Euro Back on its Feet as Lagarde, Knot Hit Back at Rate Hike Doubters

- Written by: Gary Howes

Above: ECB Board Member and Head of the Dutch central bank, Klaas Knot. Image © ECB.

Rumours, speculation and fire-fighting measures coming out of the European Central Bank are injecting volatility into Euro exchange rates this week.

ECB Governing Council and Dutch central bank chief Klaas Knot said on Thursday said investors underpricing ECB rate hikes and that "multiple" outsized 50 basis point hikes were likely required to bring down inflation.

Also on Thursday, ECB President Christine Lagarde said the central bank was determined to "stay the course" and signalled further big interest rate rises lay ahead to get inflation down.

The developments come amidst fears Eurozone financial conditions have eased too much of late as investors price in a less aggressive stance from the ECB, thereby undermining the central bank's attempts to bring inflation under control.

"I would invite [financial markets] to revise their position; they would be well advised to do so," Lagarde said in Davos at the WEF.

The Euro-Pound exchange rate rose to a high of 0.87871 following the interventions and the Euro-Dollar exchange rate rose to 1.08379.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The comments were a rebuff to a report released on Tuesday that said the ECB would likely hike interest rates 50bp in February but could then slow down to a 25bp move in March.

The report from Bloomberg cited sources not willing to give their names and smacked of an attempt by the ECB to condition the market for such a move.

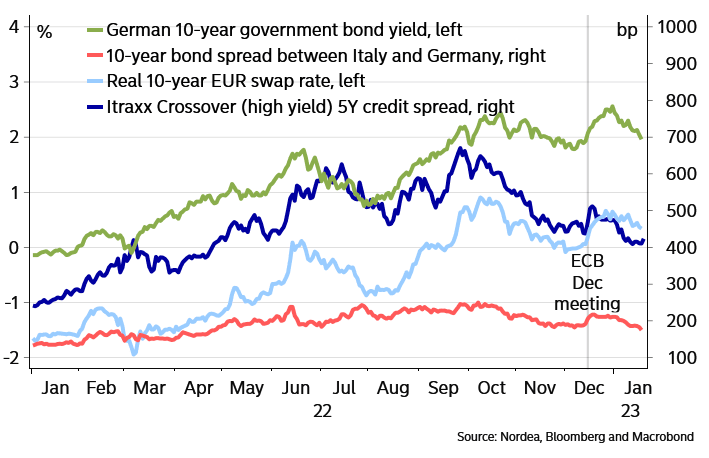

"Looking at financing conditions, many measures have eased again early this year after tightening after the ECB’s December meeting. If the ECB does not think inflation risks have fallen at the same time, such developments only add pressure on the central bank to tighten policy further," explains Jan von Gerich, Chief Analyst at Nordea Markets.

Above: Many measures of financing conditions eased again lately.

The Euro rallied against the Pound, Dollar and other major currencies in December after ECB President Christine Lagarde said the ECB would need to hike 50bp in February and March, and potentially pursue further hikes beyond.

This set the ECB as one of the more hawkish in the G10, certainly more hawkish than the Bank of England and Federal Reserve which were expected by markets to slow their hiking cycle.

This relative stance supported the Euro relative to Sterling and the Dollar.

But, any suggestion - as per Tuesday's report - that the ECB was having second thoughts would push back against this relative hawkishness and the Euro promptly fell.

Knot and Lagarde's comments are therefore in keeping with December's ECB guidance:

"It will not stop after a single 50 basis point hike, that's for sure.

"Most of the ground that we have to cover, we will cover at a constant pace of multiple 50 basis points hikes."

He said the ECB will keep tightening policy until mid-year and current market pricing of rates is inconsistent with the bank's aim of cutting inflation to its 2.0% target from levels around 10%.

"The sort of market developments that I've seen over the last two weeks or so, are not entirely welcome," Knot said of an easing in financial conditions in the Eurozone as investors priced out expectations for future hikes.

"I don't think that they are compatible, actually, with a timely return of inflation towards 2%," he said.

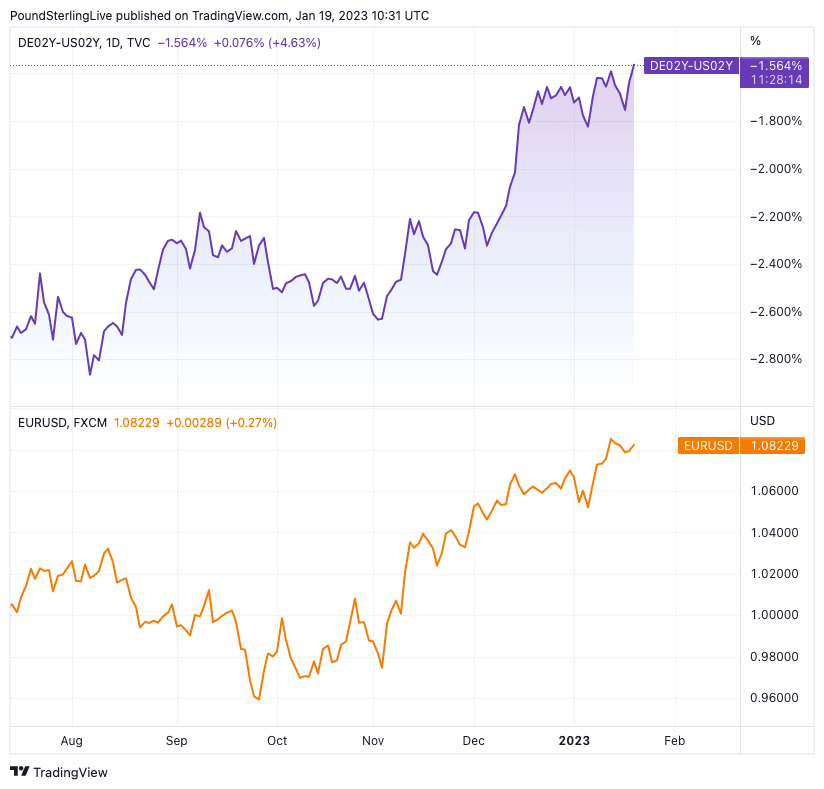

Markets have responded to Knot's comments by pushing up Eurozone bond yields relative to their U.S. counterparts as investors anticipate a faster pace of tightening at the ECB relative to the Federal Reserve.

This is illustrated in the rising differential between the German two-year bond and the U.S. two-year bond.

The below shows how the differential turned higher in December as the ECB's struck a more hawkish tone, taking the Euro-Dollar exchange rate alongside:

Above: The German-U.S. 02-year bond spread (top) and EUR/USD. Consider setting a free FX rate alert here to better time your payment requirements.

The Knot comments come on the back of those of Governing Council member Francois Villeroy de Galhau on Wednesday that it's too soon to talk about the size of the likely interest-rate increase in March.

"Let me remind you of the words of President Lagarde at her last press conference in December: We should expect to raise rates at a pace of 50 basis points for a period of time. Well, these words are still valid today," said Villeroy.

The Euro is therefore likely to remain highly reactive to the ECB which continues to ply the market with information.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes