Bitcoin Forecast at 100K by deVere

- Written by: Sam Coventry

-

Bitcoin could hit $100K by the end of January 2025 after Donald Trump takes office, predicts the CEO of one of the world's largest independent financial organisations.

Nigel Green of deVere Group predicted Bitcoin would hit $80K on a Trump victory in the US presidential election last week.

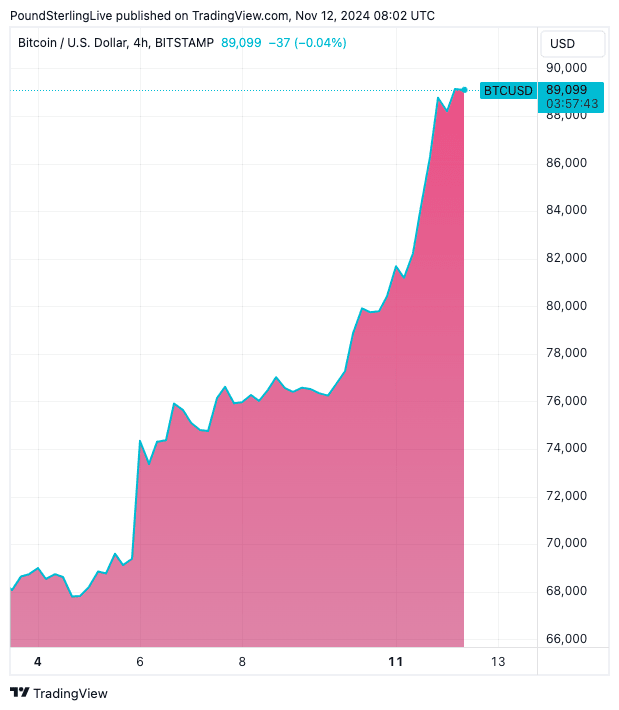

BTC/USD hit $89K on Tuesday, November 12, taking 2024's advance to 112%.

"We expect that this is just the beginning, with the cryptocurrency set to break more records under an incoming Trump administration," says Green.

He explains Trump’s crypto-friendly stance signals a transformative moment for Bitcoin and the broader digital asset market.

"His administration has a clear mandate to regulate crypto constructively, and his plan to elevate Bitcoin to a strategic asset class is a powerful endorsement. This is the most significant tailwind we’ve seen for Bitcoin since its inception," says Green.

Trump enters the White House on a ticket of tax cuts and tariff hikes, policies that economists say will be inflationary.

Analysts say Bitcoin’s role as a hedge against inflation is also gaining traction.

At the same time, gold, another hedge against inflation and often-time Bitcoin substitute, has seen a notable pullback since Trump's victory.

"Bitcoin, by its very design, is a deflationary asset. Unlike fiat currency, its supply is capped, which makes it an ideal hedge in times of inflation. As more investors recognise this, Bitcoin’s role as a long-term store of value only strengthens," says Green.

deVere Group thinks a lack of consistent regulation has long been a barrier to the mainstream adoption of cryptocurrency in the US. Trump’s administration has pledged to bring clarity to this space, creating a regulatory environment that reduces uncertainty and encourages broader participation.

This commitment to regulatory stability could "unleash a wave of institutional investment, setting the stage for robust growth in the crypto sector," says Green.

By designating Bitcoin as a strategic reserve asset, Trump’s administration is taking an unprecedented step that could lead to substantial demand for Bitcoin from government institutions.

"If adopted, this move would not only drive up Bitcoin's price but would also solidify its position as a legitimate asset in the eyes of institutional investors worldwide," adds Green.

With clear, supportive regulations, deVere expects institutional capital to pour into crypto like never before. "Bitcoin, being the most established digital asset, stands to gain the most from this influx.”

deVere’s projection of Bitcoin reaching $100,000 following Trump’s inauguration may seem ambitious, but current trends and Trump’s policies support this forecast.

"With every surge in Bitcoin’s value, it inches closer to becoming a mainstream financial tool," Green says. "The Trump administration’s backing will be the catalyst for this shift, pushing Bitcoin into the portfolios of traditional and institutional investors alike.”

Trump’s pro-crypto agenda in the world’s largest economy is set to provide the perfect storm for Bitcoin’s rise. With a clear regulatory framework and his push to make Bitcoin a strategic asset, the digital currency is poised for unprecedented growth.

"As Bitcoin breaks records, its mainstream adoption seems all but assured. The path to $100,000 is now within reach—and could signal a new era for both cryptocurrency and traditional investment portfolios," says Green.