9-Month High for UK Services PMI

Above: The services sector is by far the largest sector of the UK economy. Image © Adobe Stock

The latest UK services PMI came in stronger than analyst expectations thanks largely to a pick-up in new orders from overseas.

According to IHS Markit, the Services PMI read at 51.4, ahead of analyst expectations for a reading of 50.4, and an improvement on the previous month's 50.2.

This makes for a nine-month high.

According to IHS Markit, July data signalled a slight improvement in the performance of the UK service sector, with a renewed increase in new work supporting the fastest pace of business activity growth since October 2018.

"A number of survey respondents commented on improved sales to clients in external markets, helped by the weak sterling exchange rate against the euro and US dollar. Moreover, the latest survey indicated the fastest increase in new work from abroad since June 2018," report IHS Markit.

Despite the beat on expectations, the data appears to have had little impact on Sterling which remains primarily focused on developments on the Brexit front.

"The small rise in the services PMI in July isn’t much to cheer, though it does provide some reassurance that the economy isn’t on a downward spiral and doesn’t require fresh monetary stimulus," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.

The service sector is by far the largest component of the UK economy, accounting for over 80% of activity.

Despite the better-than-expected numbers, the rate of expansion remained subdued overall and much softer than seen on average over the past decade.

Job creation softened in July and business expectations for the year ahead eased to the weakest since March.

"One of the major risks to the service sector – as well as the economy as a whole – comes from investment. Friday’s GDP figures may well reveal that business spending resumed its downward trend, a pattern that is likely to continue for the rest of the year. Brexit uncertainty is limiting appetite to expand, but contingency planning activities ahead of 31 October may also limit resources available for possible investment projects," says James Smith, Developed Markets Economist at ING Bank.

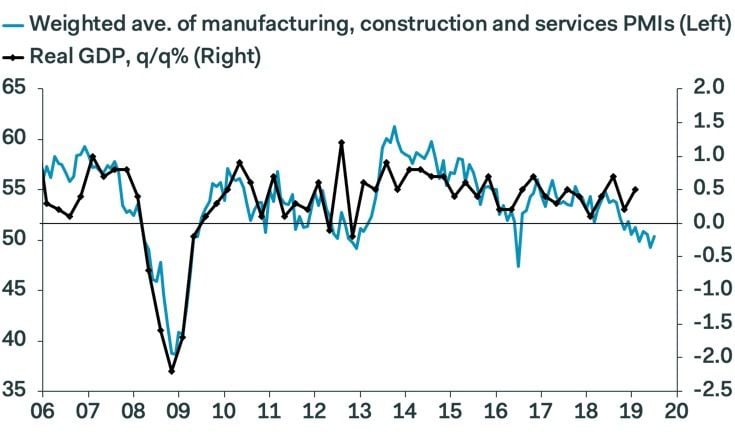

Based on the recent run of PMI numbers, ING expects underlying UK growth to remain capped at around 0.2-0.3% for at least the rest of 2019.

With all July PMIs now reported, the Composite PMI - which accounts for all three, giving a steer on UK economic growth - read at 50.7, ahead of forecasts for 49.8.

Image courtesey of Pantheon Macroeconomics

"The PMIs still collectively point to slightly declining GDP, though note that the GDP data have held up better than the PMIs have implied over the last year, due to momentum in retail sales and government spending, both of which are not covered by the PMIs," says Tombs.

Most analysts agree that the data has not yet turned down enough to warrant an interest rate cut at the Bank of England.