UK Faces "Biggest fall in Household Disposable Income for Decades" says PwC

- Written by: Gary Howes

-

Image © Adobe Images

Economists at PwC have slashed their economic growth forecasts for the UK economy and said the country's households face the biggest fall in disposable income seen in decades.

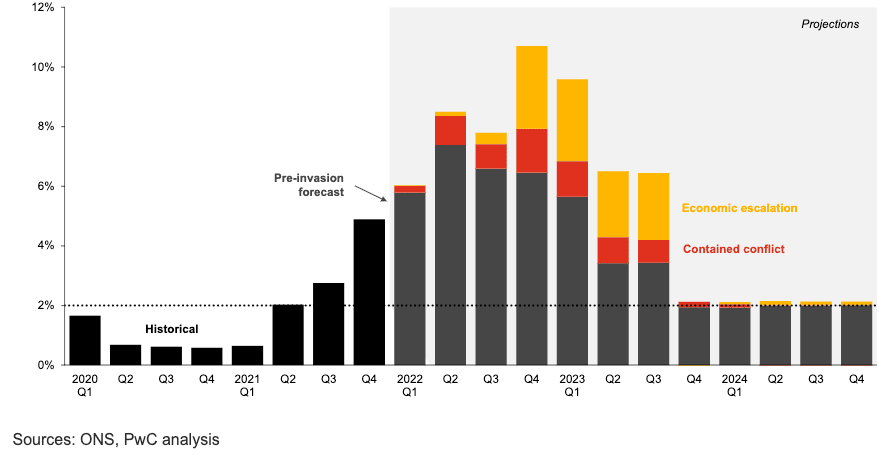

UK economic growth now expected to be 3.8% in 2022 says PwC in a new economic forecast briefing, revised down from 4.5% projected before Russian invasion of Ukraine.

They say the outbreak of war and the introduction of economic sanctions on Russia have added one percentage point to inflationary outlook.

Inflation is forecast to reach a peak of 8.4% in the second quarter of 2022 and average 7.4% in 2022. This projection is similar to the Budget for Office Responsibility's forecast for inflation to average 7.4% this year with the peak being at 9.0%.

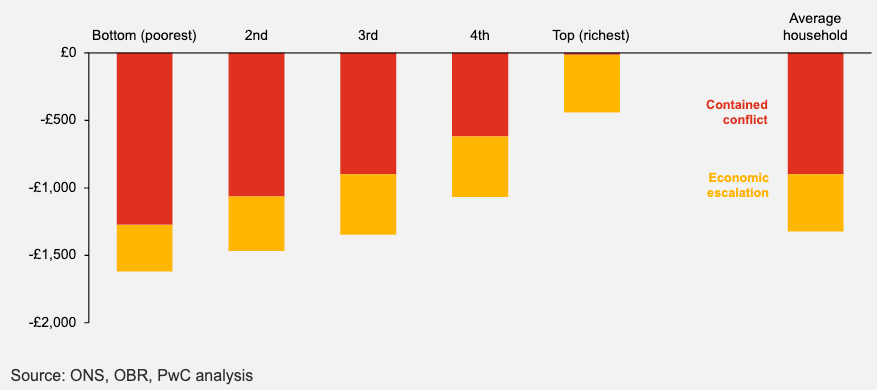

The average UK household is now set to be £900 worse off this year, with lowest earners facing potential £1,300 fall to their incomes as real wages fall by around 2% says PwC.

Above: "Projected change in household disposable income by household income quintile, from 2021/22 to 2022/23" - PwC.

PwC’s UK Economic Outlook also includes modelling for an 'economic escalation' scenario, which would include a substantial disruption to Russian exports of oil and gas. In this scenario, UK economic growth would be downgraded to 2.8%, and inflation could peak at 11% (with an average of 8.3%).

"Russia and Ukraine are key exporters of commodities such as car batteries, food and fertiliser. Russia is also a major energy supplier. It is clear that many households and businesses will be feeling great pressure from rising costs this year," says Nick Forrest, UK Economics Consulting Leader at PwC.

“Were further sanctions introduced in response to pressure to rapidly curtail the use of Russian oil and gas, the UK economy would continue to grow, but the pace of growth would be significantly slowed. The UK is not yet facing a growth crisis, but it is facing an inflation crisis," he adds.

Above: "CPI inflation (year-on-year), 2020 Q1 to 2024 Q4" - PwC.

UK CPI inflation reached 6.2% in February 2022, the highest level in three decades, with around half of the contribution to the headline inflation being driven by fuel, food and electricity prices.

"Food and energy price hikes typically act like asymmetric tax hikes on households as its users cannot materially cut back on its consumption," says Barret Kupelian, senior economist at PwC. "This will act as a headwind to economic activity as households cut back on spending in other areas.”

The energy price cap rose by 54% in April 2022, and PwC’s price cap model predicts that it may rise again by around another 36% in October, to £2,700.

In the event of economic escalation scenario, it is estimated the cap could rise to £3,500.