GBP/EUR Rate Forecasts Lowered at Goldman Sachs

- Written by: James Skinner

- GBP/EUR seen slipping to 1.1627 in three months

- With deeper fall to 1.1363 expected by early 2023

- BoE's caution, global growth risks spoiling outlook

Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

The Pound to Euro exchange rate has succumbed to souring market sentiment toward Sterling in recent weeks but it could fall further according to downgraded forecasts from Goldman Sachs, which envisage a steady slide back to levels not seen since January 2021 over the coming year.

Pound Sterling had traded comfortably back above 1.20 against the Euro heading into the latter half of April before turning lower after retail sales figures and other data offered a strong indication that sharply increased inflation may be stifling parts of the economy.

Recent data has spoiled the market’s appetite for Sterling and came soon after Bank of England (BoE) policymakers warned in February, March and April that surging inflation rates would hamper the economy enough to partially undermine themselves in later years.

“The policy stance in the UK has been on a relatively smooth and steady tightening path, even as the communication from policymakers has been anything but. Neither has been particularly helpful for the currency,” says Michael Cahill, a G10 FX strategist at Goldman Sachs.

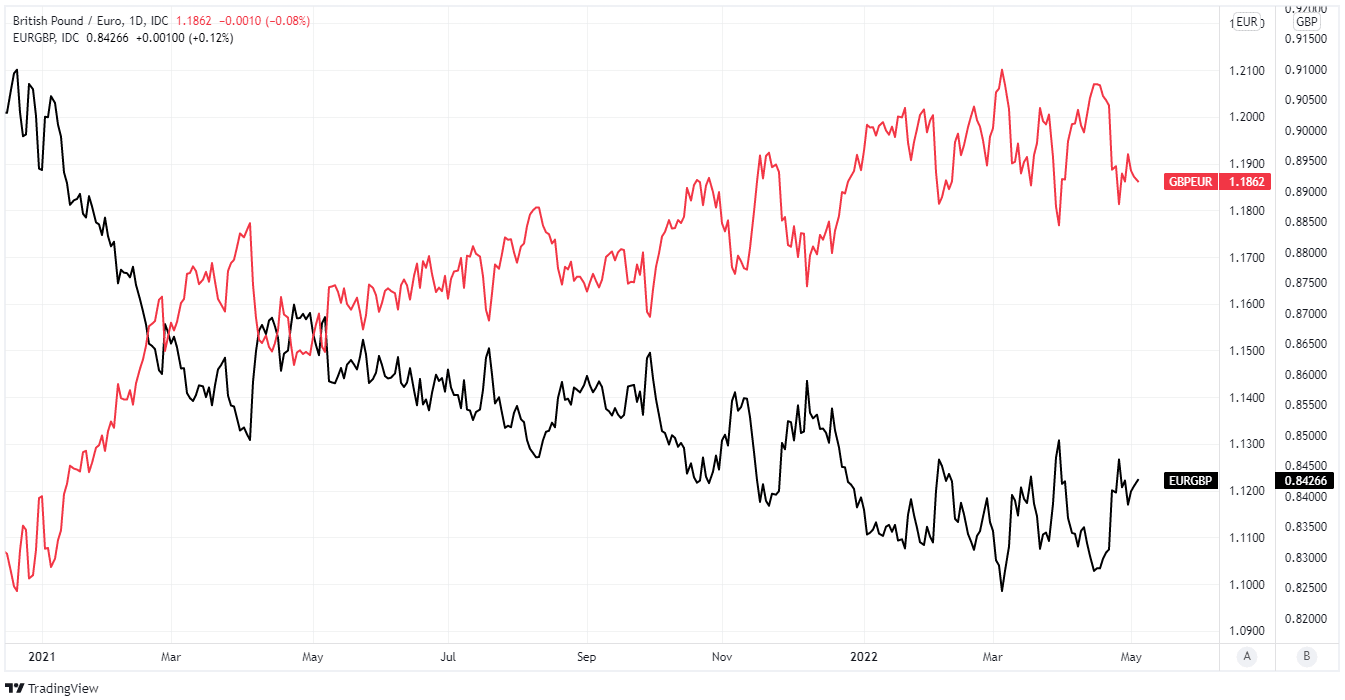

Above: Pound to Euro exchange rate shown at daily intervals alongside EUR/GBP. Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

“Perhaps even more importantly for the outlook, Sterling has a relatively high cyclical beta, so it tends to weaken when recession risks are elevated. Taking these together, we see further Sterling underperformance ahead,” Cahill and colleagues wrote in a Friday research briefing.

The downgraded forecasts look for Sterling to extend its late April losses with a fall back to 1.1627 in three months and a slide to January 2021 levels around 1.1363 over the year to May 2023.

These are down from three and twelve month projections of 1.2048 and 1.1764 respectively, and led the bank to suggest on Friday that clients consider selling Sterling in anticipation of a decline to 1.1627 in the near future. (Set your FX rate alert here).

“Investors could also consider short GBP/SEK, which would be more sensitive to risk sentiment but should trend lower given relative monetary policy paths across Europe,” Cahill and colleagues also said.

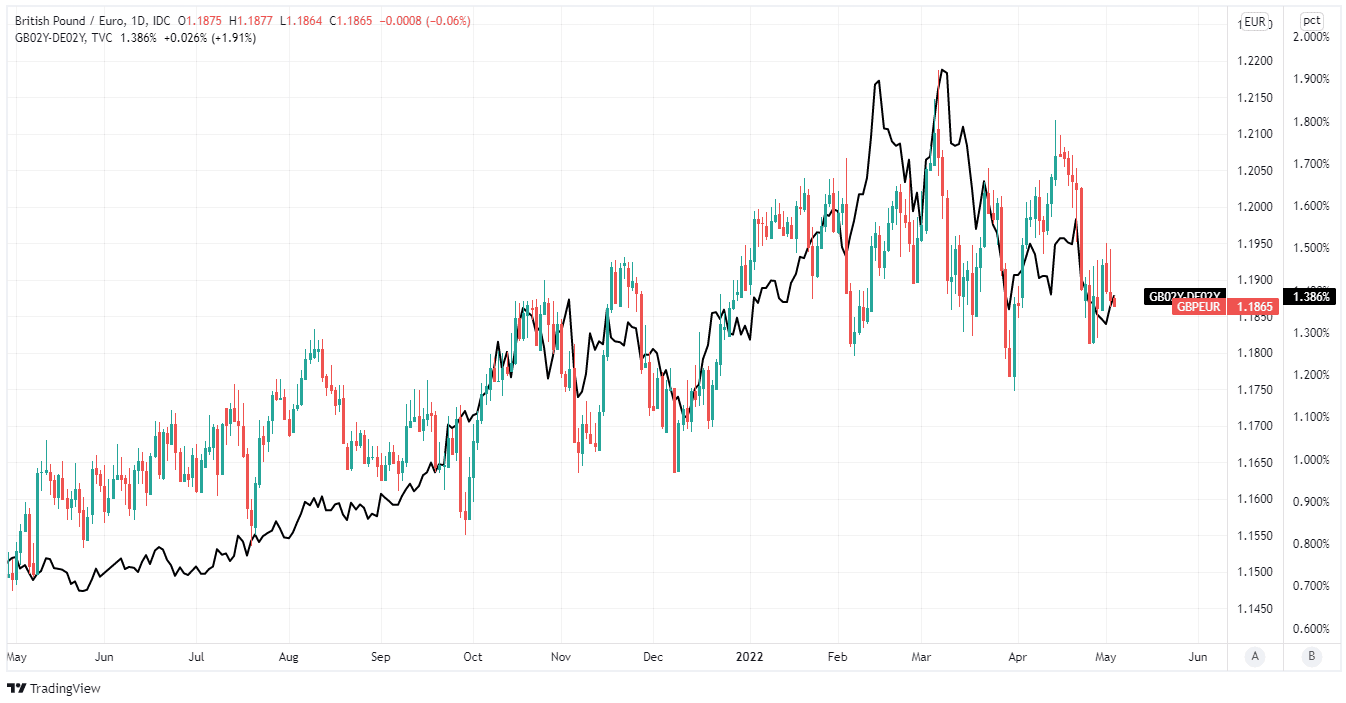

Above: Pound to Euro exchange rate shown at daily intervals with spread - or gap - between 02-year UK and German government bond yields. Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The forecast changes were one part a reflection of Sterling’s circumstances changing with the BoE’s policy stance, and the other the result of growing investor concerns about the outlook for the UK and global economies.

The BoE and Monetary Policy Committee members have implied repeatedly during recent months that surging inflation, rising taxes and other factors are likely to mean interest rates need not rise much further or as far as financial markets have assumed is likely for the months ahead.

Meanwhile, other factors have emerged to dim the global growth outlook including fresh coronavirus containment measures that are hastening an earlier economic slowdown in China and threatening a further bout of inflationary supply chain disruption.

“We do not think that hiking into a cyclical slowdown is negative for the currency—nor is it a problem that is unique to the UK. However, for now, the BoE’s more nuanced approach to balancing the growth and inflation path has negative implications for the currency,” Cahill said.

“Given the negative pressures from the terms of trade shock and more balanced policy response, and to underscore that the cyclical outlook is the primary driver of our forecast changes, we are initiating a new trade recommendation to go long EUR/GBP,” he added.