Record Budget Surplus Boosts Hunt's Coffers Ahead of Budget

- Written by: Gary Howes

Above: File image of Jeremy Hunt by Simon Dawson / No 10 Downing Street.

Chancellor Jeremy Hunt received a shot in the arm ahead of next month's budget after it was reported UK public finances recorded a record monthly budget surplus in January thanks to a strong tax take and lower-than-expected borrowing.

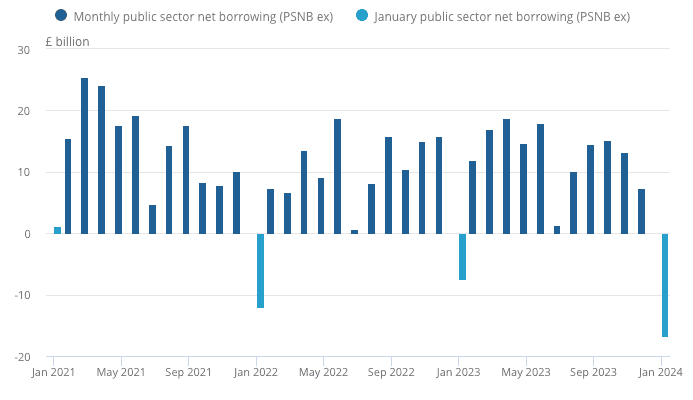

Public sector net borrowing in January 2024 was in surplus by £16.7BN, which more than doubles the surplus of January 2023 and the largest surplus since monthly records began in 1993 in nominal terms.

January is typically the Treasury's only surplus month as tax receipts are always higher than in other months, owing to receipts from self-assessed taxes.

Above: Public sector net borrowing excluding public sector banks, £ billion, UK, January 2021 to January 2024.

Combined self-assessed income and capital gains tax receipts were £33BN, said the ONS, £1.8BN less than a year earlier.

The record surplus was helped by a borrowing undershoot, with the ONS reporting that borrowing in the financial year to January 2024 was £96.6BN, £3.1BN less than in the same ten-month period a year ago.

The ONS says this is the first time in the present financial year that year-to-date borrowing has been lower than in the equivalent period in the last financial year.

The developments will present a timely boost to the Treasury ahead of next month's budget statement, where Chancellor Jeremy Hunt will seek to lower the UK's record-high tax burden.

Any forthcoming stimulus can support the UK's economic growth outlook and give the Bank of England added reason to be cautious when cutting interest rates.

As we report here, such an outcome can be supportive of the British Pound's outlook.

Falling inflation is also helping as debt interest payments - linked to the Retail Price Index - in January 2024 stood at £4.4BN, which is around 45% lower than in January 2023.

"This is largely due to the impact on index-linked gilts of downward movements in the Retail Prices Index, which has fallen by almost two-thirds since late 2022. As inflationary pressures continue to ease over the coming months, this should reduce the burden of interest payments on the public purse," says Gora Suri, economist at PwC UK.

However, these data might come too late for Chancellor Hunt as the Office for Budget Responsibility's forecast assumptions are now locked in.

"Hunt is likely to have limited scope for tax cuts or additional spending compared to his predecessors. The Chancellor may have more headroom than the OBR expected in November, due to falls in market expectations for interest rates and gilt yields, but lower tax revenues from a smaller cash economy may push headroom down," says Suri.