Pound Aided as UK Bond Yield Rebound Outpaces that of Germany

- Written by: Gary Howes

-

Image © Adobe Images

The coming days could see the British Pound extend a recent recovery against the Euro that appears to be aided by rising UK bond yields.

The Pound to Euro exchange rate recovered above 1.12 at the start of the new week as a rally in UK bond yields eclipsed a rise in equivalent German yields.

Aiding this rise in bond yields was a speech by Bank of England Monetary Policy Committee member Catherine Mann, in which she said the Bank would raise interest rates again in March.

The message is in defiance of the non-commital and cautious communication issued by the Bank at last Thursday's Monetary Policy Report.

UK bond yields fell as investors reacted to the Bank's guidance that suggested it was becoming increasingly unsure as to whether further hikes were warranted and that it would prefer to base future decisions on upcoming data.

The Pound tracked yields lower and GBP/EUR reached multi-month lows at 1.1137.

The Bank hiked by 50 basis points but the MPC dropped its reference to further rate hikes and the pledge to act "forcefully" if required.

"The policy message was unwavering: MPC members believe that the weak activity outlook should bring inflation down over time. We have argued that this policy stance puts more pressure on the currency," says Michael Cahill, a foreign exchange analyst at Goldman Sachs.

"Last week's dovish pivot by the BoE despite acute domestic inflation pressures is shifting the balance of risks in the direction of a still-weaker pound," says a weekly currency research note from Barclays.

But Mann presented research that suggests UK inflation is unlikely to fall as fast as some of her colleagues on the MPC were anticipating and that there were significant upside risks to the UK inflation profile.

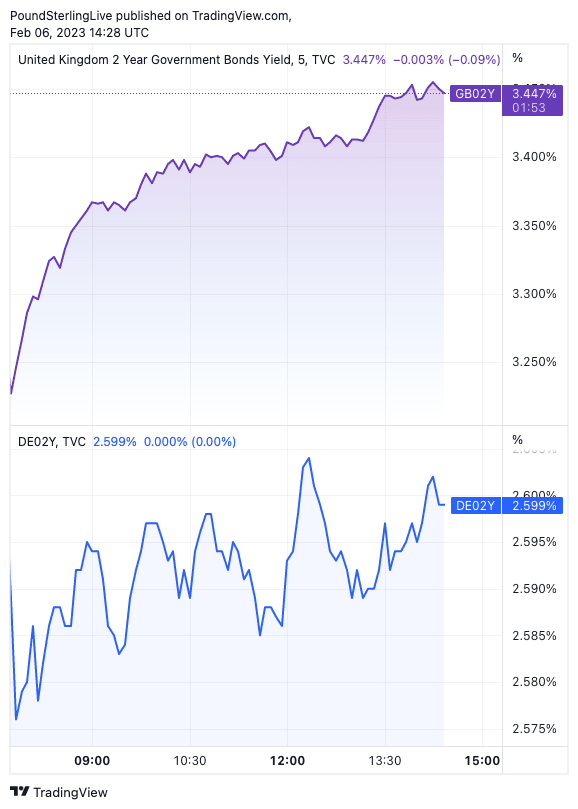

The below chart shows the yield paid on UK two-year sovereign bonds rose at a faster pace than those of Germany at the start of the week, a development that could be linked with Mann's intervention:

The top panel in the below chart meanwhile shows the differential between UK and German bonds, showing a narrowing of late.

The narrowing comes amidst expectations that the European Central Bank would accelerate its rate hiking cycle, closing the gap between UK and German bond yields.

As the below shows, a falling differential creates downside pressure on the GBP/EUR exchange rate (lower panel):

Therefore, the outlook for this pair could well rest with where bonds go next, should the differential stabilise then so too would GBP/EUR.

And if investors raise bets that the Bank of England will continue to hike rates, in defiance of Thursday's message, then the differential might increase again and the Pound could recover recently lost ground against its continental peer.