GBP/EUR Rate Supported by Worsening European Gas Crisis

- Written by: Gary Howes

- EUR punished amidst gas price surge

- Amidst fears of further Russian supply restrictions

- EUR/USD goes below parity

- GBP/EUR recovers recently lost ground

Image © Adobe Images

Euro exchange rates are under pressure amidst a worsening in the Eurozone's gas supply situation and analysts say there remains little prospect of a turnaround anytime soon.

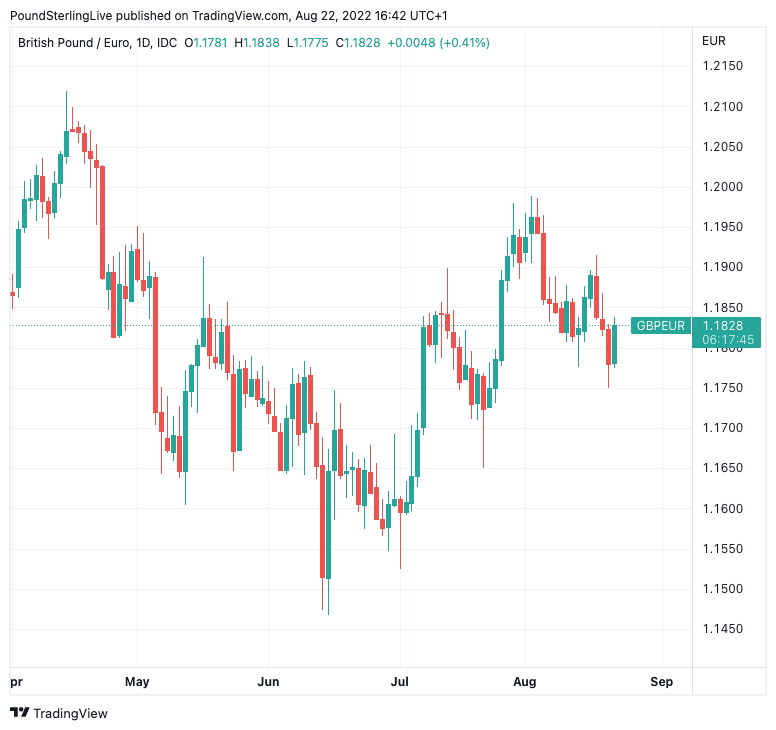

The Pound rallied against the Euro Monday and into Tuesday as Eurozone energy prices reached new records amidst another looming shutdown of Russian gas supplies.

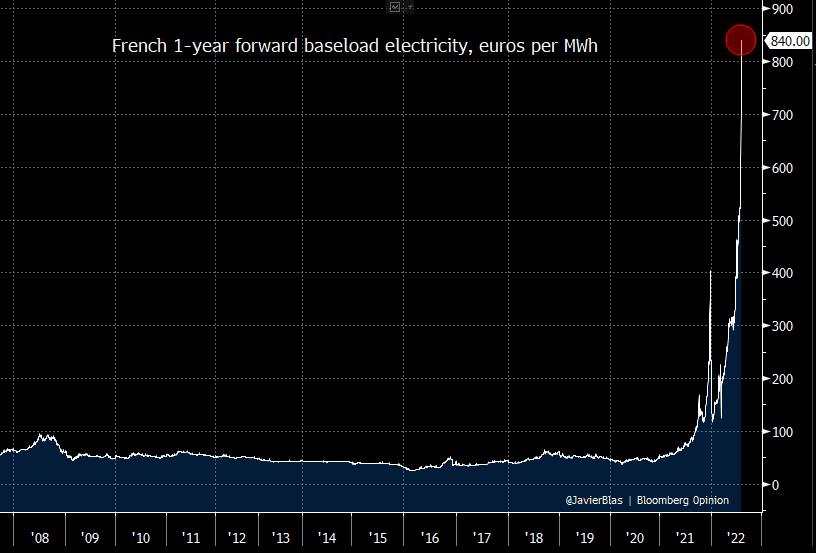

The European gas benchmark Dutch TTF rose to €295 per MWh, forcing electricity supply contracts in Germany and France to new records.

The developments prompted the Euro-Dollar exchange rate to make another foray below the psychologically important 1.0 level as investors accelerated their selloff of the single currency in anticipation of a Eurozone recession.

Recent upward momentum to Eurozone electricity prices was boosted by French nuclear power station outages and the prospect of cuts to the supply of Russian gas at month-end.

Above: French base load power contracts advanced sharply amidst tight gas supplies. Image courtesy of @JavierBlas.Set your FX rate alert here to ensure you do not miss any key targets being reached.

Russia said late Friday its Nord Stream pipeline that transfers gas to Germany will be shut for three days of maintenance on August 31.

Holger Schmieding, Chief Economist at Berenberg Bank, says the decision is a political one.

"In an apparent attempt to exploit Europe’s dependence on Russian gas, Gazprom announced last Friday that it will close the Nord Stream 1 pipeline (NS1) for an unscheduled three-day 'maintenance' on 31 August," he says in a note out Monday.

Gazprom's decision to halt supplies comes amidst a bidding frenzy for gas as European countries attempt to fill their storage facilities ahead of the winter.

"Concerns that Gazprom's three day shutdown of its main gas pipeline will be extended make EUR susceptible to sudden drops in the next few weeks," says analyst Joseph Capurso at CBA.

The Pound to Euro exchange rate rose back to a high of 1.1856 in response to developments, taking bank account transfer rates to around 1.1590 and rates offered at independent payment providers just above 1.18.

Above: GBP/EUR at daily intervals showing an attempted recovery from recent weakness.

"The end of summer sees the euro back under pressure, partly because the dollar is bid and partly because the Damoclean sword hanging over the European economy isn't going away," says Kit Juckes, Head of FX Strategy at Société Générale.

"The sharp rise in natural gas prices and uncertainty about the outlook are likely key reasons for the renewed EUR weakness, and something that could continue to push the EUR lower for the time being," says Ingvild Borgen, FX Analyst at DNB Markets.

The UK meanwhile also saw gas prices surge higher, but the market continues to see the Eurozone as being more exposed to the crisis.

This is largely because of the German manufacturing sector's heavy reliance on gas. A sharp slowdown in the Eurozone's industrial and manufacturing heart in turn spells a slowdown for the broader region.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Although UK gas prices are subject to broader European market forces there are some differences in that the UK still has its own domestic source of gas in the North Sea while also having notable terminals for the offloading and processing of seaborne Liquified Natural Gas.

By contrast, Germany doesn't have a single offloading terminal and relies largely on LNG cargoes shipped through UK ports and pipelines.

The UK's main import provider is Norway, which is a far more reliable partner than Russia is to Germany and other EU countries.

The outlook for the Euro therefore remains challenging.

Berenberg research finds a brief closure of the Nordstream 1 pipeline would not make a major difference, especially as Russia has reduced its gas exports through NS1 to 20% of capacity since 27 July.

"But it highlights two grave risks," explains Schmieding:

(i) Russia may falsely claim that it cannot re-open the pipeline afterwards because of a “technical issue” that could only be resolved if Western sanctions were lifted

(ii) Russia may also shut down its other pipelines to Europe later on.

Thus far, all indications are Gazprom will restart supplies.

Gazprom said in a statement that upon completion of the work and the absence of technical malfunctions of the unit, gas transport will be restored to the level of 33 million cubic meters per day.

The Eurozone is nevertheless now expected to fall into recession, which is unsupportive of the Euro from a fundamental perspective.

"Higher prices for even scarcer gas would worsen the serious recession into which Europe is falling already," says Schmieding.

"Immediate further cut in flows from Russia would also raise the risk that Germany may face a shortage of gas and would thus need to shut down parts of industry during the coming cold season. We currently attach a 25% probability to that risk," he adds.

The developments come as European countries race to boost their gas storage levels ahead of the winter. When storage is full the immediate pressure on gas prices might start to ease.

However, it appears there is some way to go before this happens, if indeed it happens at all.

Berenberg says in the seven days from 13 to 20 August, storage levels rose from 74.4% to 76.9% of capacity for the EU as a whole, and from 76.1% to 79.5% for Germany

Berenberg estimates the EU exceeds its 80% storage target in early September, saying Germany may get close to its 95% target in early October.

According to Bundesnetzagentur - Germany's energy agency - Nordstream 1 currently accounts only for 11% of Germany's total gas imports.

"NS1 is no longer making a major difference for the near-term. If Russia had stopped NS1 deliveries on 13 August: storage levels would still have risen 76.7% by 20 August," says Schmieding.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes