Pound-Euro Upside Limited by Growing Expectations for a 2022 Rate Hike at the ECB

- Written by: Gary Howes

-

- GBP/EUR upside dented by ECB rate hike expectations

- ECB rate hike now seen at end-2022

- But gas prices have started to retreat

- NatWest Markets stay constructive on GBP

Image © European Union - European Parliament, Reproduced Under CC Licensing.

- GBP/EUR reference rates at publication:

- Spot: 1.1772

- Bank transfers (indicative guide): 1.1460-1.1542

- Money transfer specialist rates (indicative): 1.1666-1.1713

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Bank of England looks poised to raise interest rates ahead of the European Central Bank, a divergence that has supported the Pound relative to the Euro over recent months.

But the market's expectation for a first hike at the ECB has come forward dramatically over recent days in response to surging inflation expectations in the Eurozone, a development that dents the Pound's upside potential against the single currency.

The development is useful in understanding why the GBP/EUR exchange rate appears to have been unsuccessful in moving above the key 1.18 area over recent days and might struggle to do so in the near-future.

Money markets have moved to fully price a 10 basis-point rate hike from the ECB by the end of next year, as policy-tightening expectations continue to rise in the face of rising inflation.

During mid-2021 expectations for that first rise were set at 2024, suggesting a substantial move for Euro rate expectations.

Eonia money market futures dated to the ECB's December 2022 meeting now see a 100% chance of such a move, compared with a roughly 60% chance on Friday.

The chance of a September 2022 rate hike stood at more than 80% versus roughly 50% at the end of last week.

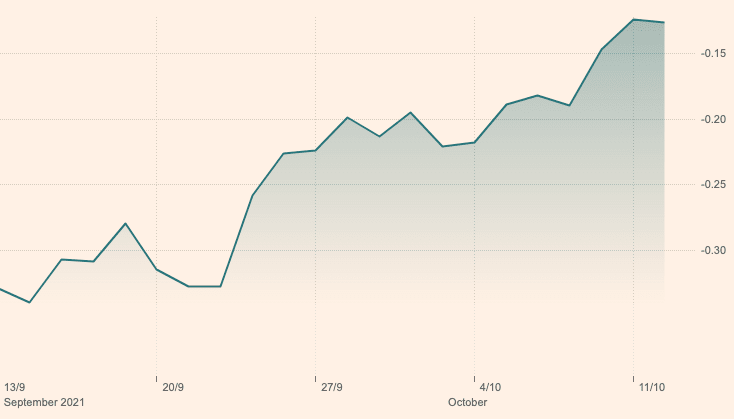

Expectations for higher interest rates in the Eurozone are encompassed by the rise in yield paid on Germany ten-year sovereign bonds, which have reached their highest levels since May and look poised to break into highs last seen in 2019.

Above: Yield on German ten-year bonds.

The rise has kept pace with that of its UK counterpart, thereby dulling the Pound's upside potential against the Euro.

The Pound-to-Euro exchange rate touched 1.18 again on October 12 and remains close by at 1.1757 at the time of writing on October 12.

However, the market is well aware that a meaningful close above 1.18 - which has been attempted on three occasions in 2021 - remains a hard ask.

Above: GBP/EUR daily chart for 2021, showing significant resistance at 1.18.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Expectations for a UK rate rise in late-2021/early-2022 were cemented on October 12 following the release of UK labour market data that painted a picture of an economy that continues to create jobs and see wages increase.

Record-high job vacancies implies there will unlikely be a surge in unemployment in the wake of the ending of the government's furlough scheme in September, implying an economy that is becoming increasingly short of spare capacity.

In short, the Bank of England will feel emboldened to raise interest rates soon, thereby supporting UK bond yields and bestowing support to the Pound.

Some economists don't see such dynamics underway in the Eurozone and expectations for ECB rate hikes will therefore have limits, if they are correct.

"Unlike the BoE, the ECB is clear that it will look through the current Eurozone inflation overshoot. As such, Eurozone real bond yields can turn more negative and undermine EUR," says Elias Haddad, Senior Currency Strategist at Commonwealth Bank of Australia.

ECB President Christine Lagarde said last week that the ECB "should not overreact to supply shortages or rising energy prices".

This contrasts notable to Bank of England Governor Andrew Bailey who said on the weekend that he was "concerned" about above target inflation and that the Bank had "got to prevent the thing from becoming permanently embedded".

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Money markets are now pricing in a UK rate hike of 10 basis points in November.

"Rates markets have priced early BoE rate hikes, and the central bank hasn’t (yet) pushed back on those expectations," says Paul Robson, Head of FX Strategy at NatWest Markets.

NatWest Markets nevertheless are of the view that a November rate hike at the Bank of England is too soon and the paring back of expectations could ultimately weigh on the Pound.

Nevertheless, UK monetary policy "is set for an earlier and possibly steeper trajectory than the ECB, Fed and the majority of major central banks. This should ensure that 5y rates, which correlate positively with the currency stay supportive of Sterling," says Robson.

Pound Sterling Live have reflected recently on the building of a deep pessimism towards the Pound amongst financial journalists of late, which appears to have been linked to an ongoing energy crisis.

The assumption made in numerous reports is that the UK is somehow unique in the current global energy crisis and is therefore set for more enduring hardship.

There is little compelling evidence that this is in fact the case.

Indeed, Robson says energy price shock worries impact a wide range of countries, including many in the Eurozone, as such "the UK has become less of an outlier".

Gas prices have fallen back sharply from their previous week highs over recent days and volatility in the market also appears to be settling.

Robson says this can nevertheless be good for the Pound.

"Extreme price rises tip the balanced in favour of stagflation concerns over supportive moves in nominal rates. Easing energy prices swing the needle more in favour of nominal rates and a stronger currency. We therefore stay with our long-held short EUR/GBP position," he says.