Spanish Inflation Surprise Boosts Euro against Pound and Dollar

- Written by: Gary Howes

Image © Adobe Stock

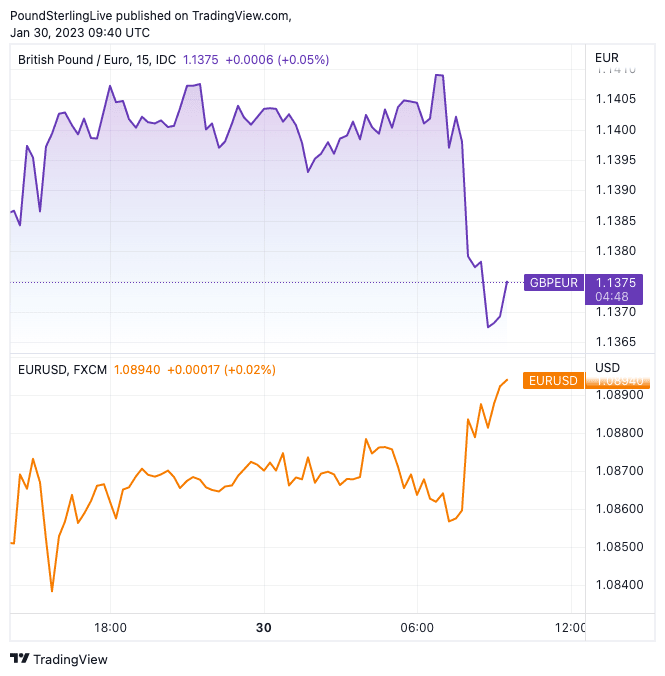

The British Pound and U.S. Dollar dropped against the Euro after Spanish inflation unexpectedly accelerated in January, prompting investors to raise expectations for the scale of interest rate hikes yet to come from the European Central Bank (ECB).

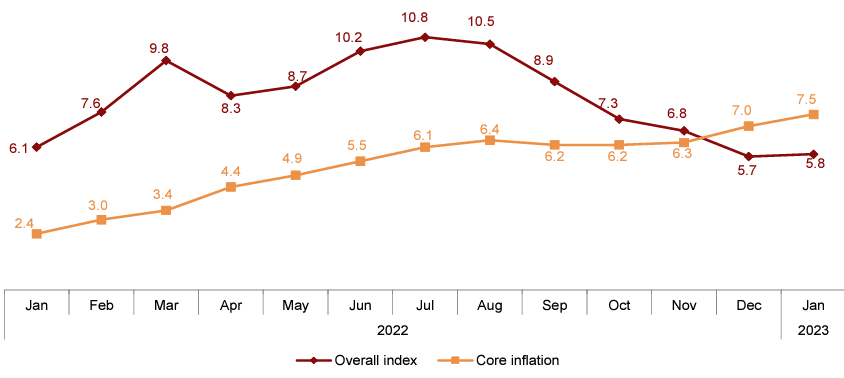

Inflation in Spain rose 5.8% year-on-year in January, surpassing the previous month's 5.7% and trouncing the market's expected forecast of 4.9%.

The HICP measure rose to 5.8% from 5.5% a month prior, core inflation rose 7.5%, said the INE.

Spain has been routinely seen as a 'bellwether' for broader Eurozone inflation with a lead of about two months, therefore the figures send a warning to the ECB's Governing Council that more work needs to be done on interest rates.

Following the Spanish inflation reading money markets promptly added 5 basis points to the expected peak of the ECB's basic rate.

The Euro rallied a third of a percent against the Pound to £0.8792 in the hour that followed the release, taking the Pound to Euro exchange rate lower to 1.1370.

The single currency rose 0.20% against the Dollar to $1.0892.

"Euro firms, yields up after Spain HICP surprisingly accelerates to 5.8% yoy in January, forecast was for drop to 4.8%. Core jumps to 7.5% yoy," says Kenneth Broux, a strategist at Société Générale.

Above: GBP/EUR (top) and EUR/USD showed a clear reaction to the Spanish data.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The increase in headline inflation ends five straight months of decline and core shot up to a new high of 7.5%. This obviously runs against the thesis that the worst for inflation in the euro zone has passed and will only strengthen the hand of the hawks on the ECB governing council who last week repeated the case for 50bp at the next few meetings," he adds.

The INE said in a statement that the increase in headline inflation was mainly because fuel prices rose more strongly and clothing and footwear prices fell less than in January last year.

Softer energy inflation meanwhile put some downward pressure on headline inflation.

Above: Annual evolution of the CPI (the last data refers to the flash estimate). Image source: INE.

Broux says the spike in core inflation is bad news and will simply add to the view that the return to target will be slow and interest rates will have to stay higher for longer.

"Core inflation continues to rise worryingly strongly, showing that underlying price pressures in the economy are still very high," says Wouter Thierie,

Economist at ING Bank.

Thierie says current figures do not yet point to a cooling in core inflation as the economy doing better than expected, helped in part by government schemes to cushion consumer spending power.

ING expects core inflation to remain stubbornly high for some time before it too begins its downward trajectory.

"This is likely to motivate the ECB to continue its tightening cycle. The ECB will not let its policy decisions depend on sharply fluctuating energy prices. We will probably also need to see a sign that core inflation is permanently falling before it will soften its tone," says Thierie.

The ECB meets on Thursday this week to deliver another 50 basis point rate hike and based on incoming data will signal at least one more such move is required.

This combative stance engendered by the ECB since December has been a major impetus behind the Euro's recent outperformance.

Spain's data suggests this is a theme that can run for some time yet.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes