Pound-to-Euro Rate: The Next Targets According to Commerzbank and Soc Gen Techs

Image © Adobe Images

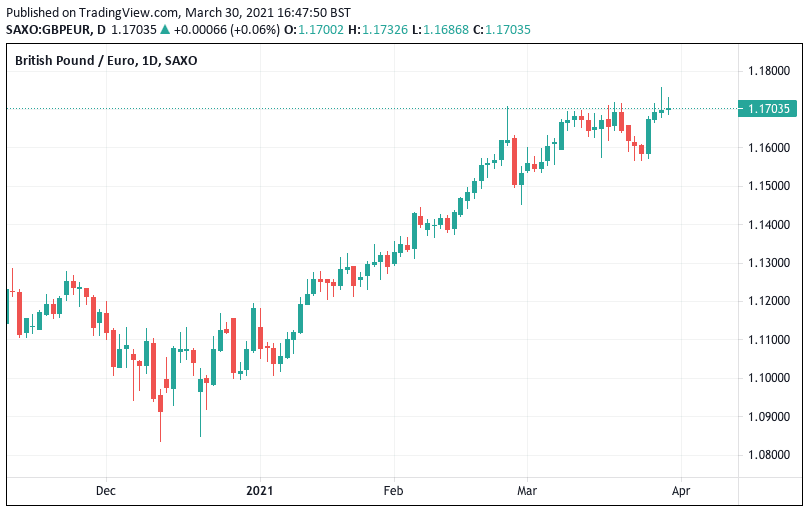

- GBP/EUR market rate at publication: 1.1720

- Bank transfer rates (indicative): 1.1410-1.1492

- Specialist transfer rates (indicative): 1.1554-1.1638

- More about bank-beating exchange rates, here

- Set an exchange rate alert, here

The British Pound is up 4.50% against the Euro already this year courtesy of a combination of faded Brexit-linked risks and expectations for a strong vaccine-lead economic rebound over coming months, developments that underpin a strong technical picture that continues to advocate for further gains.

Technical analysis from two leading of the Pound-to-Euro exchange rate (GBP/EUR) shows that Sterling retains a positive bias and upside targets reach as high as 1.21 in one instance.

Axel Rudolph, an analyst on Commerzbank's award winning FICC technical analysis team, says GBP/EUR continues it ascent towards the March and May 2019 highs at 1.1800/1.1813.

"Around these levels the cross may stabilise," says Rudolph in a regular foreign exchange analysis briefing.

The benefit of technical analysis when approaching foreign currency was recently summed up by Bipan Rai, North America Head of FX Strategy at CIBC Capital Markets.

Rai said technical analysis "is ALWAYS a useful exercise to take your emotions out of the picture and assess price action as it is and not as you’d like".

He adds FX technicals achieve their predictive power when other market participants read charts in the same way that most are expected to.

With this in mind, Rudolph says if the 1.1800/1.1813 region does not steady the uptrend in Sterling-Euro then he would expect advances to extend to the 1.2028/1.2137 major resistance zone to be reached.

The call comes as the GBP/EUR exchange rate looks to cement its recent advance above the 1.1700 level, which it has struggled to do for much of March.

These levels form the December 2016, April 2017, December 2019 and February 2020 highs and as such should act as strong resistance.

Meanwhile, any weakness in the Pound-Euro exchange rate is expected by Rudolph to find support around the four month support line which he says is located around 1.1606.

He says declines would need to clear the late February low at 1.1452 to negate current upside pressure.

Only once below here would a more concerted decline transpire that could see a decline to levels around 1.1285/1.1280.

Analysis from investment bank Société Générale meanwhile notes Pound-Euro to have been staging a steady uptrend after breaking through horizontal resistance at 1.1273 in January.

Their analysis shows the exchange rate has now reached the 78.6% fibonacci retracement from December 2019.

The outlook remains favourable to Pound Sterling as long as the Pound-Euro rate remains above 1.1574, and provided this level - which is the 30 day exponential moving average - is defended Soc Gen expect a continuation of the up move towards next projections at 1.1820.

{wbamp-hide start}

|

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |