60% of UK Businesses to Welcome Back all Furloughed Staff: Survey

- Written by: Gary Howes

-

Image © Adobe Images

UK business activity and business confidence remain above long-term averages, according to two new economic surveys, with one suggesting a post-pandemic spike in unemployment will be avoided.

The Lloyds Bank Business Barometer has revealed that although business confidence fell back slightly in October it remains above the long-term average, boosted by an increase in skilled labour that followed the ending of the government's furlough scheme in September.

The CBI meanwhile said private sector activity grew at a similar pace in the quarter to October as the same period one month previously, and now has been growing at an above average pace for six consecutive months.

Both surveys underscore the findings of the more closely watched PMI survey, which came in above expectations during October amidst an ongoing expansion of the UK economy.

All surveys confirm intense supply chain and inflationary pressures continue to act as a headwinds to economic growth, but they are not blowing strong enough yet to halt the economic recovery.

Lloyds Bank's survey reported business confidence edged lower by 3 points to 43%, but was still the second highest since the pandemic began.

They reported 48% of businesses said it was becoming easier to hire people with the right skills since the end of the furlough scheme.

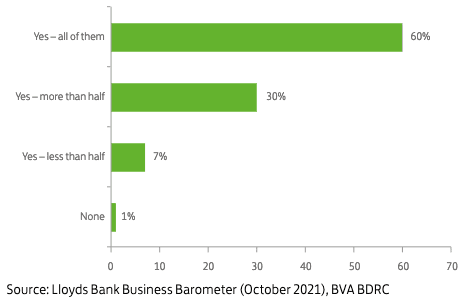

60% of firms plan to bring back all furloughed staff and a further 30% expect more than half to return.

Government data showed that 1.3 million people were still on furlough by August 31 2021.

Above: "Majority of firms will bring back all of their furloughed staff" - Lloyds Bank Business Barometer.

The findings come just days ahead of a key decision by the Bank of England that could see policy makers raise interest rates from a crisis-era low at 0.10%.

There is however an expectation amongst some economists that the Bank could avoid a November rate hike in order to assess incoming labour market data, making a December hike the more likely date for lift-off.

Some members of the Monetary Policy Committee have expressed caution on raising interest rates, wanting to see labour market data following the ending of furlough before voting for a hike.

MPC member Silvana Tenreyro said recently she needed more time to judge how the end of the furlough scheme was affecting the labour market, adding to signs that she sees no urgency to raise rates.

"Uncertainty over the effects of the furlough scheme should be resolved over the coming months, which should help paint a clearer picture of the position of the labour market," Tenreyro said in a speech to the Centre for Economic Policy Research.

However, the Lloyds Business Barometer Data shows only 7% of surveyed businesses expect less than half of furloughed staff to return and just 1% said they intend to let go all furloughed staff.

"With sixty percent of firms saying that they expect to bring back all their furloughed staff back to work, and a further thirty percent intending to bring back more than half, it should bode will for the labour market as we head into the winter," says Hann-Ju Ho, Senior Economist at Lloyds Bank Commercial Banking.

The survey meanwhile shows the prospect for higher wages in the future have also grown, consistent with official data showing job vacancies are now at 1.2 million amidst a limited supply of labour:

Advertised job vacancies meanwhile rose to more than 1.3 million in the first week of October, with shortages in hospitality, agriculture and transport, according to Adzuna, a job search engine.

"Hiring holes are appearing throughout the U.K. jobs market and pushing up overall vacancy levels to record highs," said Andrew Hunter, co-founder of Adzuna. "Employers are responding by raising wages and offering bonuses, but smaller employers who can’t afford to compete are struggling."

The CBI's monthly Growth Indicator meanwhile reported the number of manufacturers citing a lack of skilled and 'other' labour as being a limiting factor to output had reached record highs in October.

However, the survey said private sector activity is still expected to grow in the next three months.

"The CBI's October surveys suggest the UK economy continued to recover through late summer and into early Autumn, making further strides towards re-gaining its pre-pandemic level of output," said the CBI.

Above: Monthly composite: Output volumes, past three months. Image courtesy of the CBI.

The survey reveals "unprecedented supply-side pressures currently facing firms."

"The recent surge in energy prices and ongoing production outages in China, partly caused by this, highlight the ongoing risks around global supply conditions," said the CBI.

Firms report strong demand combined with this supply chain disruption has pushed inventories down to historic lows.