GBP/EUR Rate Drops to Lowest Level Since Truss-era Turmoil

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling has been hit by a fall in UK bond yields and the Euro continues a run of outperformance as investors brace for further interest rate hikes at the European Central Bank (ECB).

The dynamics leave the Pound at its lowest level against the Euro since the era of Liz Truss' premiership.

"Notable sterling pressure coming through across the board as gilt yields tumble across the curve... 10y gilt now -15bps on the day, at almost 1-month lows of 3.4%," says Michael Brown, Market Analyst at TraderX.

UK two-year bond yields fell 8% last week and are a further 0.23% lower this week, ten-year yields were down 5.40% last week and are a further 2.20% this week.

The Pound to Euro exchange rate (GBP/EUR) has now fallen three-quarters of a percent this week to trade at 1.1270, levels last seen in September when the Pound was the focus of a financial market storm after investors rejected the government's 'mini budget'.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Pound Sterling Live has reported regularly of late that global market conditions are proving to be the primary driver of the Pound, but the relatively large move in UK bond markets on Wednesday sent a timely reminder that foreign exchange markets are guided by a number of variables.

UK government bonds - or gilts - are issued by the government to raise money to fund its spending programmes, they yield a regular income to investors as compensation for holding them for long durations of time.

The yield is therefore an integral part of the equation that makes them desirable to foreign investors: rising yields can attract foreign investor flows which in turn can offer support to the local currency.

But, when yields fall the opposite can be true.

It is notable that the UK's ten-year bond yield has fallen faster than its counterpart in Germany over recent hours, shrinking the spread between the two assets.

This means the attractiveness of UK government bonds has fallen at a faster pace relative to German bonds, historically this has often resulted in a fall in the Pound to Euro exchange rate:

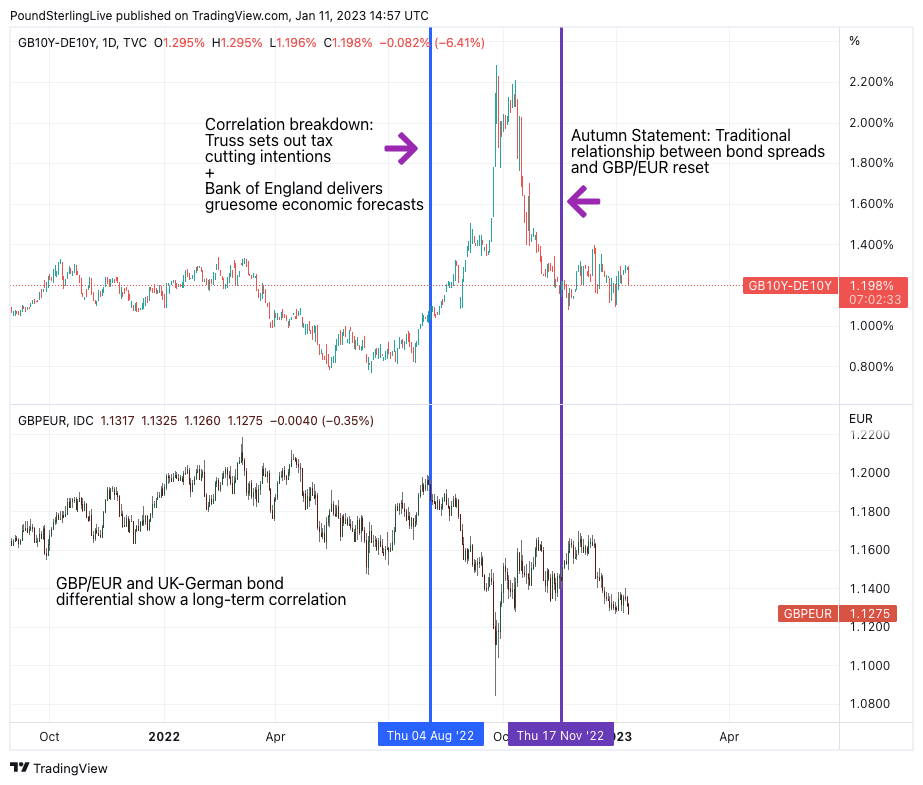

Above: UK-Germany 10-year bond yield differential and GBP/EUR (bottom). Consider setting a free FX rate alert here to better time your payment requirements.

A look at the above chart shows a long-running relationship between UK-German bond spreads and GBP/EUR.

The relationship broke down in the second half of 2022 following a surge in the bond yield differential around the time of Prime Minister Liz Truss' premiership when yields spiked but bonds fell.

The breakdown in the relationship was a result of a heightened risk premium driving the spike in UK yields: investors were worried the UK government would lose control of its finances, making UK government-issued debt riskier and less attractive.

The blue vertical line on the chart shows the approximate point at which the relationship broke down: this was when Liz Truss put forward an agenda of tax cuts in her leadership campaign.

It was also around this time that the Bank of England shocked financial markets by warning the UK economy was headed for a five-quarter-long recession.

This dire warning from the Bank signalled the UK was in for a period of economic contraction at a time when government debt levels were likely to increase, raising fears about UK debt sustainability.

The political risk premium has however disappeared since Rishi Sunak replaced Truss and the traditional relationship between GBP/EUR and the UK-German yield spread is back in control.

This leaves us with an explainer as to why GBP/EUR has fallen to its lowest since September 29: bond yields dropped notably.

But why is the UK government bond yield falling?

Bond yields are reactive to expectations for the outlook for central bank interest rates and tend to rise when expectations for higher rates increase.

Of late, expectations for the peak in the Bank of England's rate have fallen while those for European Central Bank interest rates have risen.

This has aided Eurozone bond yields while UK bond yields have extended lower, in turn impacting GBP/EUR.

GBP/EUR could therefore extend losses should expectations for UK interest rates continue to retreat and those of the Eurozone remain elevated.

Much, therefore, depends on the economic outlook for the Eurozone relative to the UK.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Economists are more optimistic about the Eurozone's economic growth prospects now that natural gas prices have fallen to levels seen before Russia's invasion of Ukraine, underpinning expectations for the ECB to pursue a more determined path of interest rate hikes over the coming months.

"We maintain our view that Euro area growth will be weak over the winter months given the energy crisis but no longer look for a technical recession. This reflects more resilient growth momentum at the end of last year, sharply lower natural gas prices and earlier China reopening," says Sven Jari Stehn, chief European economist at Goldman Sachs.

Goldman Sachs upgrades its Eurozone GDP forecast to +0.6% for 2023 (from -0.1%), which places it now meaningfully above the consensus expectation of -0.1%.

By contrast, investors remain resolutely downbeat on the UK's economic prospects in 2023, betting the Bank of England will soon exit its rate hiking cycle as the recession takes hold.

This is contributing to lower UK bond yields, which is in turn pressuring the Pound.

Goldman Sachs also upgrades its UK growth forecasts in light of easing pressures in European gas markets but they still expect a recession.

UK GDP growth forecasts are raised to -0.7% in 2023 from -1% previously, which still suggests a material underperformance when contrasted to the Eurozone.

In addition to bond yields the Pound will remain reactive to broader market conditions, putting at risk of any retreat in global equities.

Next week should meanwhile see investor attention return to domestic issues as wages, employment, inflation and retail sales data for December are due for release.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes