed tack for someone who been a staunch monetary hawk to a fully fledged dove. Her thinking behind the switch will be intriguing.

Will Bailey, Mann and Green shift the dial for the Pound? No, and we would look for any action in GBPEUR to be faded.

Looking at the European side of the equation, we will be watching European Central Bank (ECB) President Christine Lagarde's speech on Monday and that of Isabel Schnabel on Tuesday. The ECB is expected to 'outcut' the Bank of England in 2025, and the speeches should affirm this.

The central bank divergence theme is a major factor behind GBPEUR's multi-year trend of appreciation, and there is nothing to suggest it is about to come to an end.