Mt. Gox News Hits BTC, Analysts Say Investors Should "Brace"

- Written by: Sam Coventry

-

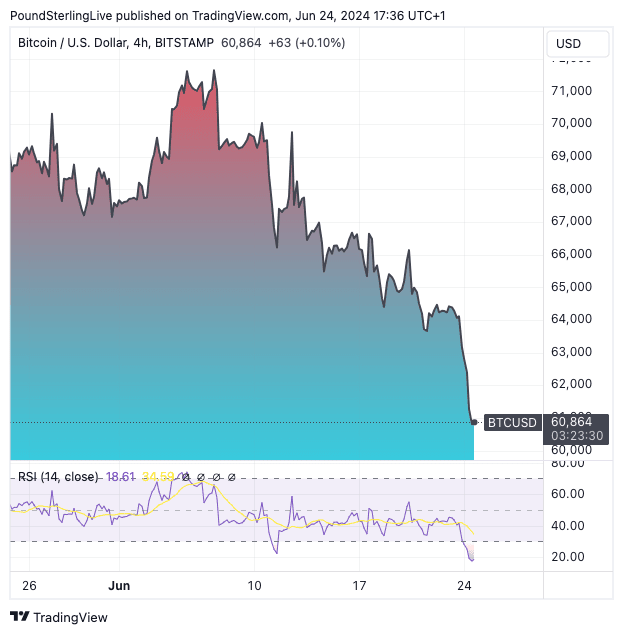

Bitcoin and crypto prices are under pressure on news that approximately 142K bitcoins will be released by the administrators of defunct bitcoin exchange Mt. Gox.

Mt. Gox said Monday it will finally start distributing assets stolen from clients in a 2014 hack, prompting a BTC selloff, and analysts warn investors to brace for volatility.

"The Rehabilitation Trustee will commence the repayments in Bitcoin and Bitcoin Cash in due course to the cryptocurrency exchanges with which the Rehabilitation Trustee has completed the exchange and confirmation of the required information for implementing the repayments. The repayments will be made from the beginning of July 2024," said a statement put out by MT. Gox's administrators.

The repayments will be made in bitcoin and bitcoin cash, and analysts say the additional bitcoin supply the move could possibly add selling pressure to the broader bitcoin market.

"Although the market was awaiting this news, the final date was not clear, but now it is. Even though the redemptions from Mt. Gox to investors will be done in-kind (i.e. not in cash) and no Bitcoins will be sold by the bankruptcy estate, some investors might be willing to sell their tokens to realise some profits," says Manuel Villegas Franceschi, Next Generation Research analyst at Julius Baer.

Price action confirms that Mt. Gox — one of the original platforms to purchase Bitcoin from — remains an important name in crypto markets. While it is no longer functional, the release of some 142K bitcoins is a market mover.

"Profit-taking could well continue, market depth is shallow, and excess token liquidity will likely impact the order books. Investors should thus brace for short-term volatility," says Franceschi.

Mt. Gox was a Japanese cryptocurrency exchange that operated between 2010 and 2014. At its peak, it was responsible for more than 70% of Bitcoin transactions.

In early February 2014, Mt. Gox suspended withdrawals after claiming to have found suspicious activity in its digital wallets. Reports on the number of coins lost ranged from 650k to 850k.

Although the amount of coins set for distribution is eclipsed by the total amount that is still missing, the value is notably higher.

Franceschi says Mt. Gox Bitcoin investors have an average entry price well below USD 500 "and are thereby sitting on astronomical returns".

He says this will incentivise selling amongst beneficiaries.

"Profit-taking is likely, market depth is shallow, and excess token liquidity will likely impact the order books. Investors should thus brace for short-term volatility. Furthermore, even though the longterm convictions are intact, having the capacity to tolerate short-term drawdowns will be critical," says Franceschi.