World's Largest Bank Says Bitcoin An Asset, But Stable Coins Better for Payments

- Written by: Sam Coventry

-

Image: Adobe Images.

The Industrial and Commercial Bank of China (ICBC) says Bitcoin is a compelling asset, but its credential as a form of payment is weakening. In addition, it described Ethereum as "digital oil" in a recent report.

ICBC, the world’s largest bank based on total assets ($6.6 trillion), said in a recent research note that Bitcoin continues to benefit from scarcity akin to physical gold via "mathematical consensus."

This is thanks to its difficulty to divide and "identify authenticity".

Analysts at ICBC said Bitcoin's reputation from a monetary perspective was "gradually weakening". However, at the same time, it believes BTC's asset attributes are continually "strengthening".

Regarding Ethereum, ICBC analysts stated that the upgrades to Ethereum’s blockchain technology, tackling its safety, longevity and scalability, can deliver "technical power for the digital [economy]".

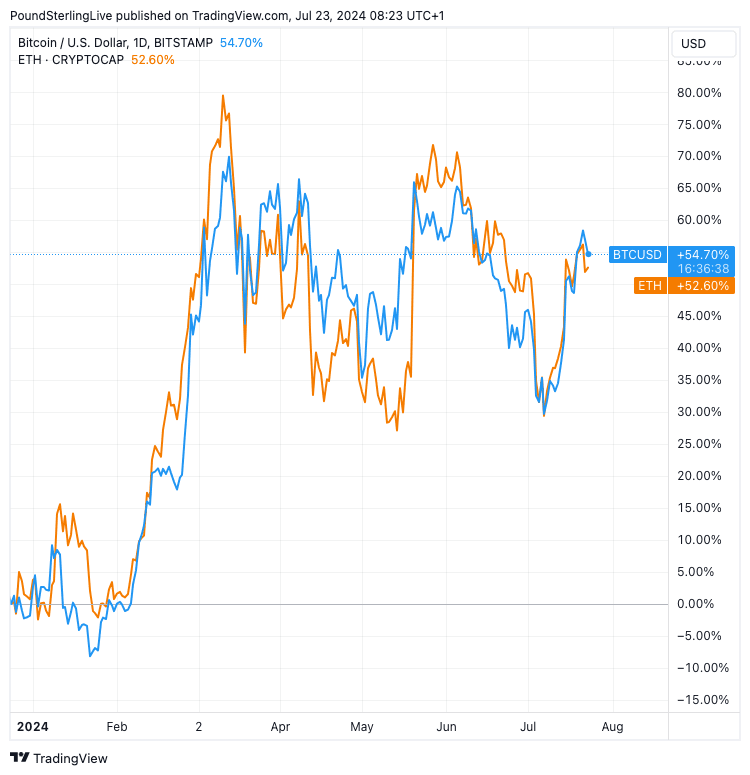

Above: ETH and BTC in 2024.

ICBC describes Ethereum as a "digital oil", fuelling next-generation innovations and applications.

ICBC analysts pinpoint the growing role of stablecoins and CBDCs in helping to bridge the gap between fiat currencies and cryptocurrencies. Stablecoins are increasingly providing a credible source of real-world value in the digital world, making it possible to transact between both worlds more seamlessly than ever before.

ICBC analysts said CBDCs offer the potential to eliminate the barriers surrounding cross-border payments, easing the reliance on third parties and also reaching out to the so-called "unbanked" community with a new range of next-generational financial services.

Rising Values

The price of Ethereum (ETH) has risen more than 48% in the year to date while the price of Bitcoin has experienced a similar surge so far in 2024, up over 53% at the time of writing.

Support for these assets comes following the approval of contracts for difference (CFDs) for institutional investors.

Developments in the retail sector include the MT5 trading platform becoming compatible with crypto CFDs, allowing those who trade forex and commodities to speculate on cryptocurrency without having to directly hold crypto assets.

In the U.S., no less than 11 crypto-focused ETFs were launched in early 2024. All of which were tied to the spot Bitcoin price.

This also demonstrated a significant vote of confidence from the U.S. Securities and Exchange Commission (SEC), enabling individuals to buy into Bitcoin despite the inherent volatility that’s magnified compared with traditional assets.