Euro Softens into a New Month as Eurozone Inflation Dents ECB Rate Hike Expectations

- Written by: Gary Howes

Image © Adobe Stock

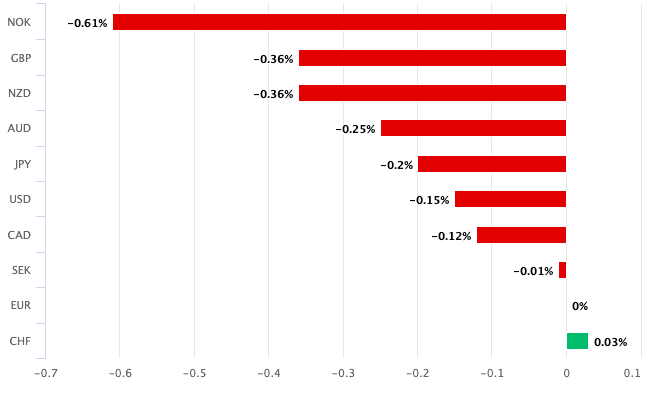

The Euro was softer across the board on the same day it was reported Eurozone inflation data for June undershot analyst expectations and confirmed easing price pressures across the bloc.

The Euro was lower against all G10 currencies as investors continue to pare expectations for the peak in the European Central Bank's (ECB) policy rate in light of evidence inflation is en route back to the 2.0% target.

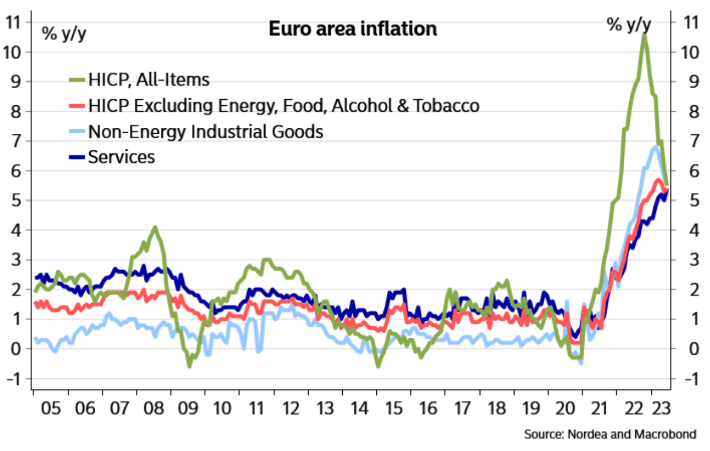

Eurostat reported headline HICP inflation was 5.5% higher in June, down from 6.1% in May and below the 5.6% expected by a consensus of economists.

A tick higher in the month-on-month figure to 0.3% was however recorded, up from 0% and above consensus for 0%. But it was the core inflation measure - which strips out the impact of variables such as food and energy - that will be of most interest to policymakers, given it came in at 0.3% m/m.

This is below the 0.7% the market was anticipating, but slightly above the previous month's 0.2%.

Above: The Euro lagged against the majority of its peers on the final day of H1.

Germany provided an upward impulse with a 0.3% m/m uplift in headline inflation from -0.1% in May. But, even in Germany, core inflation also undershot at 0.3% m/m in June, whereas the market was expecting 0.7%.

Services inflation rose from 5.0% to 5.4% on the back of base effects and due mainly to the introduction in Germany of a €9.00 transport ticket incentive a year ago.

French CPI rose 4.5% in the year to June, below expectations for 4.6% and below May's reported 5.1%.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Italian inflation fell sharply in June with a 0% month-on-month reading, down from 0.3% in May said Istat, taking the year-on-year figure to 6.4%, which was far below the 6.8% expected by consensus and May's 7.6%.

But it is in Spain where trends are most instructive of the outlook as the year-on-year rate fell to 1.9% in June, which puts it below the ECB's 2.0% target. Economists say Spain is something of a bellwether for Europe as inflationary pressures 'pass through' far quicker than in other European countries.

"This is the end of the supply shock. Spain is 1st because of faster pass-through; others to follow," says Erik Nielsen, Group Chief Economics Advisor at UniCredit Bank.

But services inflation set another record high at 5.4%, "and even abstracting from the base effects, this will cause some concern for the Governing Council," says a note from TD Securities.

Above: Eurozone inflation breakdown, image courtesy of Nordea.

It is this lag in service inflation that means a July ECB interest rate hike "is pretty much nailed on, and nothing today shifts our view on a final hike in September," says TD Securities.

Yet, and despite the record services PMI reading, there is nothing in this data that would give investors reason to beef up bets for a higher policy rate at the ECB, which can explain some Euro exchange rate weakness into month-end.

Money market pricing shows an expectation for two further 25 basis point interest rate hikes to come out of the European Central Bank in 2023, with one hike essentially guaranteed in July, raising the prospect of a skip at the September meeting.

Either way, the peak is close at hand as pricing has failed to move substantially higher for some weeks now and inflation data points to slowing inflation rates.

For the Euro, there might be little further upside impetus left in the interest rate channel.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes