Bank of England Won't Cut as Fast as Markets Think, says DNB

- Written by: Sam Coventry

-

Image © Adobe Images

The Bank of England won't cut as fast as markets expect owing to a solid economic upswing, says an economist at one of Scandinavia's biggest commercial and investment banks.

Knut A. Magnussen, Senior Economist at DNB, says the UK economy is in "what seems like a solid upswing" and "the BoE has little pressure to cut rates, in our view."

He says the Bank will cut rates again in November and again at "every other" meeting, implying a slow approach to rate cuts.

The view comes in the same week that we report economists at Goldman Sachs think the Bank will open the floodgates soon, with November opening the door to a succession of cuts.

As such, Goldman Sachs thinks the market is underestimating the cuts that are coming, which would imply lower lending rates in the UK and could potentially weigh on the Pound and morgage rates.

The divergent views held by DNB and Goldman Sachs rest with differing expectations for services sector inflation and wages, two variables the Bank of England is watching closely. Goldman thinks they will cool rapidly, while DNB thinks they won't.

The recent decline in the UK's headline unemployment rate signals "a strengthening of the labour market," says Magnussen. "It seems that higher activity has increased the demand for labour, and employment has risen from April, following a weak period from May 2023 to March 2024."

DNB thinks wages and services inflation will continue to fall, but the fall will be slow and keep the Bank of England alert.

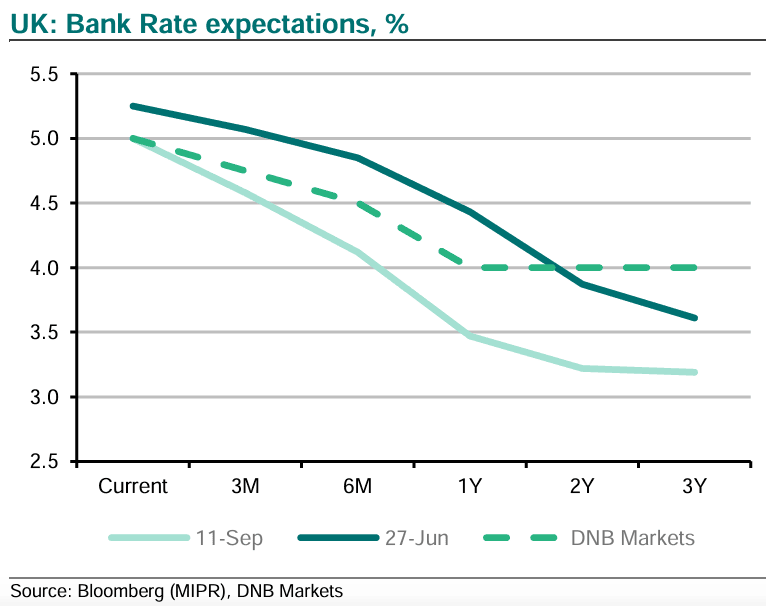

Money market pricing shows investors are looking for Bank Rate to be lowered "all the way" to c3.25%. This is c75bp lower than DNB's expected terminal rate.

"We believe the stronger labour market and rising economic activity will limit how much rates may be reduced. It seems reasonable that lower (services) inflation and wage growth would open room for cuts, but as long as the British economy avoids a recession, we believe rates will only be lowered to c4%," says Magnussen.

The Pound and mortgage rates can expect to be supported by UK rate differentials for longer if DNB is correct.