GBP/EUR Week Ahead Forecast: Lower Levels, Eurozone Inflation Ahead

- Written by: Gary Howes

-

Image © Adobe Images

The Pound to Euro rate is forecast to fall back into its 2024 range and potentially test levels below 1.17 in the week commencing May 27 as Sterling's post-inflation rally runs out of steam.

Pound Sterling retook its crown as the best-performing G10 currency of 2024 following last week's above-consensus inflation print, but the advance against the Euro has run into familiar resistance and the coming days could see further weakness.

"We expect EUR/GBP to remain within its established range and since the pairing currently trades closer to the lower end, investors can position for a short-term rebound," says Thomas Flury, a Strategist at UBS, who looks for the Euro to recover against the Pound.

Pound-Euro rose to 1.1763 last week, taking it within a few pips of the 2024 high, but the exchange rate has repeatedly refused to stick above ~1.1720 for any period of time.

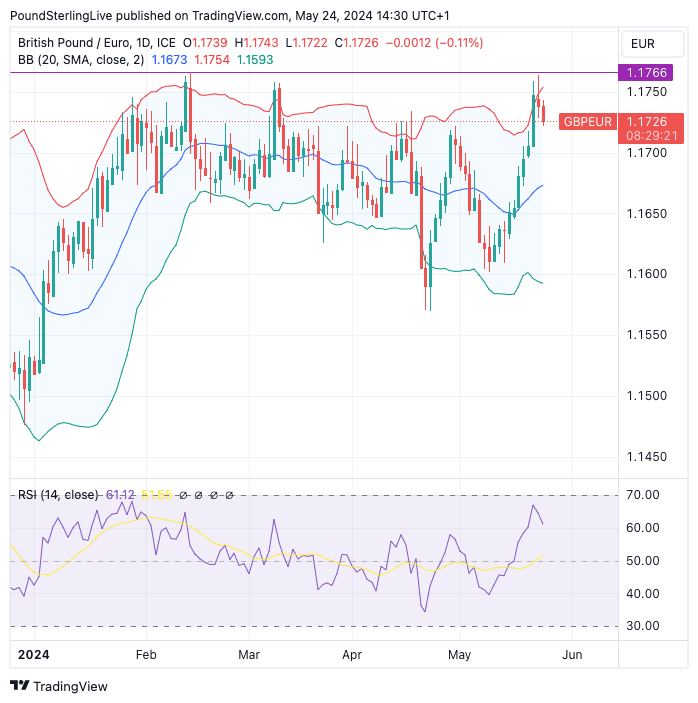

Above: The Pound to Euro is forecast to fade. Chart shows daily intervals with RSI and Bollinger bands shown. Track GBP/EUR with your own custom rate alerts. Set Up Here

The above chart shows the exchange rate rose to the top end of the envelope created by Bollinger bands. This is a technical study that hints at when an exchange rate is starting to stray out of its range.

The RSI, a measure of momentum, was also approaching overbought conditions at 70 and has now turned lower, offering further confirmation the rally might be fading.

For those hoping for a decisive break higher in Pound-Euro, the good news is that the pair retains a constructive setup as it resides above key moving averages. If the exchange rate can consolidate above 1.17 this week, then we could be looking at the makings of a platform that can propel Sterling to new multi-month highs in the coming weeks.

The market's realisation that the Bank of England won't be cutting interest rates in June is in favour of further GBP gains. In fact, it looks as though markets see the first interest rate fully priced by September.

By this stage, the European Central Bank will likely have cut interest rates twice, establishing a central bank divergence that is instinctively supportive of the GBP/EUR upside.

But again, the pair's inability to hold levels above 1.1720 for more than a day or two should be of concern for those looking to make short-term payments: there is clearly significant speculative and real-money interest in selling GBP on strength in this region.

There are no major releases due from the UK this week, but Eurozone inflation will be of interest on Friday. Note that Germany releases inflation figures on Wednesday, which can often provide a steer as to where the final print is headed.

German headline CPI is expected at 2.8% year-on-year and the Eurozone equivalent at 2.5%. The rule of thumb is that an undershoot is supportive of ECB interest rate cuts, which can weigh on the Euro. The opposite stands for an overshoot in the numbers.

However, Thomas Flury, Strategist at UBS says the data's impact will probably be short-lived. He says even a stronger-than-expected print would not change the ECB’s strong commitment to a June cut.

"In fact, an upside surprise would weigh on the euro, as a mix of high inflation and lower rates is negative. An undershoot, however, would support the euro even further, as low inflation and lower rates typically lead to a relief rally for the currency," says Flurry.

Such a market reaction would be the opposite of what the playbook demands, making for an interesting week ahead.