Pound Sterling Recovering Ground Lost to the Euro

- Written by: Gary Howes

-

Image © Adobe Images

The British Pound was one of the big losers on midweek news that U.S. inflation had fallen faster in June than economists were expecting, prompting investors to lower bets for the number of upcoming interest rate hikes not just in the U.S. but also in the UK.

The Pound to Euro exchange rate (GBPEUR) slipped 0.66% on the day but is looking to reclaim the 1.17 handle at the time of writing on Thursday, buoyed by some better-than-expected UK GDP data.

The ONS reported UK GDP fell 0.1% in the month to May, a better outcome than the -0.3% the market was expecting.

The data underlines the economy continues to outperform ever-dreary investor and economist perceptions of the UK economy and its currency, in the process underpinning the Pound's 2023 outperformance.

The British Pound was the second worst-performing major currency on the day U.S. inflation was reported to have fallen by a larger-than-expected amount.

Signs of rapidly cooling U.S. inflation prompted a sharp fall in U.S. bond yields as investors bet the Federal Reserve could now confidently consider ending its rate hiking cycle.

This development was also reflected in broad-based losses for the U.S. Dollar, ensuring the Pound-Dollar exchange rate rose to its highest levels since April 2022 at 1.30, with gains extending to 1.3060 on Thursday.

But inflation expectations around the world also fell and investors bet other central banks could now soon consider quitting their own hiking cycles, prompting lower yields more broadly, including in the UK where expectations are particularly high.

"Overbought Sterling positions, allied to a moderation in rate expectations are proving to weigh on near-term Sterling performance," says Jeremy Stretch, a foreign exchange strategist at CIBC Capital Markets.

Indeed, the rapid rise in Bank of England rate hike expectations over recent months meant UK yields and the Pound had outperformed peers elsewhere, leaving them particularly rich and prone to a sizeable give-back.

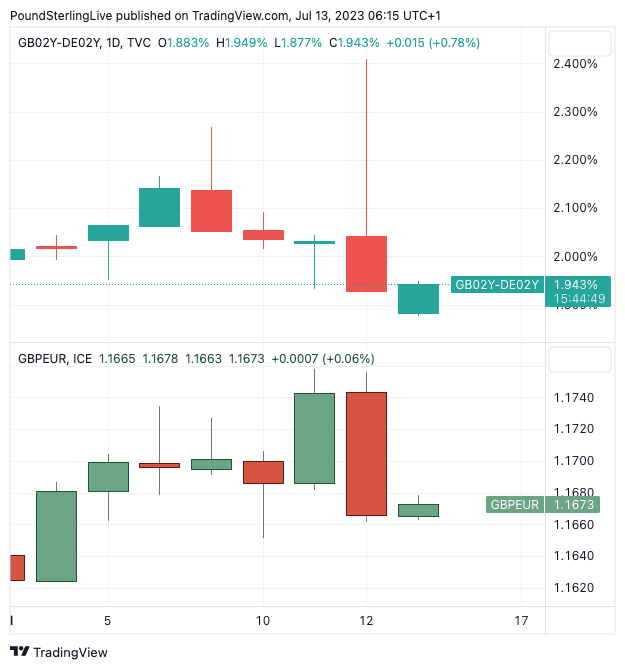

A key driver of the Pound to Euro exchange rate is the differential in the two-year bond yield between the UK and Germany, which dropped sharply in the wake of the U.S. inflation release:

As the above chart shows, the Pound-Euro exchange rate (lower panel) responded to the fall in yield differentials. The pair had gone as high as 1.1756 ahead of the U.S. inflation release which promptly sent it sub-1.17 to where we find it at 1.673 at the time of writing.

"Sterling gained against the dollar (cable close 1.2988), but recorded a significant loss against the euro," says Mathias Van der Jeugt, an analyst at KBC Bank.

He confirms UK yields declined "even more" than U.S. equivalents as "markets apparently concluded that the Fed potentially nearing the end of its hiking cycle would remove some pressure from the BoE as well."

The Pound is 2023's best-performing major currency as a result of elevated Bank Rate expectations and rising yields, could recent developments in the U.S. therefore spell an end of the rally?

For sure, a fall in UK yields reflects expectations that the eventual peak in the Bank of England's Bank Rate will be lower than the market had previously expected (in excess of 6.0%), in turn weighing on UK bond yields.

But it is still too soon to tell if the Pound's rally against the Euro is at an end and much will depend on next week's UK inflation data release which would need to undershoot market expectations to truly let the air out of UK rate expectations.

For now, the UK's bond yield advantage against the Eurozone remains sizeable which hints the Pound-Euro exchange rate can stay elevated on a multi-week basis, although a break of recent highs near 1.1750 might be harder to achieve in the near term.