GBP/EUR Rate Could About to Slip Into a Downtrend

- Written by: Gary Howes

Image © Adobe Images

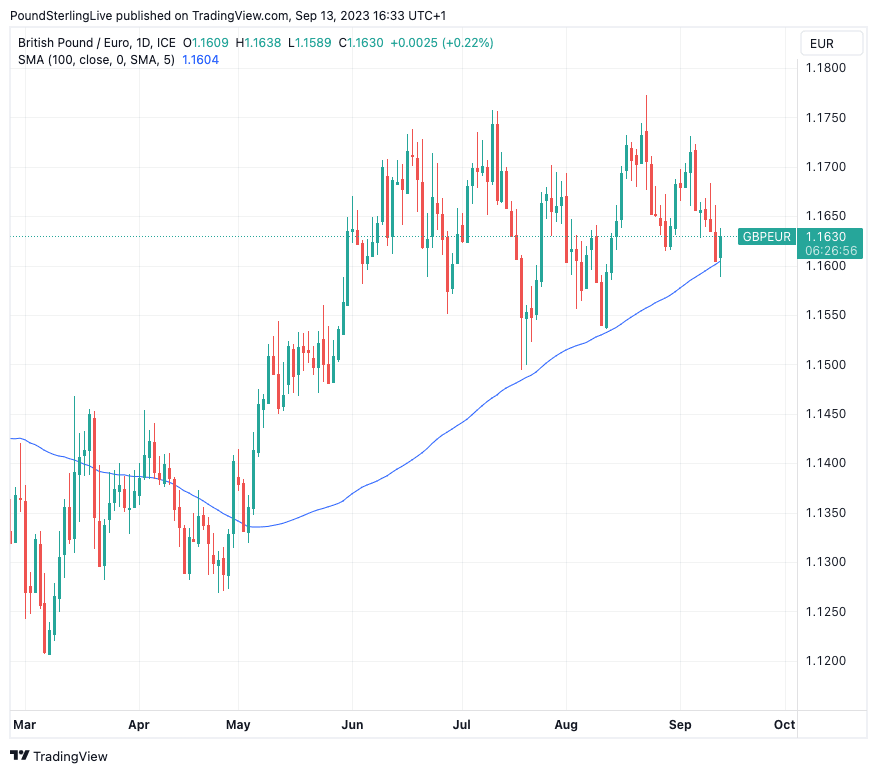

Pound Sterling is struggling to stay above a key technical level against the Euro and risks slipping into a downtrend just as a key European Central Bank interest rate decision comes into view.

Ahead of Thursday's midday ECB event, the Pound to Euro exchange rate is seen testing the 100-day moving average (DMA) in a sign this pair could be about to witness a turn in trend that brings lower levels.

As long as the pair stays above the 100 DMA we can consider the 2023 uptrend to remain intact and a move below the 100-day moving average would see us call an end of that trend:

Above: GBPEUR at daily intervals with the 100-day moving average annotated.

Watching the 100 DMA offers a useful technical gauge of multi-week direction and trend that allows us to ignore the background noise of the foreign exchange market, which can often be quite confusing.

As long as the pair remains above this moving average we would maintain a view that the uptrend can resume at some point in the near future.

However, a break below this momentum indicator would signal that momentum has turned in favour of the Euro and would advocate for further Pound-Euro weakness.

There are three major catalysts on the horizon that could prompt a successful defence of the 100 DMA by Pound Sterling or see the Euro take the upper hand, the first coming today with the ECB's interest rate decision.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The market is split on whether the ECB will raise interest rates, meaning the decision itself could offer some short-term volatility.

A rate hike could see an initial move higher in the Euro exchange rate complex while a hold could prompt weakness.

But the more durable moves would rest with the guidance the ECB offers regarding future policy, as well as the flavour of the inflation and growth forecasts that will be issued.

A leak to Reuters on Tuesday spilled news that the ECB would revise its inflation forecast higher, prompting a rally in the Euro.

Thus, there looks to be little room for surprises in the forecasts.

This means the written guidance and the tone of ECB President Lagarde's press conference will most likely influence direction in foreign exchange markets.

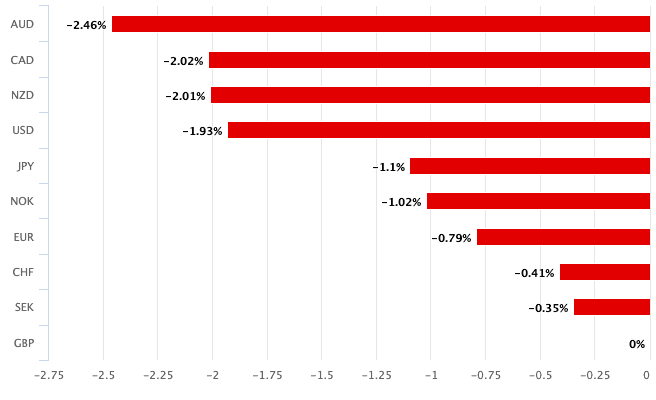

Above: The Pound has lost ground to all its G10 peers over the course of the past month.

Should the ECB leave rates unchanged they would likely signal the door remains wide open to a further rate hike before year-end, which could offer a 'hawkish' flavour to proceedings that can inspire some Euro upside. Therefore, we could have a scenario where the Euro falls on an initial decision to leave rates steady but ultimately rises when the guidance is released.

But, given the slowdown in the Eurozone economy, there appears little room for the ECB to guide beyond a single further rate hike, suggesting upside in the Euro might ultimately be limited.

The second catalyst that will be crucial for determining direction in Pound-Euro comes next week in the form of UK inflation data.

The figures, due on Wednesday, will come just a day before the Bank of England's September rate decision and will be key in guiding the Bank.

If inflation beats expectations - particularly core and services inflation - the market might take a hawkish slant into the Bank of England meeting.

This would be typically supportive of Sterling, but we saw wage data beat expectations on Tuesday and the Pound ultimately retreat, suggesting the market is firmly wedded to the view that whatever the data, the Bank of England only has one interest rate left in it.

Hence, Wednesday's inflation release might not be the market-moving event it has been over recent months.

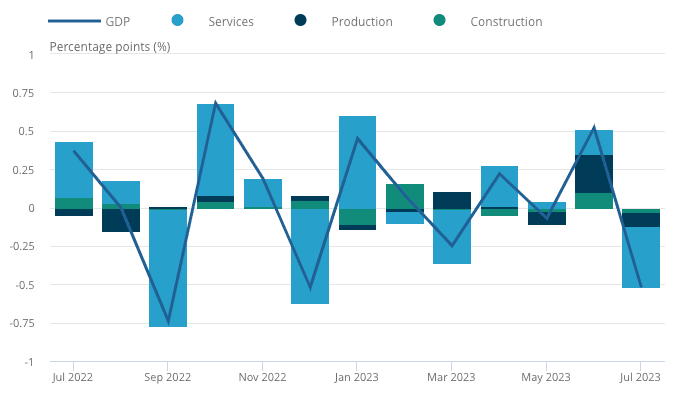

Above: Growth data this week confirmed a contraction in July as the UK's erratic post-Covid economic performance continued.

The Bank of England itself would likely offer more volatility for Pound-Euro and, as is the case with the ECB, the flavour of guidance regarding future decisions will be of paramount importance.

Does the Bank guide firmly to the prospect of further hikes, or does it repeat Governor Andrew Bailey's recent communication that the hiking cycle is almost done?

A repeat of the latter would almost certainly see a repeat of the Pound's downside reaction to Bailey's comments made to lawmakers in the UK parliament last week.

UK bond yields have been falling of late as investors price the end of the hiking cycle, essentially meaning UK monetary conditions are easing.

This is good for mortgage holders, but it can be inflationary and be counterproductive for a Bank of England desperately trying to fight inflation. For the Pound, it is a negative.

Bailey has proven himself to be an instinctively 'dovish' central bank governor (being behind the curve on the extent of the rate hikes needed throughout 2022 and presiding over overly optimistic forecasts).

Those watching the Bank of England should therefore be wary of him defaulting to form and prompting a weak end to September for the Pound against the Euro.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes