Bitcoin Scales New Heights, Solana Outperforms

- Written by: Sam Coventry

-

Image © Adobe Images

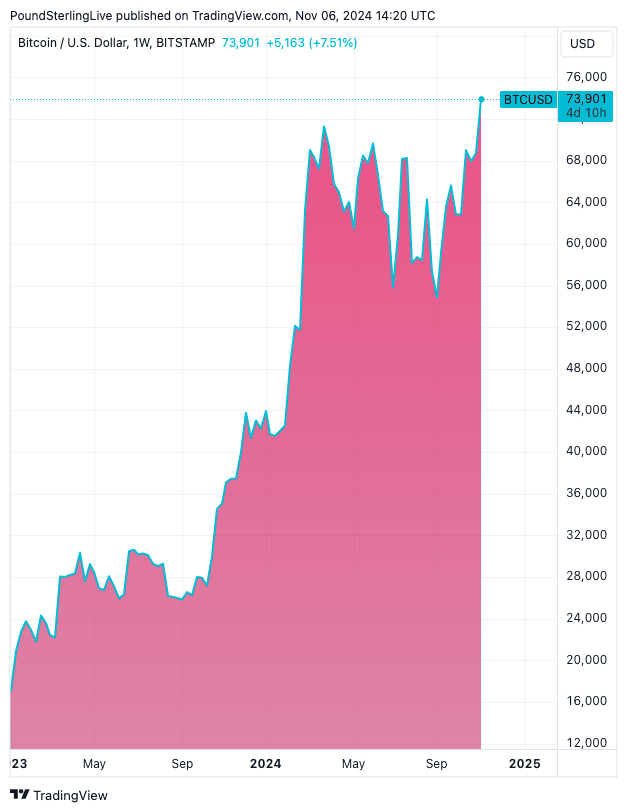

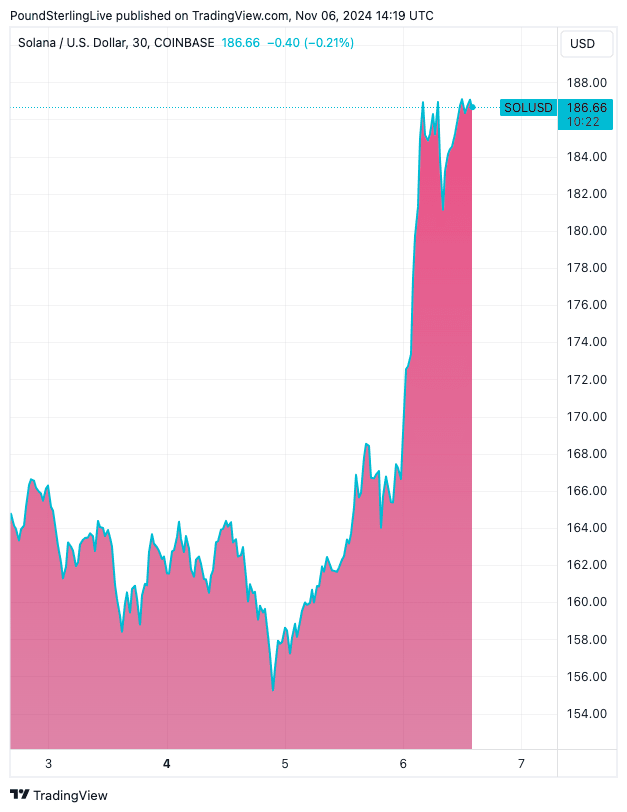

Bitcoin has surged by nearly 9% within the past 24 hours, reaching all-time highs, and Solana is up 11%.

Both are expected to be leading beneficiaries of the anticipated Republican sweep in the U.S. elections.

Researchers at Julius Baer, the Swiss private bank, believe that this political shift could pave the way for significant regulatory changes that would favour the broader crypto landscape, boosting Bitcoin’s appeal as a hedge and investment.

“A Republican majority is expected to accelerate a shift in the regulatory backdrop for crypto,” stated the Julius Baer researchers. “This shift could lead to a more favourable environment for assets like Bitcoin, which would benefit from the clarity and potential relaxation of regulatory constraints.”

Above: Bitcoin/USD hits all-time highs.

The regulatory adjustments anticipated with a Republican-led Congress extend well beyond the scope of existing legislative frameworks.

Julius Baer analysts highlight that key focus areas would include regulations around stablecoins, self-custody, and a comprehensive framework for crypto oversight.

These would influence not only the legislative framework but also the stance of critical agencies like the Securities and Exchange Commission (SEC) and the Internal Revenue Service (IRS) on anti-money laundering (AML) and bank secrecy standards in crypto. According to Julius Baer, this evolving environment is a significant factor propelling Bitcoin's current surge.

The potential for policy shifts is particularly relevant in the case of Bitcoin, which has attracted investor interest as a resilient asset amid financial uncertainty. “A favourable regulatory outlook could solidify Bitcoin’s status as a trusted store of value in the digital realm,” the Julius Baer team noted, adding that they expect market sentiment to strengthen further if the election outcome is confirmed as a Republican victory.

Above: Solana is another winner...

In the context of other digital assets, Ethereum has shown relative underperformance compared to Bitcoin and Solana. “Solana, in particular, has a higher sensitivity to the regulatory backdrop, as it remains in a grey area. This perceived flexibility has given it an advantage over Ethereum in the current market,” the researchers observed.

As the U.S. equity markets prepare to open, Julius Baer analysts expect the crypto rally to spill over into related equities, particularly those tied to Bitcoin's growth, such as miners, exchanges, and leveraged crypto assets.

Despite the positive momentum, Julius Baer researchers warn that volatility is likely to persist in the near term. The upcoming Federal Reserve’s Open Market Committee (FOMC) meeting on Thursday adds another layer of uncertainty to the outlook. “Volatility won’t suddenly disappear, and hedging directional exposure may remain costly in the short run,” the researchers emphasized. “However, if the FOMC deviates from market expectations with a 25-basis-point cut, Bitcoin and other crypto assets could see an additional boost, especially if balance sheet normalization is set to pause.”

With liquidity conditions potentially easing and quantitative tightening possibly coming to a halt, the Julius Baer team sees a supportive backdrop for Bitcoin’s upward trajectory. Nevertheless, they caution that lingering political uncertainty—particularly the risk that either party may challenge the election outcome—could dampen the rally.

“In the event of a confirmed Republican sweep, the regulatory landscape could indeed change in a way that supports further Bitcoin gains,” concluded the Julius Baer team. “This would not only affirm Bitcoin’s long-term appeal but also position it favorably within an evolving economic environment.”