The German Economy is Now Seen "Teetering on Brink of Recession" after Second-quarter Contraction

- Written by: James Skinner

-

© Christian Müller, Adobe Stock

- German economy shrinks for second time inside last year.

- Economists say Germany "teetering on brink of recession".

- Export woes drive contraction as Brexit and trade war hit.

- Risks are tilted to downside into year-end says Berenberg.

The German economy is now said to be teetering on the brink of recession after official data revealed a contraction in growth for the second-quarter, which has strengthened the case for the European Central Bank (ECB) to cut interest rates and restart its quantitative easing program from September.

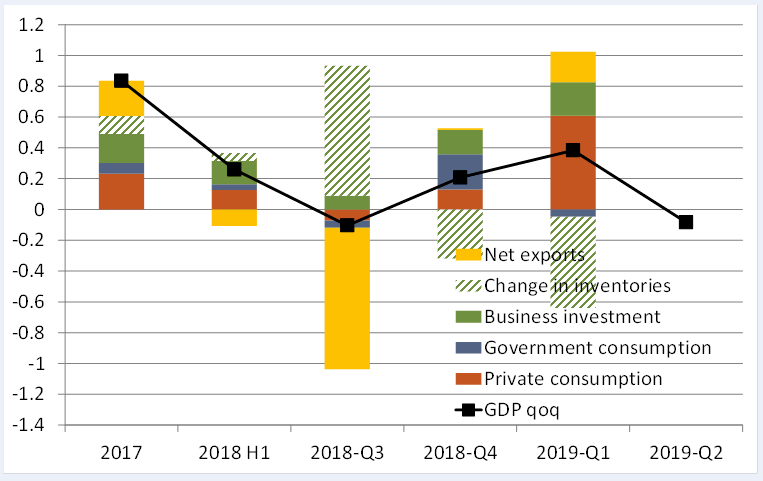

German GDP growth was -0.1% for the three months to the end of June, Destatis said on Wednesday, which partly reverses the 0.4% increase seen at the beginning of the year but was in line with the market consensus. This and another contraction back in the third quarter of 2018 mean the German economy grew by just 0.4% in the year to the end of June 2019.

Destatis says household and government spending contributed positively to growth over the course of the recent quarter, but that exports and 'net trade' were drag on the economy which more than offset continued healthy levels of domestic activity.

Exports fell much faster than imports during the quarter, leading some economists to suggest that woes in the factory sector connected to the U.S.-China trade war and Brexit could soon start to sink the domestic side of the economy too.

"The reversal of one-offs that had boosted growth in Q1 (0.4% qoq) accounts for much of the quarterly volatility," says Florian Hense, an economist at Berenberg. "The reversal of one-offs that had boosted growth in Q1 (0.4% qoq) accounts for much of the quarterly volatility."

Above: Berenberg graph showing contributions to GDP growth.

Germany's economy has been on a downward slope since the middle of 2018 when growth began to slow just months after around half of China's annual exports to the U.S. were clobbered by White House tariffs. Some $250 bn of annual exports to America are now subject to a 25% tariff while a further $300 bn is still at risk of new levies, although implementation of those has mostly been delayed until December 15.

The tariff fight between the world's two largest economies has hurt Germany because China is a significant market for the continent's car manufacturers, not to mention the makers of other industrial products, many of which are based in Germany. Chinese demand for all of those goods has been slowing in line with its economy, which forced the German industrial sector into a recession that is still ongoing.

"The data increasingly suggest that softness in export-oriented production industries is spreading to the rest of the economy and thus domestic demand is struggling to keep the economy above water," says Berenberg's Hense. "The ongoing slowdown in China, the escalation in the trade dispute between the US and China and the risk of a hard Brexit cloud the outlook for the German economy."

Hense has been forecasting the German economy would expand by 0.1% in each of the third and fourth quarters, and by 0.6% for 2019 overall. However, he now says risks to those projections are tilted toward the downside.

Germany's economy will have to contend in the final half of the year not only with a U.S.-China trade war that has tanked the Chinese car market but also the twin threats of a 'no deal' Brexit and the prospect of the White House imposing tariffs on cars imported from Europe too.

Above: Pantheon Macroeconomics graph showing German GDP correlation with IHS Markit PMI.

"Q3 sentiment data suggest that the economy remains weak. The risk of a recession is now elevated, but indicators for domestic private demand remain relatively resilient, especially in the services sector and with respect to consumers’ spending," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics. "The chart shows that the German economy has hit the skids since the middle of last year, but GDP shouldn’t be falling outright, at least not based on the headline PMI."

President Donald Trump delayed in May, for a period of six months, the implementation of a 25% tariff on cars imported from Europe pending the outcome of discussions with the European Commission about reducing tariffs on cars imported from the U.S. as well as providing American farmers greater access to the European agricultural market.The reprieve expires in November, right after the October 31 date that is set to mark Brexit day.

The schedule of risks for the months ahead means Germany could conceivably be forced to contend with both a 'no deal' Brexit that threatens to impede exports to the UK at the same time as the White House is threatening to close off the U.S. market. Both of those things would take place at the same times as the bottom is falling from the Chinese market for cars and other goods.

"There may be another boost to exports to the UK ahead of the next Brexit deadline at the end of October. But that will probably be smaller than the 0.1%-of-GDP boost in Q1, and it could turn out to be the prelude to a bigger hit to external demand if a no-deal Brexit actually takes place. The bottom line is that the German economy is teetering on the edge of recession," says Andrew Kenningham, chief Europe economist at Capital Economics.

This weak performance explains why Eurozone growth fell from 0.4% to 0.2% in the second quarter, while the deteriorating outlook accounts for why the ECB said in July it's tasked staff with devising a "tiered system for reserve remuneration" and considering "options for the size and composition" of a new quantitative easing program.

The ECB already bought up a large part of the European bond market between January 2015 and December 2018 as it sought to stimulate economic growth in the hope of lifting inflation back to the target of "close to, but below 2%". Inflation has been below the target for much of the time since the Eurozone debt crisis.

"Today’s confirmation of a German contraction in the second quarter further ignites discussion about a possible broader downturn. With more downside risks down the line like Brexit, Italian political turmoil and trade war uncertainty, that debate seems to be legitimate. The ECB has all but decided on a next stimulus package for September, but the question is whether governments are willing to provide additional support," says Bert Colijn, an economist at ING.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement