GBP/EUR Exchange Rate Eyes 1.16 as FX Plays Catch-up With Bond Market Moves

- Written by: Gary Howes

- German inflation undershoots expectations

- Prompts broader EUR decline

- GBP rises as it catches up with bond yields

Image © Adobe Images

The Pound to Euro exchange rate's strong performance looks to have extended into the midweek session with a further quarter of a per cent gain taking it to just below 1.16 as currency markets play catch-up with developments in fixed interest and surprisingly soft German CPI inflation.

The Euro retreated after the state of North Rhine Westphalia - a key economic region - revealed inflation was at 0.1% month-on-month in May, a significant undershoot of the 0.5% expected by markets and a marked slowdown on April's 0.4% reading.

The data signalled the all-state reading was set to undershoot, meaning the Eurozone's inflation problem might be fading. Indeed, early afternoon Wednesday Destatis said German CPI inflation declined 0.1% in the month to May, a sharp undershoot of the 0.6% gain the market was looking for and a rapid deceleration on April's 0.4% gain. In the year to May, prices rose 6.1%, undershooting the expected 7.3% and April's 7.2%.

"The worst is over," says Salomon Fiedler, an economist at Berenberg Bank. "Consumer price inflation is set to decrease further in the quarters ahead on the back of receding cost pressures that have already been visible for some time in early stages of the pricing chain."

For the Euro, this means the European Central Bank (ECB) has more optionality than previously expected when it comes to raising interest rates again. This weighed on Eurozone sovereign bond yields, prompting a further retracement in Euro exchange rates.

French CPI followed the German North Rhine Westphalia in providing a surprise: the headline read at -0.1% month-on-month in May, undershooting expectations for 0.4% and representing a sharp contraction on the previous month's 0.6%.

More German CPI figures hit the screens midmorning and the message was similar to that coming from the North Rhine: Brandenburg reported 0.1% m/m in May, below 0.4% expected, Bavaria reported -0.1% vs. 0.4% expected and Hesse reported 0% vs. 0.3% expected. Saxony reported -0.3% vs. 0.3% expected.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The contrast in inflation dynamics between the Eurozone and UK is now particularly notable; UK CPI data for April revealed inflation overshot expectations, prompting investors to raise bets that the Bank of England will continue to hike rates on a number of occasions over the coming months.

UK bond yields spiked in the wake of last week's inflation data release that came in ahead of analyst expectations at 8.7%, prompting markets to raise bets on future Bank of England interest rate hikes.

This prompted the yield paid on UK bonds to rise, a development that typically invites international capital inflows that boosts the Pound.

But the Pound failed to rally following the inflation surprise, with some analysts saying the currency's relationship with bond yields was breaking down as investors were becoming worried about the UK's economic trajectory.

Yet the Pound's rise against the Euro over the subsequent days could suggest something of a delayed reaction and the relationship with yields is in fact still relevant.

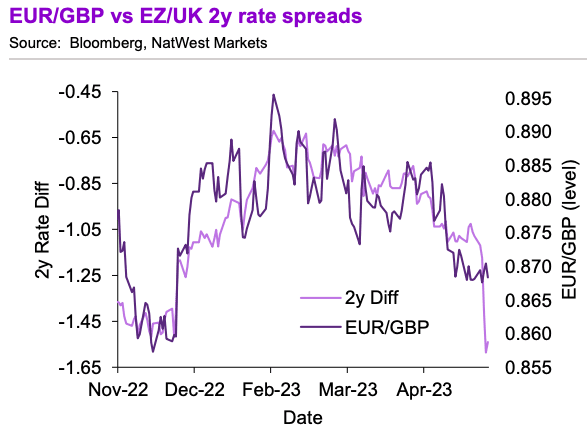

The below chart shows how the Euro-Pound exchange rate tracks the differential in yields paid on UK and Eurozone debt:

Image courtesy of NatWest Markets.

"Over the past year, both EUR/GBP and GBP/USD have tracked nominal rates. This suggests Sterling’s recent correction may be not that deep," says Paul Robson, Senior Currency Strategist at NatWest Markets, writing in a research publication dated May 26.

A reading of the chart suggests UK bond yields have moved sharply in favour of further Sterling strength against the Euro.

GBP/EUR closing in on 1.16 equates to a retreat to approximately 0.8620 in EUR/GBP, which is consistent with the move in the UK-EU bond differential, albeit a delayed one.

The next question becomes whether we are truly reaching the end of the road for the rally as FX catches up with the moves in bond yield differentials.

The above chart shows the UK two-year bond yield minus the German two-year bond yield, plotted against GBP/EUR (left column).

The chart shows the positive relationship is still, in fact, intact (in September the relationship broke down as markets baulked at the unfunded spending and tax promises put forward by Prime Minister Liz Truss).

The chart also suggests the gap between GBP/EUR and the yield differential has closed.