GBP/EUR Rate Can Hold Upper Hand on "Carry Advantage" say Analysts

- Written by: Gary Howes

-

- Barclays says turned more positive on GBP

- ING says GBPEUR can retest 2023 highs short-term

- MUFG says Eurozone slowdown offers GBPEUR support

Image © Pound Sterling Live

Barclays, ING, MUFG and other institutions have said there is scope for further Pound Sterling gains against the Euro in the wake of a decisive Bank of England interest rate hike and slowing Eurozone economic activity.

While the Pound to Euro exchange rate has experienced some retracement from its recent high of 1.1739, analysts suggest that additional support is on the horizon with analysis from ING finding a retest of that high could be on the agenda for this week.

Barclays meanwhile says there is scope to revise lower its forecasts for the Euro relative to the Pound in light of recent developments.

"We have turned more positive on the pound near term, particularly in crosses but also EURGBP relative to our previous forecasts," says Sheryl Dong, a currency analyst at Barclays.

Dong acknowledges the Bank of England's newfound proactive stance against inflation and identifies resilient consumer and business demand amid tight labour markets as factors supporting the Pound's strength.

Despite the economic growth concerns posed by the potential for further rate hikes, the Pound's carry advantage is expected to remain intact by some analysts, providing additional support.

'Carry' refers to the flow of investor funds across international borders as investors seek out higher returns. Expectations for a peak in Bank Rate close to 6.0% means UK monetary assets will yield amongst the highest in the G10 space thereby offering Sterling a carry advantage.

Jeremy Stretch, a currency strategist at CIBC Capital Markets, also points out the Pound's ongoing resilience due to the carry-based rate support it now finds itself commanding.

"Until the consumer rolls over, amplifying recession risks, Sterling will continue to garner a degree of carry-based rate support," he notes

"Higher rates will likely enhance sterling's already considerable carry advantage, even as the bar for further hawkish surprises versus market pricing remains high," says Dong.

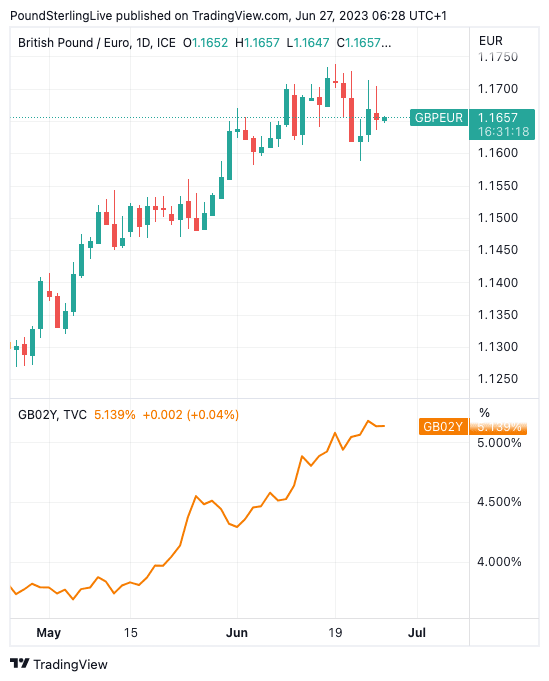

Above: GBPEUR (top) and the two-year UK govt. bond yield.

The Bank of England looks on course to 'outhike' peers as the UK's inflation problem remains undeniably sticky.

"There is much discussion in the financial press about central bankers having seen the 'easy' base effect-driven decline in headline inflation. But now they are into the hard yards of getting core inflation down from around 5% - or in the Bank of England's case, 7%," says Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE at ING Bank.

Above: The UK two-year bond yields more than its German equivalent (bottom).

Turner suggests that the inverted yield curve and recent Pound gains are likely to outweigh concerns of a hard landing in the UK, providing stability to the currency. (An inverted yield curve is where short-term bond yields are set higher than longer-term yields, reflecting that investors see acute near-term inflationary pressures.)

"A very inverted yield curve probably trumps hard landing fears and that sterling holds onto recent gains for the time being," says Turner.

ING forecasts EUR/GBP to "drift back" to 0.8520 this week (GBP/EUR back towards 1.1740), while GBP/USD should find demand under 1.27.

Derek Halpenny, Head of Research for Global Markets EMEA & International Securities at MUFG, says the inversion of the yield curve could mean investors are turning increasingly confident that the Bank of England can beat inflation.

"The 2s10s UK Gilt curve has inverted sharply of late and this is the strongest indication that investors now, for the first time in this tightening cycle, believe the BoE are acting aggressively enough to hit growth and potentially bring inflation lower," he says.

The Pound-Euro exchange rate will meanwhile also continue to take additional guidance from the European side of the equation, where fears of a deepening growth slowdown are weighing.

"The much weaker than expected PMIs from Europe last week may mean there is better scope for GBP gains versus EUR than versus the dollar given the broader global growth concerns remain elevated," says Halpenny.

The Euro was under notable pressure ahead of the weekend following the release of economic survey data that one economist described as "dreadful" and prompted economists to say now could be the time for the European Central Bank (ECB) to end its rate hiking cycle.

S&P Global reported its monthly PMI survey revealed the Eurozone's economy flirted with contraction in June as the region's economic upturn fades amidst a fall in new business orders for the first time since January.

The Services PMI read at 52.4 in June, which was lower than the market's expected 54.5, making for a significant downside miss, and signalling a sharp slowdown from May's impressive 55.1.

The data gave a Composite PMI - which gives a better assessment of the broader economy - of 50.3 which puts it on the cusp of contraction. The market expected 52.5, which would have been marginally lower than May's 52.8.

Slowing inflation when combined with a slowing economy would give the ECB reason to consider how much further rates will need to rise.

To be sure, at least one more rate hike is coming, based on the guidance from ECB Governing Council members, but beyond this one hike question marks emerge.