Economic Growth Stalled in July

- Written by: Gary Howes

-

- Economy's summer lull confirmed

- Pingdemic, supply chain issues blamed

- Aug/Sept seeing improved activity

- But economists warn bounceback will be tepid

Image © Adobe Images

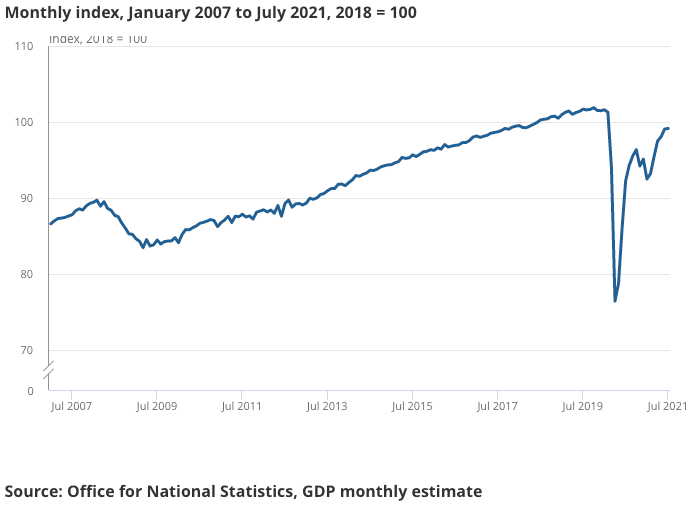

A slowdown in UK economic growth during the summer has been confirmed by the release of official GDP data for July.

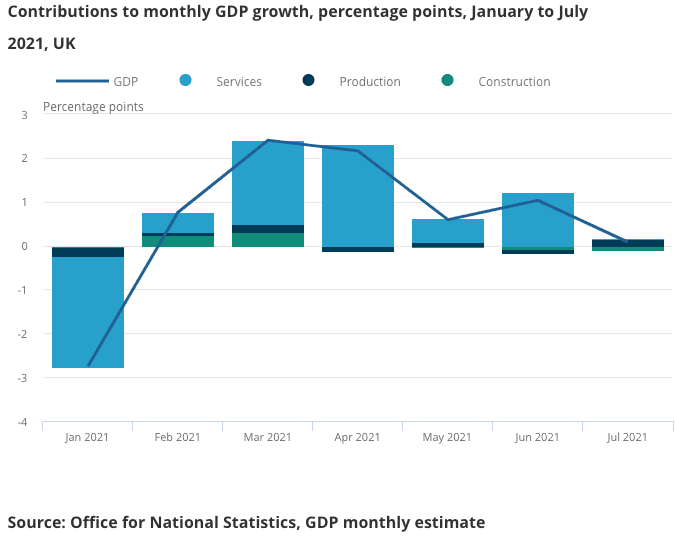

The ONS reported that the UK economy grew just 0.1% month-on-month in July, significantly lower than the 0.6% the market was expecting.

The decline came amidst self-imposed consumer and business caution owing to rising cases of Covid-19 in the country.

"The economic recovery effectively was stopped in its tracks by the surge in Covid-19 cases in July," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

The ONS says output from the services centre - the backbone of the UK economy - remained broadly flat in July 2021, and remains 2.1% below its pre-pandemic level (February 2020).

July activity suffered the effects of the 'pingdemic'; this saw millions of people instructed to self-isolate via their NHS app after having been in close contact with someone who has subsequently tested positive for Covid.

Annual growth read at 7.5%, below the 8% forecast.

The three-month rolling figure read at 3.6% in July, below the consensus forecast for 3.8%.

The ONS says industrial production was the main positive contributor to GDP’s growth in July 2021 having risen 1.2%.

"The UK’s economic recovery continued in July against the backdrop of the ‘pingdemic’ gathering pace," says Alpesh Paleja, CBI Lead Economist.

The UK economic slowdown was expected as it was foreshadowed by a slew of surveys and near-term data that suggested an air of caution amongst consumers.

But the same survey and near-term data is now suggesting August and September have seen a pick-up in activity, giving hope that some lost output can be regained.

"The good news is that the recovery appears to have regained momentum last month," says Tombs.

He points out that the ONS’ Business Impact of Covid-19 survey points to a 1.2% month-to-month increase in business turnover in August, having signalled only a 0.6% rise in July.

He also notes "restaurant diner numbers, footfall at retail locations and transportation usage all picked up in August too, according to data from OpenTable, Springboard and Apple, respectively."

Paleja does however warn that some issues that dented growth in July remain: "Labour shortages and supply chain disruption have continued since and are likely to have taken the edge off growth as we head into Autumn."

Global supply chain issues continue to frustrate UK businesses as do staff shortages caused by a structural readjustment to the UK labour force as well as the requirement for European citizens to apply for work visas.

"Placing HGV drivers on the Shortage Occupation List could make a real difference," says Paleja.

Above: GDP July and forecasts from Pantheon Macroeconomics.

Meanwhile inflation continues to rise towards the Bank of England's 4.0% forecast.

There was little reaction in the value of the Pound, confirmation that this data is in the rear-view mirror and has essentially been 'priced in'.

It could help explain why the Pound suffered losses against the Dollar and moved sideways against the Euro during this period.

"Businesses hope the bulk of supply disruption will prove temporary, but firms are not confident that all shortages will fade any time soon," says Paleja.

The government has said this week it wants to fast track drivers into the haulage industry and reports suggest proposals would be made that would see the Class C test used for rigid lorries combined with the Class E test for larger articulated lorries.

There is usually a 2-3 week minimum period between taking the two tests.

"The UK economy is showing some sign of strain with the shortage in HGV drivers and supply chain issues. This is going to take some time to resolve itself, so the figures may be a bit bumpy for a while longer," says Paul Craig, portfolio manager at Quilter Investors.

Pantheon Macroeconomics warn that surveys continue to show that a large minority of households remain fearful of contracting Covid-19, even though they have been double-vaccinated.

"This suggests that the recovery in consumer-facing sectors might run out of steam again in the autumn if, as we expect, Covid-19 cases and hospital admissions remain on their current upward trend," says Tombs.

He says the real disposable incomes of households are meanwhile set to be squeezed in the final quarter of the year by a further pick-up in inflation, the end of the furlough scheme, and the withdrawal of the £20 per week uplift to the value of Universal Credit.

"Given this, we look for moderate quarter-on-quarter gains in GDP of 1.5% in both Q3 and Q4, well below the 3.0% figure forecast by the BoE for both quarters. As a result, we continue to think it is very unlikely that the MPC will hike Bank Rate as soon as Q2 2022, as markets still expect," says Tombs.

Paul Dales, Chief UK Economist at consultancy Capital Economics says after initially rebounding rapidly the economy has now stalled and GDP is stuck 2.1% below its pre-pandemic level.

"We expect to learn next week that CPI inflation jumped from 2.0% in July to 3.1% in August. Stalling GDP and rising inflation will leave a whiff of stagflation in the air," says Dales.