Strong Labour Market Leaves Bank of England Little Choice but to Pursue Higher Interest Rates

- Written by: Gary Howes

-

Image © Adobe Images

Strong labour and wage data out of the UK suggests the Bank of England has little choice but to continue raising interest rates in order to stem demand and ultimately lower inflation.

The UK recorded a loss of 109K jobs in the three months to August - which was less than the 155K the market expected - but the unemployment rate still fell to 3.5% from 3.6%.

This is largely due to the economic inactivity rate increasing by 0.6 percentage points to 21.7% in the three months to August 2022.

"Things are still tight as the number of potential candidates continues to shrink. Even with a flatlining economy, Britain's unemployment rate isn't far off the lowest level seen in nearly five decades and thousands more people continue to become 'economically inactive' by dropping out of the labour market entirely," says Aude Barral, CCO of the tech recruitment platform CodinGame.

The most timely estimate of payrolled employees for September 2022 shows another monthly increase, up 69K on the revised August 2022 figures, to a record 29.7 million.

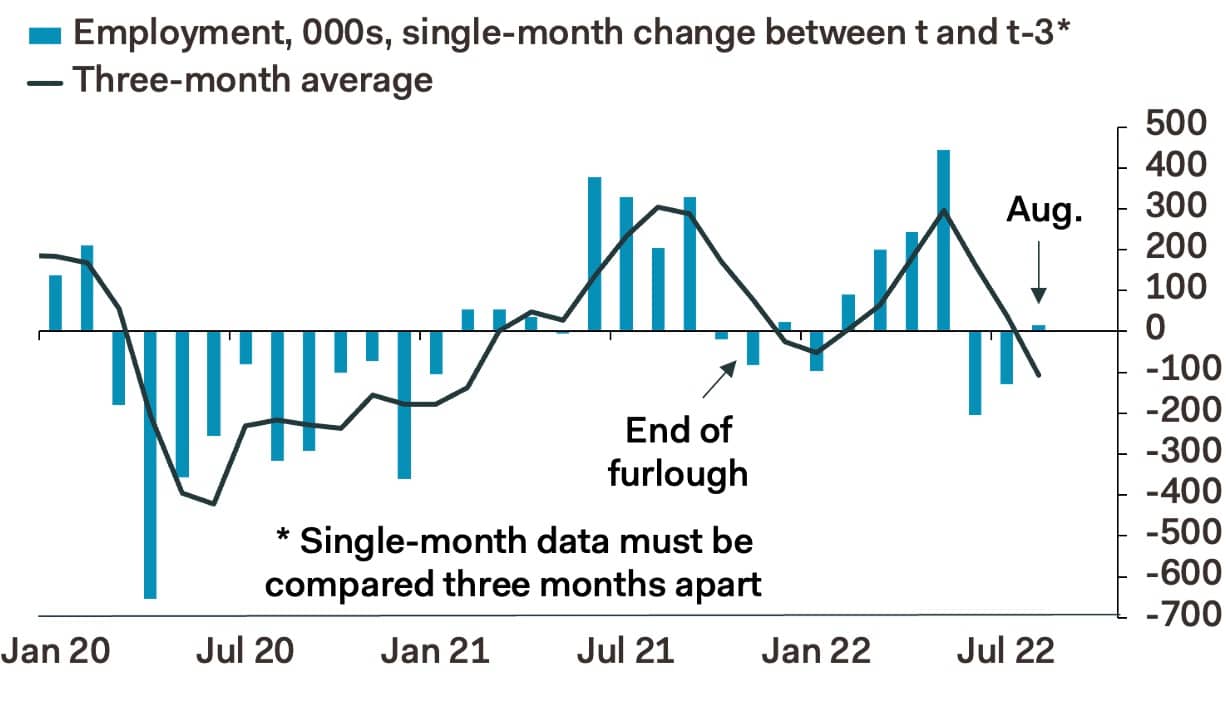

Image courtesy of Pantheon Macroeconomics.

Wages were robust with average earnings, with bonuses included, at 6.0% in August, which was up notably on the 5.5% from the month prior.

Wage increases suggest embedded inflation expectations and the Bank of England will have little choice but to continue hiking interest rates.

"Wage growth retained too much momentum for the MPC to tolerate in August," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

But, a slowdown in hiring is evident in the data and Tombs says this will lead to less churn in the job market, easing the pressure on businesses to pay more to retain staff.

"As a result, we continue to think that the MPC will be able to stop hiking Bank Rate once it has hit 4%, well below the near-6% peak priced-in by markets," he says.

A slowdown is certainly coming with the number of vacancies falling sharply by 46K on the quarter to 1,246,000,.

The ONS says this is the largest fall on the quarter since June to August 2020.

"The number of job vacancies has begun to fall away sharply as thousands of employers rethink - or freeze - their hiring plans. Vacancies have now declined for three months in a row and this trend is likely to continue as business confidence shrinks," says Barral.