Time to Buy Pound Sterling, Sell the Euro: Westpac

Image © Adobe Images

- GBP/EUR spot rate at time of publication: 1.1011

- Bank transfer rate (indicative guide): 1.0625-1.0700

- FX specialist providers (indicative guide): 1.0956

- More information on FX specialist rates here

The Pound-to-Euro exchange rate will recover from around current levels, according to foreign exchange strategists at Aussie-based international lender and investment bank Westpac.

In a note to clients out Monday, Westpac strategists say they are selling the Euro and buying Sterling based on a number of observations, primary amongst them that the EU and UK will strike a post-Brexit trade deal.

The call comes amidst rising tensions that the two sides are too far apart on the outstanding issues to be in a position to secure a deal before the transition period ends on December 31.

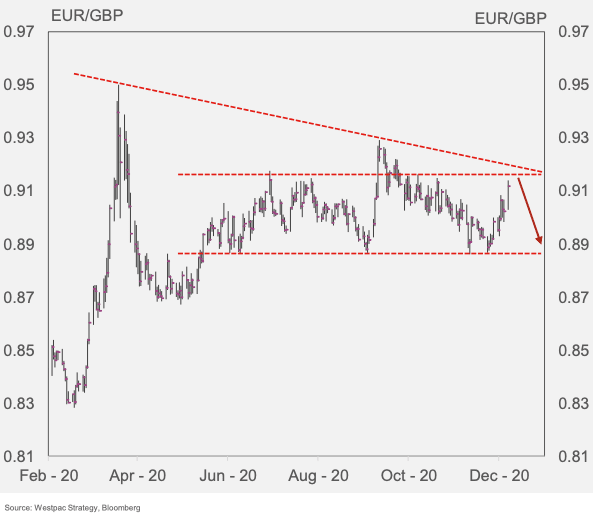

A EUR/GBP sell was initiated at 0.9125 by Westpac's strategists, which is a buy at approximately 1.0960 in GBP/EUR terms.

"Prospects for a Brexit deal has been faltering over the past 10 days causing EUR/GBP to trade back to the upper bounds of its recent range," says Tim Riddell, a foreign exchange strategist with Westpac in London. "Potential to retest recent lows if a deal can be struck, or even an extension to negotiations."

The call comes following a period of particularly strong outperformance by the Euro which Westpac say has gained support from a series of data beats and hopes that COVID beleaguered Eurozone nations will rebound as vaccines are rolled out as well as prospects for a positive EU-UK trade deal.

But, there are concerns for the outlook given the EU Recovery Fund is being delayed by opposition from Hungary and Poland.

"Although opposition might be circumvented it may delay the implementation and undermine the cohesion of EU," says Riddell.

The call comes on the same day that Poland and Hungary recommitted to their veto of the EU budget, stating their opposition to law and order clauses that mean the two countries would only receive covid-19 rescue funds if they followed certain EU rules.

Hungary and Poland have blocked the €2TRN EU budget, objecting to the tying of disbursements to democratic standards.

They argue that the so-called conditionality threatens their autonomy and makes them targets for funding cuts.

Beyond the politics, another potential headwind for the Euro is the European Central Bank which meets on Thursday 10 to deliver its latest package of easing measures, aimed at supporting the EU economy.

The ECB is expected by Westpac to increase its PEPP quantitative easing programme by some €500BN and extended for at least 6 months as well as increasing TLTRO maturities from 3 to 5 years) when it also receives its Staff projections this week.

"Anything further combined with sharply lower staff projections or EUR profiles could see EUR lower," says Riddell.

Finally, Pound outperformance against the Euro could be realised by the UK being ahead of the EU in terms of rolling out a vaccination programme.

The UK approved the Pfizer-BioNtech vaccine on December 02 and will start administering doses on December 08.

The EU has yet to indicate when it might approve the vaccine.

A target for the trade resides at 0.8850 EUR/GBP, or ~1.13 GBP/EUR.

A clear risk to the trade is that EU and UK trade negotiations end without a deal, which at the time of writing cannot be ruled out.