Euro Under Pressure Amidst German Electricity and Gas Price Surge

- Written by: Gary Howes

Image © Adobe Images

The latest developments in Eurozone energy markets maintain a case for further Euro downside, say analysts.

The Eurozone's single currency extended further below recent highs against the Dollar and Pound on energy market developments that showed European benchmark power prices surged above €500 for the first time.

The developments threaten to heap further pressure on the region's businesses over the coming months.

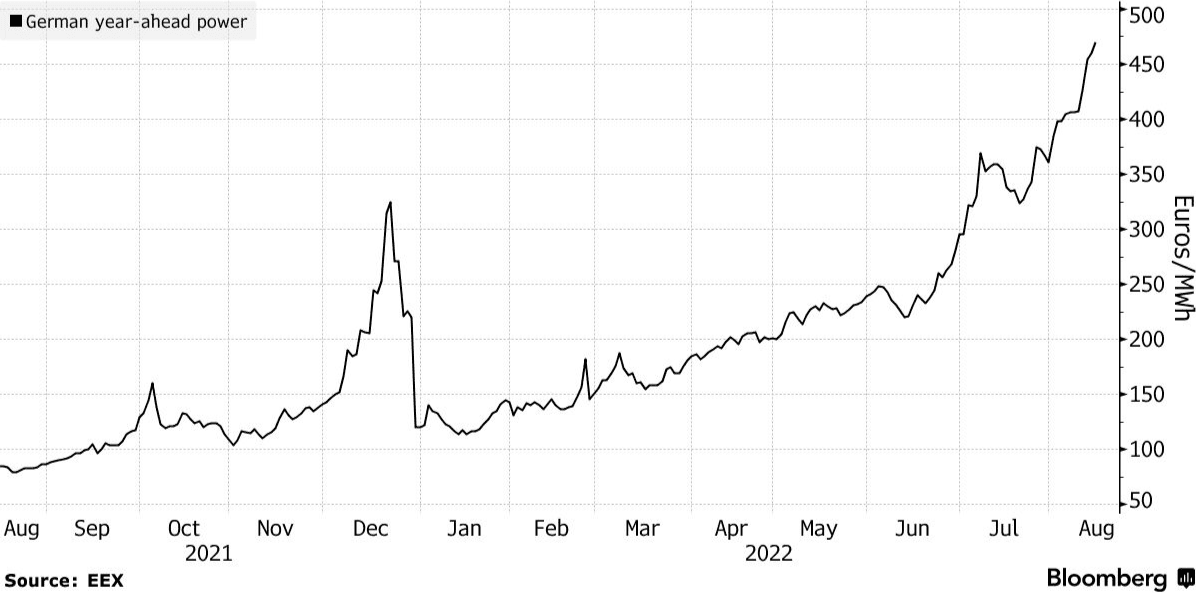

German year-ahead power rose 5.2% to €502 / megawatt-hour on the European Energy Exchange AG on Tuesday.

This represents a 500% gain in the last year.

Ole S Hansen, Head of Commodity Strategy at Saxo Bank says the EU gas and power situation continues to deteriorate with the Euro suffering as a consequence.

European gas prices continued their push higher as European countries kept pressure on demand in order to fill their storage tanks ahead of the winter, amidst an ongoing supply squeeze from Russia.

The European gas benchmark - TTF - rose 6.5% to the highest intraday price since early March.

This will raise costs at the Eurozone's gas power stations, but electricity prices are further pressured by a decline in output from France’s nuclear power stations amidst low river water levels and maintenance issues.

Above: German power prices for deliver in one year's time. Chart courtesy of Bloomberg.

Power imports from Scandinavia were also threatened by low levels in hydropower dams.

The prospect of sub-optimal economic output will likely lead to a further deterioration in the Eurozone's current account position, according to economists.

The current account - the Eurozone's bank balance with the rest of the world - has fallen into deficit in 2022 amidst surging import costs and falling exports.

"The deterioration in the current account and trade position of the Euro zone is massive. The Euro zone has one export engine - Germany - and that export engine is now in serious trouble. The German growth model of the past several decade is over. Euro is going below parity," says Robin Brooks, Chief Economist at the IIF.

Image courtesy of @RobinBrooksIIF

The Pound to Euro exchange rate is now a third of a percent higher this week amidst broader Euro weakness, at 1.1870. This takes bank account rates to ~1.1630 for euro payments and ~1.1835 at independent payment providers.

The Euro to Dollar exchange rate was meanwhile a third of a percent lower at 1.0130, meaning banks are quoting rates below parity at around 0.9845, however independent providers are quoting above parity at 1.0099.

"The current situation in Europe is precarious and will require material improvements on both the geopolitical and inflation fronts. Growth is likely to moderate in the second half of the year," says Stéfane Marion, analyst at NBC Financial Markets.

"We continue to see some lingering euro weakness in the short term," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes