GBP/EUR Rate Pulling Back to Key Support: The Week Ahead Forecast

- Written by: Gary Howes

- GBP/EUR can decline back to key support

- But weakness to remain limited

- UK PMIs due Wednesday

- ECB decision due Thursday

Image © Adobe Images

The Pound to Euro exchange rate's 2024 rally faced a sizeable setback last week with Friday's pullback in response to weak retail sales figures, and this failure sets the tone for moderation over the coming days.

However, a busy calendar that includes January PMIs for both the Eurozone and the UK, as well as Thursday's European Central Bank interest rate decision, could yet revive the Pound-Euro's rally.

Ahead of these events, our preference is for the Pound-Euro to pull back to the 1.16 area, where we find the support of the 200-hour moving average.

Above: GBP/EUR at four-hour intervals. Track GBP with your own custom rate alerts. Set Up Here.

The above chart reveals the 200-hour MA (blue line) to have offered support to pullbacks already in 2024, and its location at the psychologically significant 1.16 level reinforces its importance short-term.

The chart also shows the Pound-Euro rate's failure at 1.1688, where it also failed back in December, confirming this to be a tough ceiling to contend with in the event of any resurgence by Pound Sterling.

Bigger picture, the setup remains constructive for Pound-Euro as it trades above the 200-day moving average, with other momentum indicators remaining positive. A restart of the uptrend can't be discounted over the next one to two weeks, and a break above 1.1688 opens the door to more formidable resistance at the 2023 highs around 1.1750.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The British Pound has proven highly sensitive to UK data of late, as evidenced by the rally that followed last week's stronger-than-expected inflation reading and the slide that followed Friday's slump in retail sales.

Wednesday brings the release of S&P Global's PMI survey for January, which will give a strong hint as to how the economy fared in the first month of 2024.

"For the GBP resilience to extend into the coming days and weeks, the UK economic data has to show more meaningful signs of improvement," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

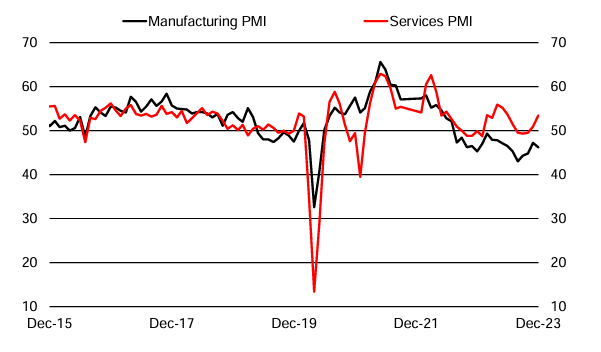

Above: "PMI services strength unlikely to last" - UniCredit.

The market expects a reading of 46.7 for the manufacturing sector, 53.5 for the services sector and 52.3 for the composite reading.

The experience of last week showed risks are two-sided, which gives a simple rule of thumb that says the Pound can gain on upside surprises and fall on disappointment, with the scale of the move matching the scale of the deviation from consensus.

Look for volatility on Thursday when the European Central Bank (ECB) is expected to keep rates unchanged and continue to push against the aggressive market rate cut expectations.

While this has supported the Euro, particularly against other non-USD pairs, it has become a consensus expectation heading into the January decision. This is because a host of ECB speakers attending the Davos forum made it clear a rate cut in the first half of 2024 is not going to happen.

Thus, the bar for further 'hawkish' developments that can boost Euro exchange rates is set high.

"We believe there may be scope for a dovish surprise on 25 January," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole. "Especially if the ECB signals that it is focusing on any evidence of second-round disinflation effects, e.g., peaking wage growth and services inflation, that could keep core inflation trending lower."

Above: ECB President Christine Lagarde said last week that interest rate cuts were a question for the summer rather than in spring. File image of ECB President Lagarde. Credits: World Economic Forum, Swiss-image.ch, Photo: Valeriano DiDomenico.

The ECB could also play down the inflationary impacts of the potentialy inflationary developments related to attacks on shipping in the Red Sea, noting them as transitory.

"We believe that the single currency will continue to take its cue from the price action in the Eurozone rate and yields. The single currency should remain vulnerable to the extent that

any dovish ECB surprises and/or downside economic surprises erode the EUR's rate and yield appeal," says Marinov.

Ahead of Thursday's decision, keep an eye on Eurozone PMIs for signs that the Eurozone economy struggled in January.

The Euro has proven sensitive to this release in the past, and the consensus is looking for the composite to read at 18.1, manufacturing at 44.8 and services at 49.

Because sentiment towards the Eurozone is so poor, the biggest reaction function lies to the upside on any gloom-defying prints.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes