Government Finances Not as Bad as They Looked in September - Pantheon

- Written by: James Skinner

-

"Indeed, public borrowing in the first six months of this year has totalled £72.5B, slightly below the OBR’s £72.9B forecast

Image © Adobe Images

Government borrowing rose by just less than one percent of economic output in September, according to Office for National Statistics data released on Friday, although some economists say the data was not quite as bad as it appeared.

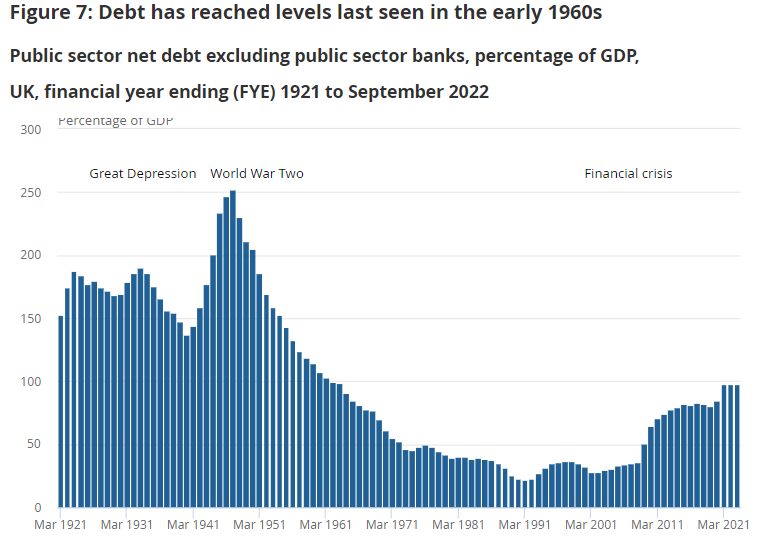

Public sector net borrowing was £20BN last month, up £2.2BN from the same month one year ago and also some £5.2BN more than forecast by the Office for Budget Responsibility (OBR).

"September’s public finance figures aren’t quite as bad as they first look, as the very high level of borrowing largely reflects a temporary £4.4B jump in net social benefit payments, to help households with their winter energy bills," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"Note that the public sector net cash requirement of £8.9B in September undershot the £13.3B predicted by the OBR in March. The continued pattern of sharp downward revisions to estimates of borrowing in recent months also suggests that September’s data will look a bit healthier in a few months’ time," Tombs also said on Friday.

Pantheon's Tombs noted on Friday that while September's data look bad and did also reveal higher borrowing than was anticipated by the OBR, last month's number also still left total net public borrowing for the first six months of the financial year running below the level forecast by the OBR for the period overall.

"Indeed, public borrowing in the first six months of this year has totalled £72.5B, slightly below the OBR’s £72.9B forecast. The trend, however, likely will deteriorate, as the downturn in economic activity develops," Tombs said.

Meanwhile, government borrowing for the year to the end of September 2022 was £72.5BN, down £24.9BN on the same period one year ago and marking the continuation of an earlier trend that saw borrowing fall by more than half for the financial year to the end of March 2022.

Government borrowing was £133.3BN for that latter period, around £5.5BN more than anticipated by the OBR but down from some £312.6BN during the prior year, which was connected to the repeated coronavirus-related closures of the economy.

However, and as was noted by Pantheon Macroeconomics above, the trend in borrowing is on course to deteriorate and for multiple reasons including an anticipated deterioration of the economy, which was highlighted by Friday's retail sales figures for September.

"This troubling retail sales figure adds to my view that the UK is headed for recession. I expect retail sales to get worse in 2023 as consumers face higher mortgage costs, higher rental costs and possibly higher energy bills too," says Emma Mogford, manager of the Premier Miton Monthly Income Fund.

The deteriorating outlook for the economy has been driven by high inflation connected to rising import costs and more recently, interest rates, which poses risk to the government finances because it can reduce tax receipts while also lifting expenditures on things like welfare.

Friday's public finances data showed government tax receipts were £52BN in September 2022, up £4.5BN from the prior year, but the largest contributors to these tax receipts are taxes levied on income earned through employment and value-added-taxes levied on items sold in shops.

Both sets of those tax receipts will be adversely impacted by declines in retail sales over the coming months, if not the coming years, and by what is a widely-anticipated increase in unemployment over the same period that will also serve to raise government expenditure and borrowing.

"Although the retail sales were undoubtably depressed by the Bank Holiday for the late Queen’s funeral which saw the majority of retailers across the nation closed, since the start of the year there has been only one month where retail spend did not contract," says Philip Shaw, chief UK economist at Investec.

"Some of this represented the shift away from goods back towards services as life returned closer to pre-pandemic ‘norms’ [but] this transition has largely run its course. As such, the recent run of weak retail sales reports likely represents consumers being forced to pare back spending," he added.